Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3. Suppose that a central bank (CB) implements a flexible exchange rate regime. The main aim of the CB is to keep the inflation rate

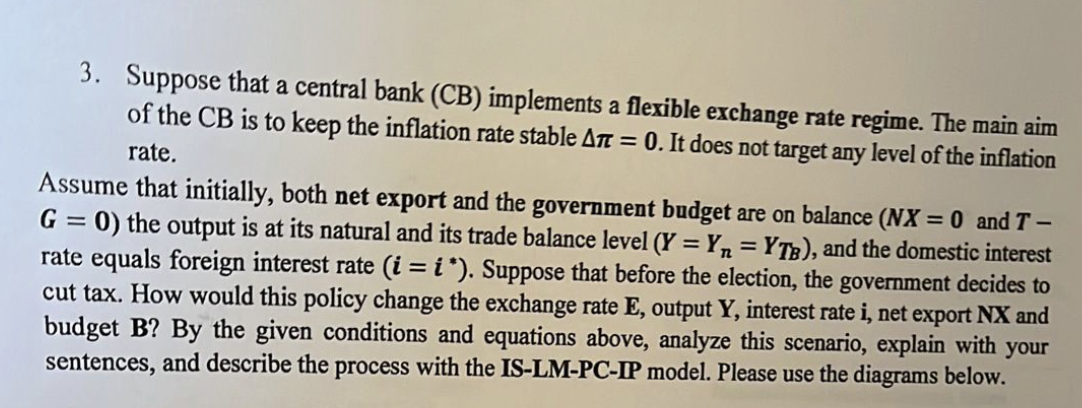

3. Suppose that a central bank (CB) implements a flexible exchange rate regime. The main aim of the CB is to keep the inflation rate stable =0. It does not target any level of the inflation rate. Assume that initially, both net export and the government budget are on balance (NX=0 and T G=0 ) the output is at its natural and its trade balance level (Y=Yn=YTB), and the domestic interest rate equals foreign interest rate (i=i). Suppose that before the election, the government decides to cut tax. How would this policy change the exchange rate E, output Y, interest rate i, net export NX and budget B? By the given conditions and equations above, analyze this scenario, explain with your sentences, and describe the process with the IS-LM-PC-IP model. Please use the diagrams below

3. Suppose that a central bank (CB) implements a flexible exchange rate regime. The main aim of the CB is to keep the inflation rate stable =0. It does not target any level of the inflation rate. Assume that initially, both net export and the government budget are on balance (NX=0 and T G=0 ) the output is at its natural and its trade balance level (Y=Yn=YTB), and the domestic interest rate equals foreign interest rate (i=i). Suppose that before the election, the government decides to cut tax. How would this policy change the exchange rate E, output Y, interest rate i, net export NX and budget B? By the given conditions and equations above, analyze this scenario, explain with your sentences, and describe the process with the IS-LM-PC-IP model. Please use the diagrams below Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started