Answered step by step

Verified Expert Solution

Question

1 Approved Answer

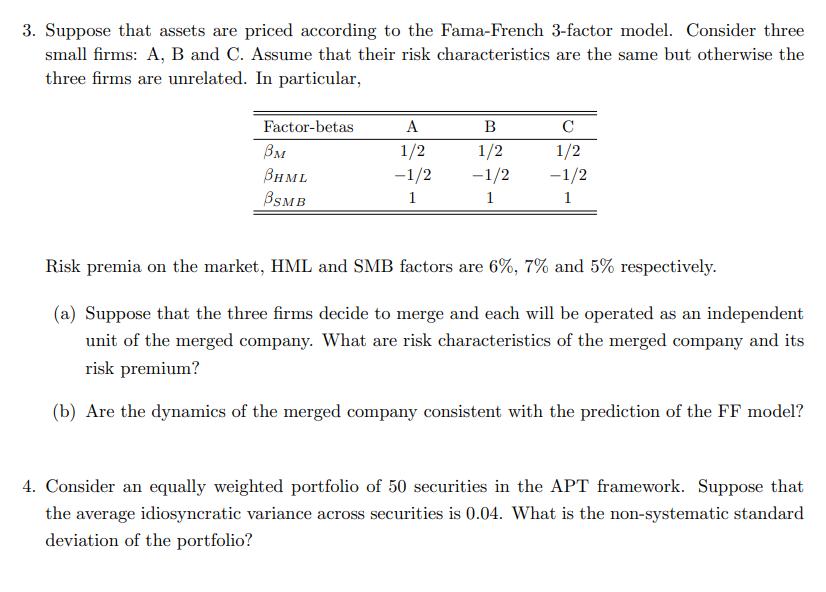

3. Suppose that assets are priced according to the Fama-French 3-factor model. Consider three small firms: A, B and C. Assume that their risk

3. Suppose that assets are priced according to the Fama-French 3-factor model. Consider three small firms: A, B and C. Assume that their risk characteristics are the same but otherwise the three firms are unrelated. In particular, Factor-betas A B C BM 1/2 1/2 1/2 BHML -1/2 -1/2 -1/2 BSMB 1 1 1 Risk premia on the market, HML and SMB factors are 6%, 7% and 5% respectively. (a) Suppose that the three firms decide to merge and each will be operated as an independent unit of the merged company. What are risk characteristics of the merged company and its risk premium? (b) Are the dynamics of the merged company consistent with the prediction of the FF model? 4. Consider an equally weighted portfolio of 50 securities in the APT framework. Suppose that the average idiosyncratic variance across securities is 0.04. What is the non-systematic standard deviation of the portfolio?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started