Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3. Suppose that in 2019, Global launches an aggressive marketing campaign that boosts sales by 17%. However, their operating margin falls from 5.57% to 4.2%.

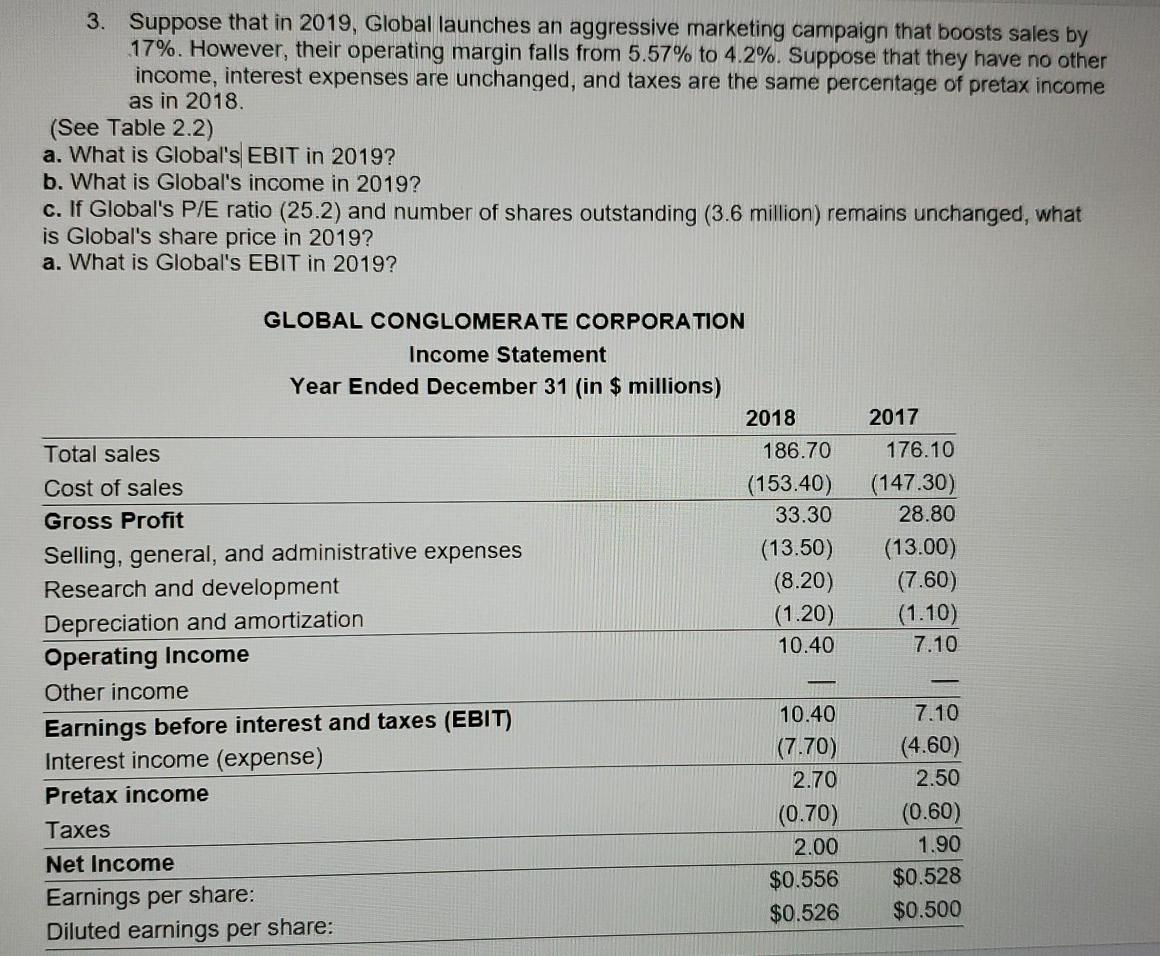

3. Suppose that in 2019, Global launches an aggressive marketing campaign that boosts sales by 17%. However, their operating margin falls from 5.57% to 4.2%. Suppose that they have no other income, interest expenses are unchanged, and taxes are the same percentage of pretax income as in 2018. (See Table 2.2) a. What is Global's EBIT in 2019? b. What is Global's income in 2019? c. If Global's P/E ratio (25.2) and number of shares outstanding (3.6 million) remains unchanged, what is Global's share price in 2019? a. What is Global's EBIT in 2019? GLOBAL CONGLOMERATE CORPORATION Income Statement Year Ended December 31 (in $ millions) 2018 Total sales 186.70 Cost of sales (153.40) Gross Profit 33.30 Selling, general, and administrative expenses (13.50) Research and development (8.20) Depreciation and amortization (1.20) Operating Income 10.40 Other income Earnings before interest and taxes (EBIT) 10.40 Interest income (expense) (7.70) Pretax income 2.70 Taxes (0.70) Net Income 2.00 $0.556 Earnings per share: $0.526 Diluted earnings per share: 2017 176.10 (147.30) 28.80 (13.00) (7.60) (1.10) 7.10 - 7.10 (4.60) 2.50 (0.60) 1.90 $0.528 $0.500

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started