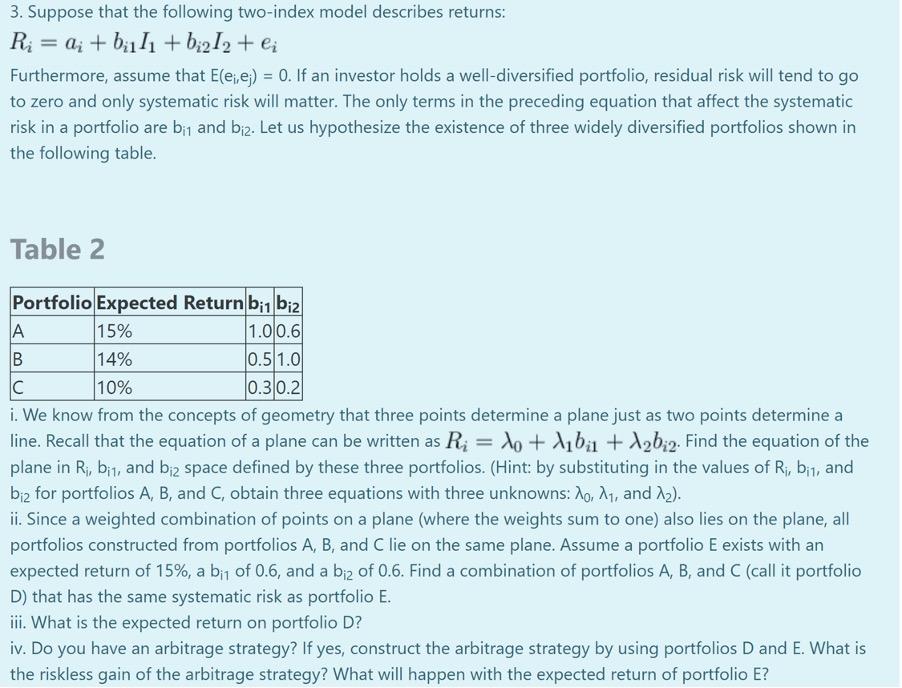

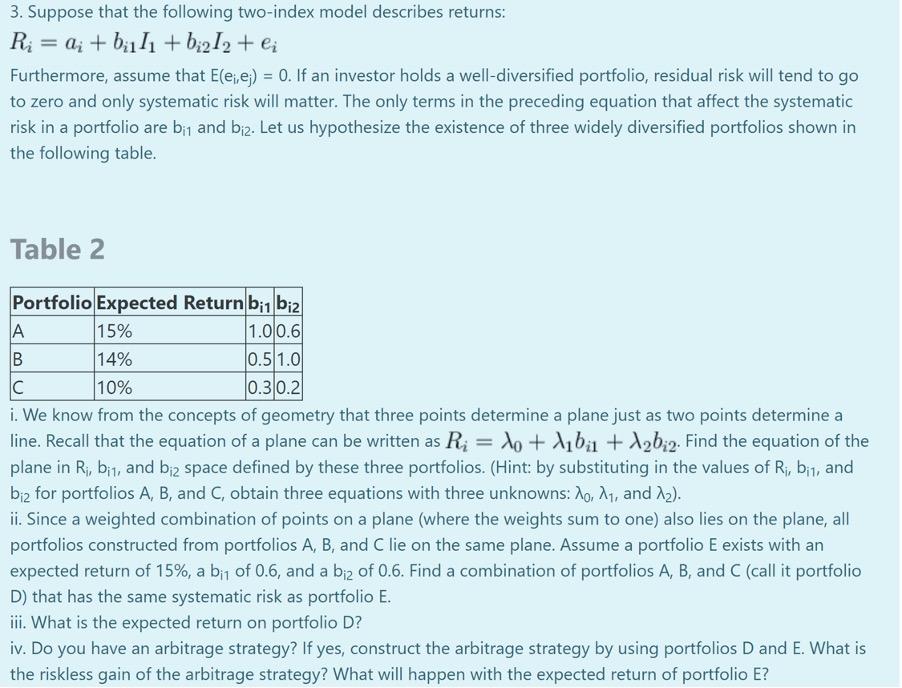

3. Suppose that the following two-index model describes returns: R; = a; + bill1 +b;212 + ei Furthermore, assume that E(ei, ej) = 0. If an investor holds a well-diversified portfolio, residual risk will tend to go to zero and only systematic risk will matter. The only terms in the preceding equation that affect the systematic risk in a portfolio are bi and biz. Let us hypothesize the existence of three widely diversified portfolios shown in the following table. Table 2 Portfolio Expected Return bil biz A 15% 1.0.0.6 B 14% 0.5 1.0 C 10% 0.30.2 i. We know from the concepts of geometry that three points determine a plane just as two points determine a line. Recall that the equation of a plane can be written as R; = 10 + liba + 12bie. Find the equation of the plane in Ri, bit, and bi2 space defined by these three portfolios. (Hint: by substituting in the values of Ri, bit, and biz for portfolios A, B, and C, obtain three equations with three unknowns: 10, 11, and 22). ii. Since a weighted combination of points on a plane (where the weights sum to one) also lies on the plane, all portfolios constructed from portfolios A, B, and Clie on the same plane. Assume a portfolio E exists with an expected return of 15%, a bit of 0.6, and a biz of 0.6. Find a combination of portfolios A, B, and C (call it portfolio D) that has the same systematic risk as portfolio E. iii. What is the expected return on portfolio D? iv. Do you have an arbitrage strategy? If yes, construct the arbitrage strategy by using portfolios D and E. What is the riskless gain of the arbitrage strategy? What will happen with the expected return of portfolio E? 3. Suppose that the following two-index model describes returns: R; = a; + bill1 +b;212 + ei Furthermore, assume that E(ei, ej) = 0. If an investor holds a well-diversified portfolio, residual risk will tend to go to zero and only systematic risk will matter. The only terms in the preceding equation that affect the systematic risk in a portfolio are bi and biz. Let us hypothesize the existence of three widely diversified portfolios shown in the following table. Table 2 Portfolio Expected Return bil biz A 15% 1.0.0.6 B 14% 0.5 1.0 C 10% 0.30.2 i. We know from the concepts of geometry that three points determine a plane just as two points determine a line. Recall that the equation of a plane can be written as R; = 10 + liba + 12bie. Find the equation of the plane in Ri, bit, and bi2 space defined by these three portfolios. (Hint: by substituting in the values of Ri, bit, and biz for portfolios A, B, and C, obtain three equations with three unknowns: 10, 11, and 22). ii. Since a weighted combination of points on a plane (where the weights sum to one) also lies on the plane, all portfolios constructed from portfolios A, B, and Clie on the same plane. Assume a portfolio E exists with an expected return of 15%, a bit of 0.6, and a biz of 0.6. Find a combination of portfolios A, B, and C (call it portfolio D) that has the same systematic risk as portfolio E. iii. What is the expected return on portfolio D? iv. Do you have an arbitrage strategy? If yes, construct the arbitrage strategy by using portfolios D and E. What is the riskless gain of the arbitrage strategy? What will happen with the expected return of portfolio E