Question

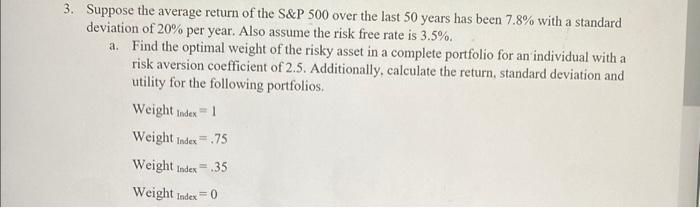

3. Suppose the average return of the S&P 500 over the last 50 years has been 7.8% with a standard deviation of 20% per

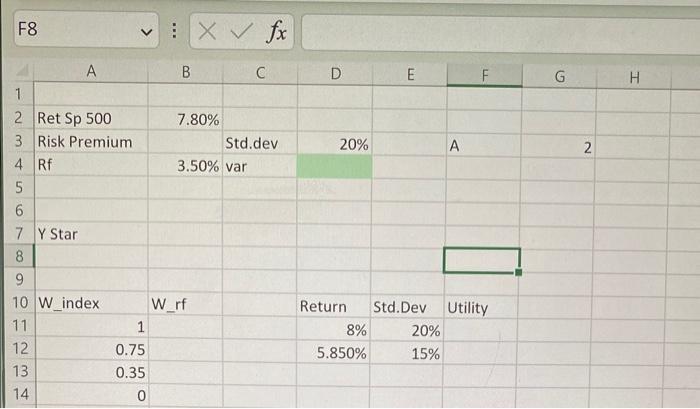

3. Suppose the average return of the S&P 500 over the last 50 years has been 7.8% with a standard deviation of 20% per year. Also assume the risk free rate is 3.5%. a. Find the optimal weight of the risky asset in a complete portfolio for an individual with a risk aversion coefficient of 2.5. Additionally, calculate the return, standard deviation and utility for the following portfolios. Weight Index = 1 Weight Index .75 Weight Index =.35 Weight Index = 0 F8 4 1 2 Ret Sp 500 3 Risk Premium 4 Rf 5 6 7 Y Star 8 9 10 W_index 11 12 13 14 A 1 0.75 0.35 0 B X fx 7.80% W_rf 3.50% var C Std.dev D 20% Return 8% 5.850% E A F Std.Dev Utility 20% 15% G 2 H

Step by Step Solution

3.53 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Optimal Weight and Portfolio Analysis a Optimal Weight Given Market return rm 78 Riskfree rate rf 35 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Business Statistics For Contemporary Decision Making

Authors: Black Ken

8th Edition

978-1118494769, 1118800842, 1118494768, 9781118800843, 978-1118749647

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App