Answered step by step

Verified Expert Solution

Question

1 Approved Answer

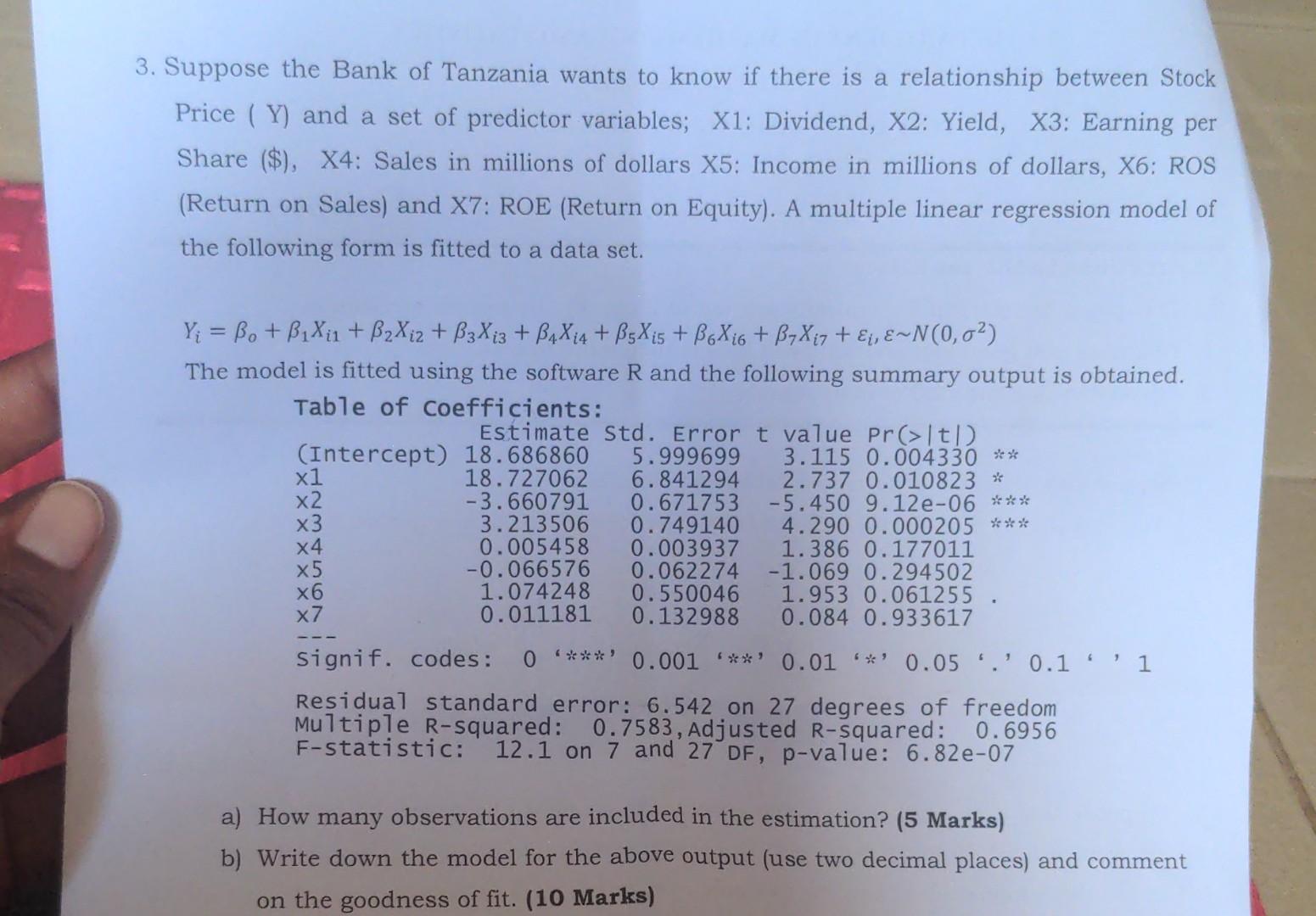

3. Suppose the Bank of Tanzania wants to know if there is a relationship between Stock Price ( Y) and a set of predictor variables;

3. Suppose the Bank of Tanzania wants to know if there is a relationship between Stock Price ( Y) and a set of predictor variables; X1: Dividend, X2: Yield, X3: Earning per Share (\$), X4: Sales in millions of dollars X5: Income in millions of dollars, X6: ROS (Return on Sales) and X7: ROE (Return on Equity). A multiple linear regression model of the following form is fitted to a data set. Yi=0+1Xi1+2Xi2+3Xi3+4Xi4+5Xi5+6Xi6+7Xi7+i,N(0,2) The model is fitted using the software R and the following summary output is obtained. Table of coefficients: 1 Residual standard error: 6.542 on 27 degrees of freedom Multiple R-squared: 0.7583 , Adjusted R-squared: 0.6956 F-statistic: 12.1 on 7 and 27DF,p-value: 6.82e07 a) How many observations are included in the estimation? (5 Marks) b) Write down the model for the above output (use two decimal places) and comment on the goodness of fit. (10 Marks) c) Test the overall significance of the model. (10 Marks) d) Construct the 95% confidence intervals for all the regression parameters. 17 Marks) e) On level alpha =0.05 which of the parameters are significantly different from 0 . (13 Marks) f) Write down the model that can predict the stock price

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started