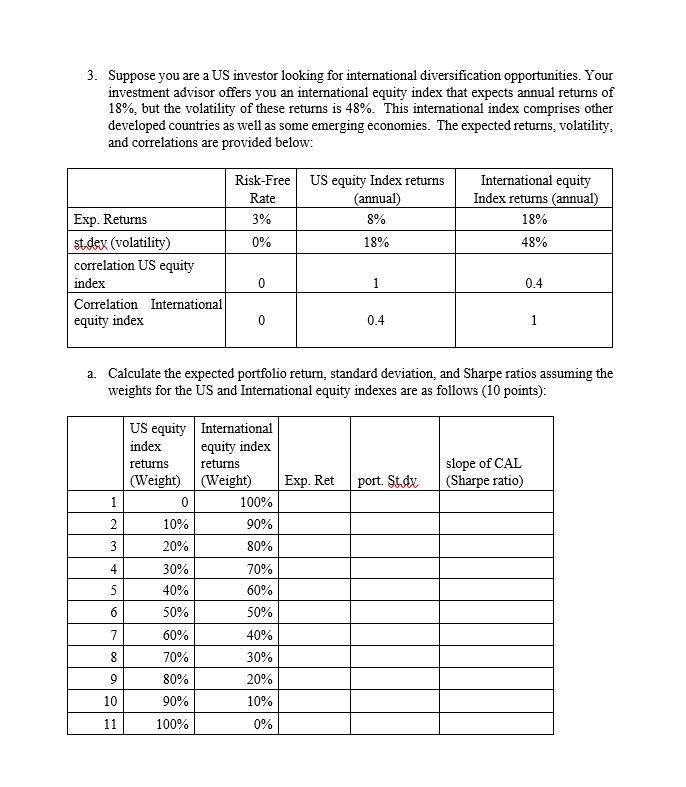

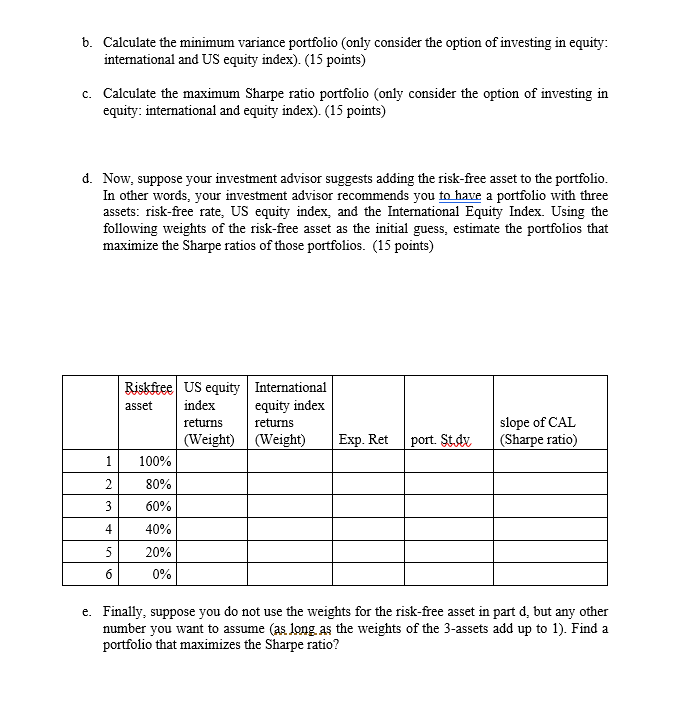

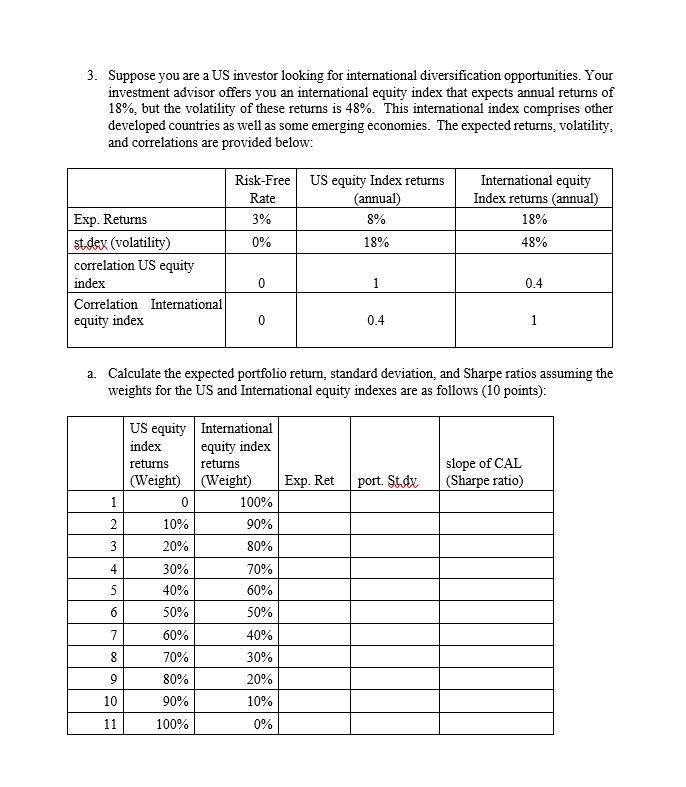

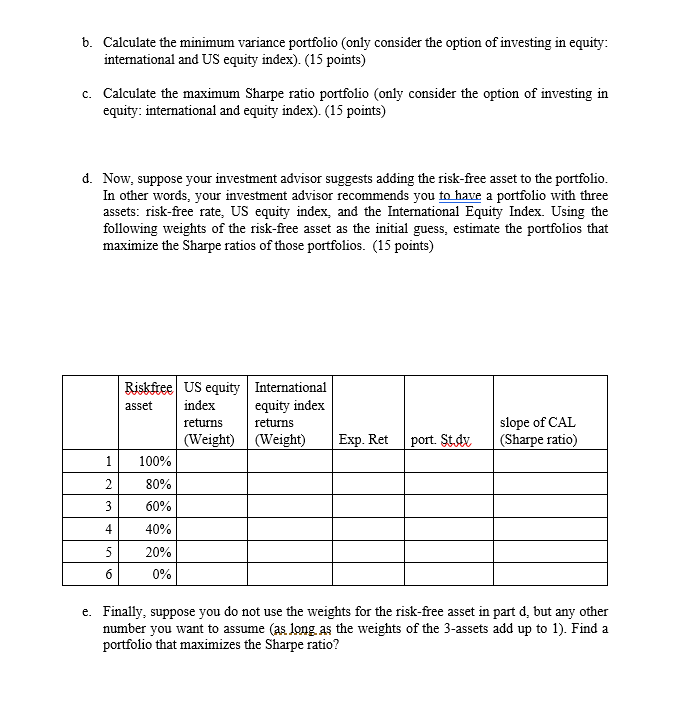

3. Suppose you are a US investor looking for international diversification opportunities. Your investment advisor offers you an international equity index that expects annual returns of 18%, but the volatility of these returns is 48%. This international index comprises other developed countries as well as some emerging economies. The expected returns, volatility, and correlations are provided below: Risk-Free US equity Index returns Rate (annual) 3% 8% 18% International equity Index returns (annual) 18% 0% 48% Exp. Returns st.dex (volatility) correlation US equity index Correlation International equity index 0 1 0.4 0 0.4 1 a. Calculate the expected portfolio return, standard deviation, and Sharpe ratios assuming the weights for the US and International equity indexes are as follows (10 points): slope of CAL (Sharpe ratio) Exp. Ret port. St.dy 1 2 3 4 US equity International index equity index returns returns (Weight) (Weight) 0 100% 10% 90% 20% 80% 30% 70% 40% 60% 50% 50% 60% 40% 70% 30% 80% 20% 90% 10% 100% 0% 5 6 7 8 9 10 11 6. Calculate the minimum variance portfolio (only consider the option of investing in equity: international and US equity index). (15 points) C. Calculate the maximum Sharpe ratio portfolio (only consider the option of investing in equity: international and equity index). (15 points) d. Now, suppose your investment advisor suggests adding the risk-free asset to the portfolio. In other words, your investment advisor recommends you to have a portfolio with three assets: risk-free rate, US equity index, and the International Equity Index. Using the following weights of the risk-free asset as the initial guess, estimate the portfolios that maximize the Sharpe ratios of those portfolios. (15 points) Exp. Ret slope of CAL (Sharpe ratio) port. St.de 1 2 3 Riskfree US equity International asset index equity index returns returns (Weight) (Weight) 100% 80% 60% 40% 20% 0% 4 5 6 e. Finally, suppose you do not use the weights for the risk-free asset in part d, but any other number you want to assume (as long as the weights of the 3-assets add up to 1). Find a portfolio that maximizes the Sharpe ratio? 3. Suppose you are a US investor looking for international diversification opportunities. Your investment advisor offers you an international equity index that expects annual returns of 18%, but the volatility of these returns is 48%. This international index comprises other developed countries as well as some emerging economies. The expected returns, volatility, and correlations are provided below: Risk-Free US equity Index returns Rate (annual) 3% 8% 18% International equity Index returns (annual) 18% 0% 48% Exp. Returns st.dex (volatility) correlation US equity index Correlation International equity index 0 1 0.4 0 0.4 1 a. Calculate the expected portfolio return, standard deviation, and Sharpe ratios assuming the weights for the US and International equity indexes are as follows (10 points): slope of CAL (Sharpe ratio) Exp. Ret port. St.dy 1 2 3 4 US equity International index equity index returns returns (Weight) (Weight) 0 100% 10% 90% 20% 80% 30% 70% 40% 60% 50% 50% 60% 40% 70% 30% 80% 20% 90% 10% 100% 0% 5 6 7 8 9 10 11 6. Calculate the minimum variance portfolio (only consider the option of investing in equity: international and US equity index). (15 points) C. Calculate the maximum Sharpe ratio portfolio (only consider the option of investing in equity: international and equity index). (15 points) d. Now, suppose your investment advisor suggests adding the risk-free asset to the portfolio. In other words, your investment advisor recommends you to have a portfolio with three assets: risk-free rate, US equity index, and the International Equity Index. Using the following weights of the risk-free asset as the initial guess, estimate the portfolios that maximize the Sharpe ratios of those portfolios. (15 points) Exp. Ret slope of CAL (Sharpe ratio) port. St.de 1 2 3 Riskfree US equity International asset index equity index returns returns (Weight) (Weight) 100% 80% 60% 40% 20% 0% 4 5 6 e. Finally, suppose you do not use the weights for the risk-free asset in part d, but any other number you want to assume (as long as the weights of the 3-assets add up to 1). Find a portfolio that maximizes the Sharpe ratio