Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3. Suppose you have $10,000 of capital. You spend a lot of effort to analyze Tesla and you conclude that the future prospects of

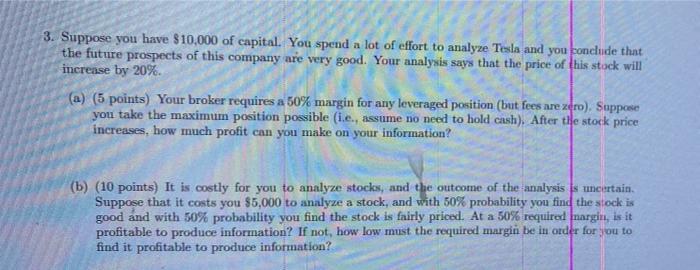

3. Suppose you have $10,000 of capital. You spend a lot of effort to analyze Tesla and you conclude that the future prospects of this company are very good. Your analysis says that the price of this stock will increase by 20%. (a) (5 points) Your broker requires a 50% margin for any leveraged position (but fees are zero). Suppose you take the maximum position possible (i.e., assume no need to hold cash). After the stock price increases, how much profit can you make on your information? (b) (10 points) It is costly for you to analyze stocks, and the outcome of the analysis is uncertain. Suppose that it costs you $5,000 to analyze a stock, and with 50% probability you find the stock is good and with 50% probability you find the stock is fairly priced. At a 50% required margin, is it profitable to produce information? If not, low must the required margin be in order for you t find it profitable to produce information?

Step by Step Solution

★★★★★

3.35 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

a If the stock price increases by 20 then the profit from the p...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started