Answered step by step

Verified Expert Solution

Question

1 Approved Answer

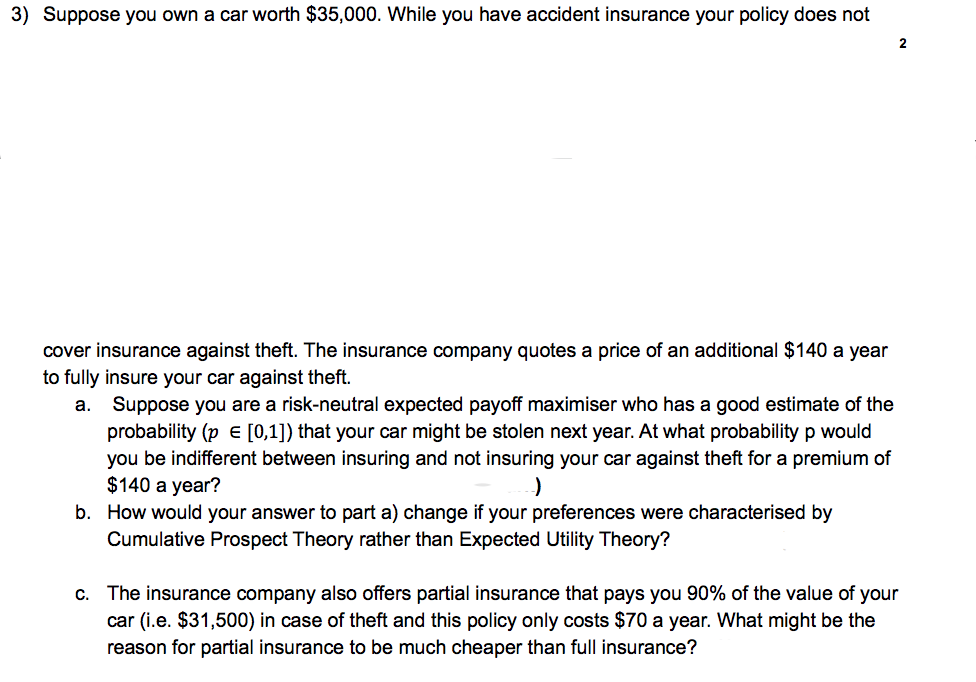

3) Suppose you own a car worth $35,000. While you have accident insurance your policy does not cover insurance against theft. The insurance company

3) Suppose you own a car worth $35,000. While you have accident insurance your policy does not cover insurance against theft. The insurance company quotes a price of an additional $140 a year to fully insure your car against theft. a. Suppose you are a risk-neutral expected payoff maximiser who has a good estimate of the probability (p = [0,1]) that your car might be stolen next year. At what probability p would you be indifferent between insuring and not insuring your car against theft for a premium of $140 a year? -) b. How would your answer to part a) change if your preferences were characterised by Cumulative Prospect Theory rather than Expected Utility Theory? 2 c. The insurance company also offers partial insurance that pays you 90% of the value of your car (i.e. $31,500) in case of theft and this policy only costs $70 a year. What might be the reason for partial insurance to be much cheaper than full insurance?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Solving the car insurance problem a Riskneutral expected payoff maximizer You are indifferent betwee...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started