Answered step by step

Verified Expert Solution

Question

1 Approved Answer

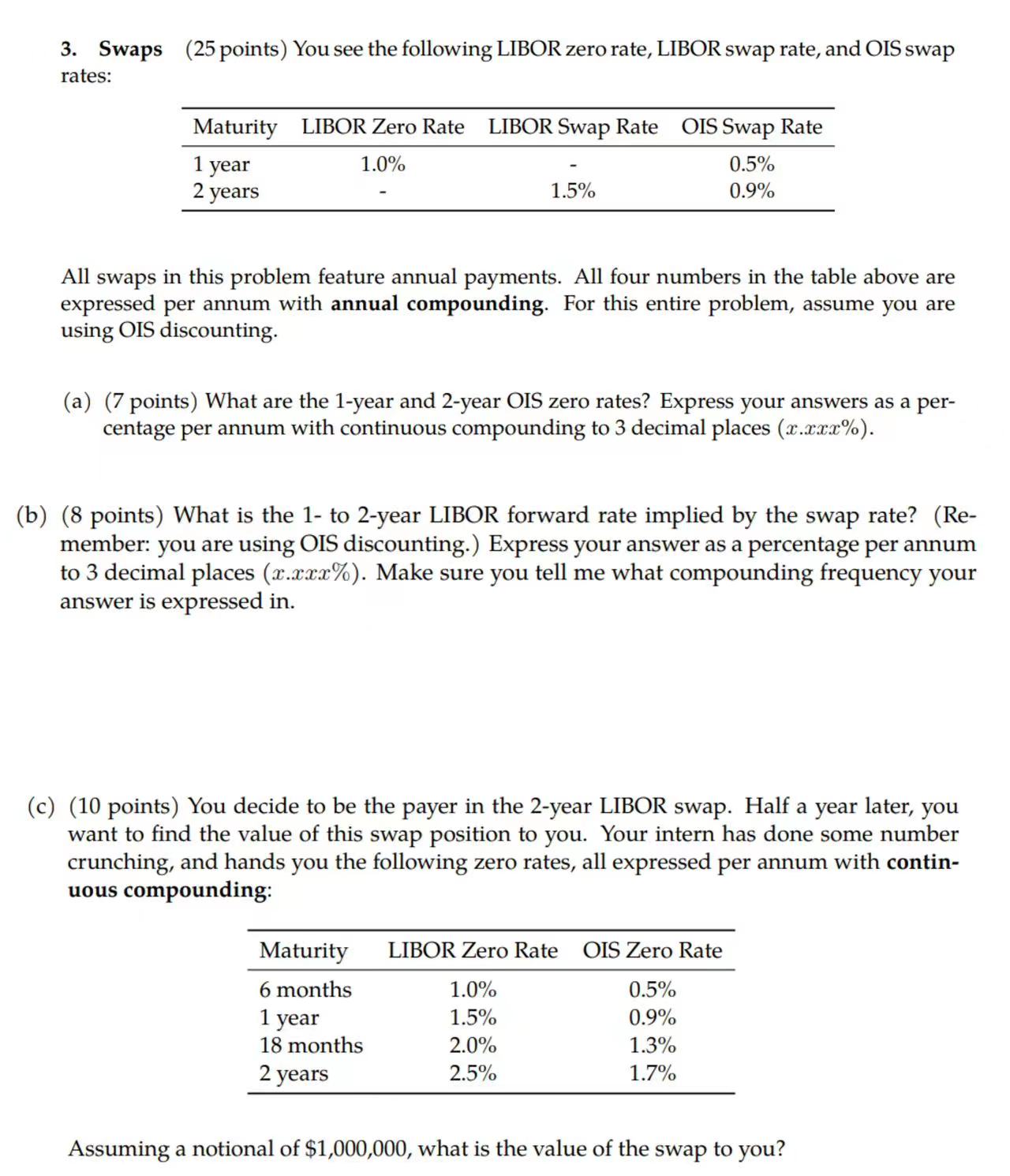

3. Swaps (25 points) You see the following LIBOR zero rate, LIBOR swap rate, and OIS swap rates: Maturity LIBOR Zero Rate LIBOR Swap

3. Swaps (25 points) You see the following LIBOR zero rate, LIBOR swap rate, and OIS swap rates: Maturity LIBOR Zero Rate LIBOR Swap Rate OIS Swap Rate 1 year 2 years 1.0% 1.5% 0.5% 0.9% All swaps in this problem feature annual payments. All four numbers in the table above are expressed per annum with annual compounding. For this entire problem, assume you are using OIS discounting. (a) (7 points) What are the 1-year and 2-year OIS zero rates? Express your answers as a per- centage per annum with continuous compounding to 3 decimal places (x.xxx%). (b) (8 points) What is the 1- to 2-year LIBOR forward rate implied by the swap rate? (Re- member: you are using OIS discounting.) Express your answer as a percentage per annum to 3 decimal places (x.xxx%). Make sure you tell me what compounding frequency your answer is expressed in. (c) (10 points) You decide to be the payer in the 2-year LIBOR swap. Half a year later, you want to find the value of this swap position to you. Your intern has done some number crunching, and hands you the following zero rates, all expressed per annum with contin- uous compounding: Maturity LIBOR Zero Rate OIS Zero Rate 6 months 1.0% 0.5% 1 year 1.5% 0.9% 18 months 2.0% 1.3% 2 years 2.5% 1.7% Assuming a notional of $1,000,000, what is the value of the swap to you?

Step by Step Solution

★★★★★

3.40 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

a To find the 1year and 2year OIS zero rates we can use the given OIS swap rates 1year OIS zero rate ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started