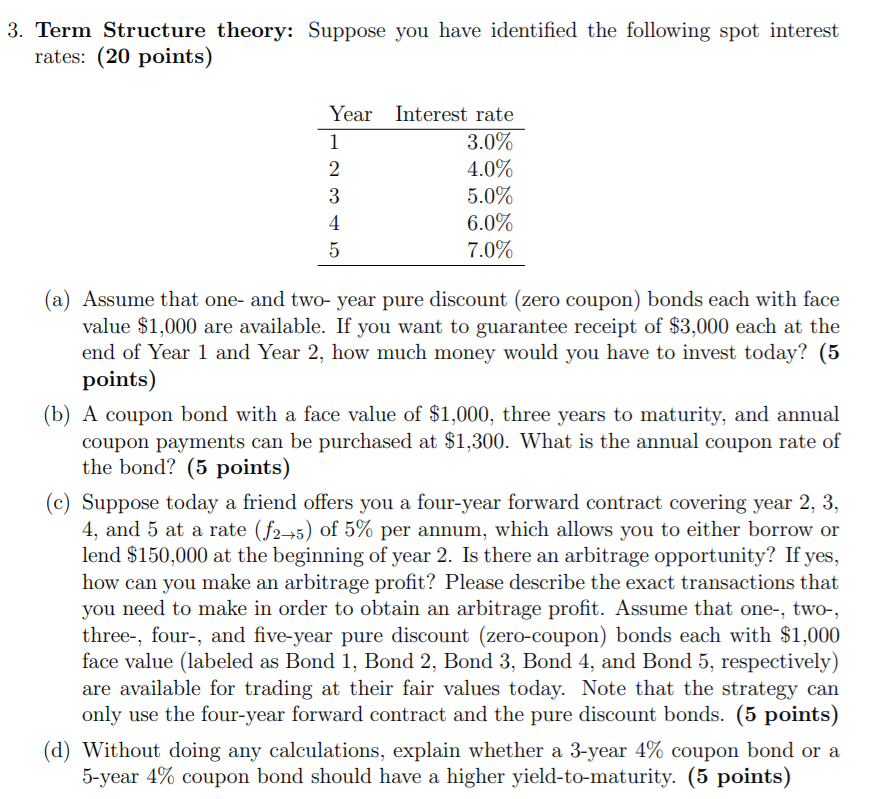

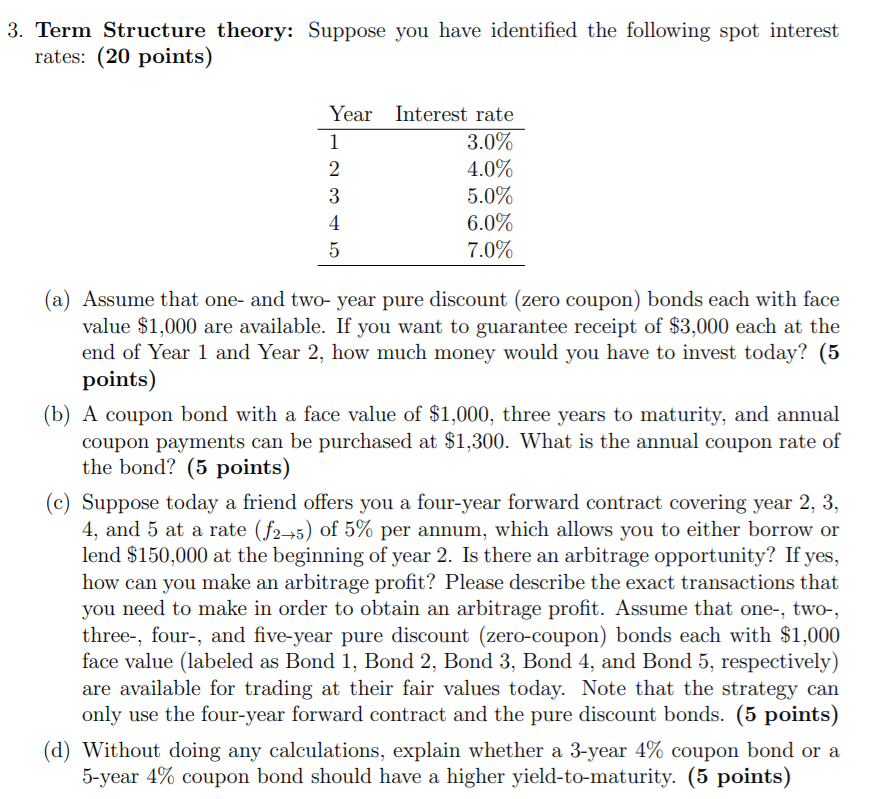

3. Term Structure theory: Suppose you have identified the following spot interest rates: (20 points) Year 1 2 3 4 5 Interest rate 3.0% 4.0% 5.0% 6.0% 7.0% (a) Assume that one- and two-year pure discount (zero coupon) bonds each with face value $1,000 are available. If you want to guarantee receipt of $3,000 each at the end of Year 1 and Year 2, how much money would you have to invest today? (5 points) (b) A coupon bond with a face value of $1,000, three years to maturity, and annual coupon payments can be purchased at $1,300. What is the annual coupon rate of the bond? (5 points) (c) Suppose today a friend offers you a four-year forward contract covering year 2, 3, 4, and 5 at a rate ($275) of 5% per annum, which allows you to either borrow or lend $150,000 at the beginning of year 2. Is there an arbitrage opportunity? If yes, how can you make an arbitrage profit? Please describe the exact transactions that you need to make in order to obtain an arbitrage profit. Assume that one-, two-, three-, four-, and five-year pure discount (zero-coupon) bonds each with $1,000 face value (labeled as Bond 1, Bond 2, Bond 3, Bond 4, and Bond 5, respectively) are available for trading at their fair values today. Note that the strategy can only use the four-year forward contract and the pure discount bonds. (5 points) (d) Without doing any calculations, explain whether a 3-year 4% coupon bond or a 5-year 4% coupon bond should have a higher yield-to-maturity. (5 points) 3. Term Structure theory: Suppose you have identified the following spot interest rates: (20 points) Year 1 2 3 4 5 Interest rate 3.0% 4.0% 5.0% 6.0% 7.0% (a) Assume that one- and two-year pure discount (zero coupon) bonds each with face value $1,000 are available. If you want to guarantee receipt of $3,000 each at the end of Year 1 and Year 2, how much money would you have to invest today? (5 points) (b) A coupon bond with a face value of $1,000, three years to maturity, and annual coupon payments can be purchased at $1,300. What is the annual coupon rate of the bond? (5 points) (c) Suppose today a friend offers you a four-year forward contract covering year 2, 3, 4, and 5 at a rate ($275) of 5% per annum, which allows you to either borrow or lend $150,000 at the beginning of year 2. Is there an arbitrage opportunity? If yes, how can you make an arbitrage profit? Please describe the exact transactions that you need to make in order to obtain an arbitrage profit. Assume that one-, two-, three-, four-, and five-year pure discount (zero-coupon) bonds each with $1,000 face value (labeled as Bond 1, Bond 2, Bond 3, Bond 4, and Bond 5, respectively) are available for trading at their fair values today. Note that the strategy can only use the four-year forward contract and the pure discount bonds. (5 points) (d) Without doing any calculations, explain whether a 3-year 4% coupon bond or a 5-year 4% coupon bond should have a higher yield-to-maturity. (5 points)