Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3. The 6-month zero interest rate is 5% and the 12 -month zero interest rate is 6%. A bank offers to borrow or lend money

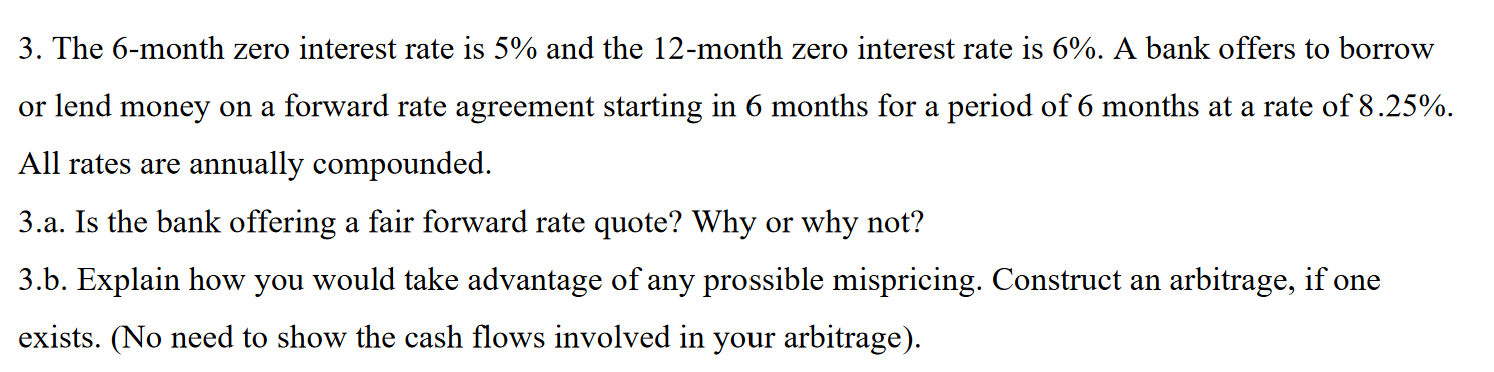

3. The 6-month zero interest rate is 5% and the 12 -month zero interest rate is 6%. A bank offers to borrow or lend money on a forward rate agreement starting in 6 months for a period of 6 months at a rate of 8.25% All rates are annually compounded. 3.a. Is the bank offering a fair forward rate quote? Why or why not? 3.b. Explain how you would take advantage of any prossible mispricing. Construct an arbitrage, if one exists. (No need to show the cash flows involved in your arbitrage)

3. The 6-month zero interest rate is 5% and the 12 -month zero interest rate is 6%. A bank offers to borrow or lend money on a forward rate agreement starting in 6 months for a period of 6 months at a rate of 8.25% All rates are annually compounded. 3.a. Is the bank offering a fair forward rate quote? Why or why not? 3.b. Explain how you would take advantage of any prossible mispricing. Construct an arbitrage, if one exists. (No need to show the cash flows involved in your arbitrage) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started