Answered step by step

Verified Expert Solution

Question

1 Approved Answer

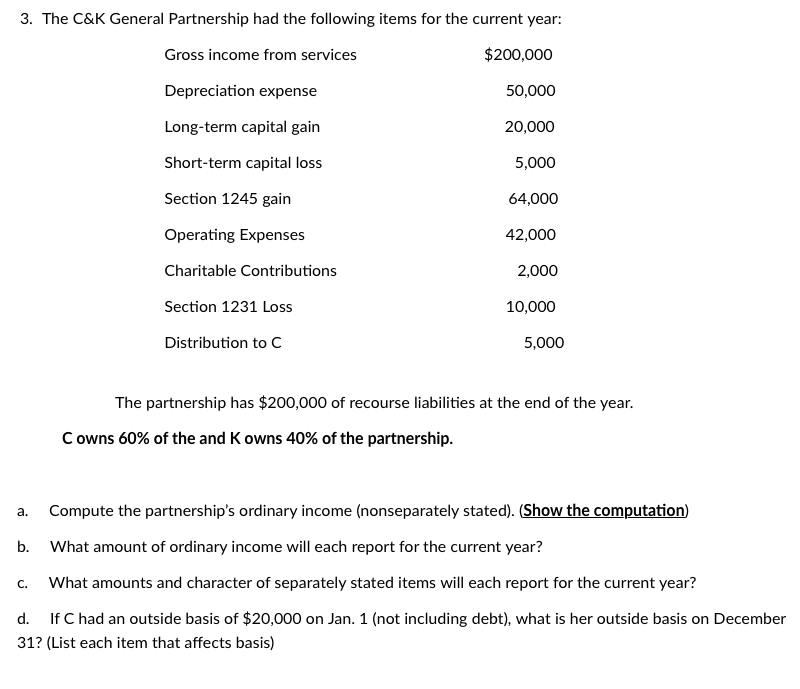

3. The C&K General Partnership had the following items for the current year: Gross income from services $200,000 Depreciation expense 50,000 Long-term capital gain

3. The C&K General Partnership had the following items for the current year: Gross income from services $200,000 Depreciation expense 50,000 Long-term capital gain Short-term capital loss Section 1245 gain Operating Expenses Charitable Contributions a. Section 1231 Loss b. Distribution to C 20,000 C owns 60% of the and K owns 40% of the partnership. 5,000 64,000 42,000 2,000 10,000 5,000 The partnership has $200,000 of recourse liabilities at the end of the year. Compute the partnership's ordinary income (nonseparately stated). (Show the computation) What amount of ordinary income will each report for the current year? C. What amounts and character of separately stated items will each report for the current year? d. If C had an outside basis of $20,000 on Jan. 1 (not including debt), what is her outside basis on December 31? (List each item that affects basis)

Step by Step Solution

★★★★★

3.36 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Lets calculate the partnerships ordinary income nonseparately stated items and then determine the am...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started