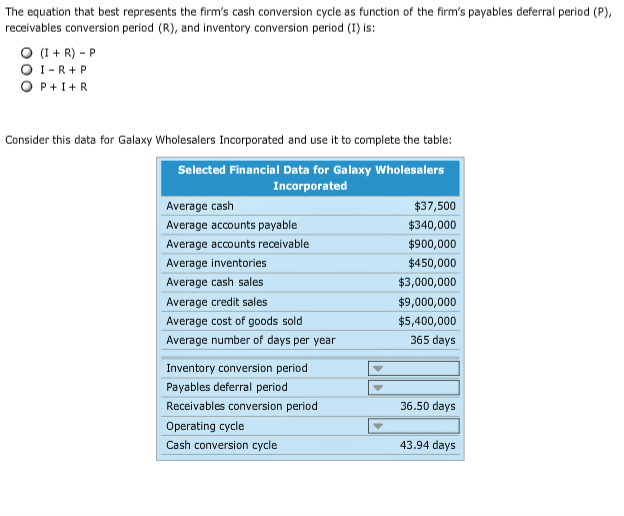

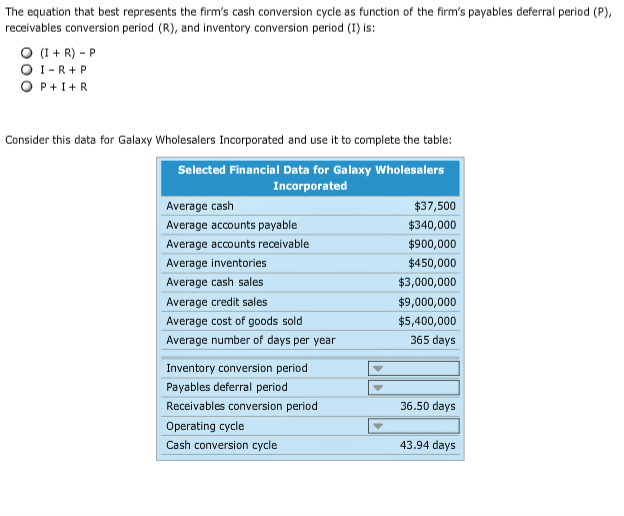

3. The components of the operating cycle Aa Aa Proper management of a firm's working capital is vital and challenging due to the and uncertainty between a firm's cash inflows and outflows. The flows of cash and goods into and out of a firm can be depicted visually using several models, including a timeline and a cycle or circular flow. The operating cycle focusses on both (1) the movement of its raw materials and its finished and saleable products, and (2) the associated financial transactions and cash flows, and can be expressed using two equations: Equation 1: Operating Cycle Inventory Conversion Period + Receivables Collection Period Equation 2: Operating Cycle Payables Deferral Period+ Cash Conversion Cycle Knowledge of the timing of these activities and flows is critical because it helps you maintain the firm's liquidity and solvency. It gives you the information so that you can plan for potential cash shortages and work to raise the necessary the deficiency occurs additional capital According to Equation 1, the operating cycle focusses on the flow of raw materials and finished goods through the business and the sale of these goods to the company's customers, and the amount of time associated with these activities. Based on this perspective of the operating cycle, the operating cycle cab be broken down into the following two parts-depending upon how the business's firm's funds are invested: the amount of time needed for the business to obtain its raw materials, transform them into finished goods and sell them on credit to the firm's customers, which is called the period; and the time period during which the finished product is sold to a credit customer and the corresponding account receivable is created and the customer's cash is ultimately collected, which is called the period The other perspective on the operating cycle, described in Equation 2, focusses on the financial transactions that accompany the two investments described in Equation 1: the accounts that are used to purchase the firm's raw materials, and the accounts that are created when the finished goods are sold. It also facusses on the time gap that is created when the accounts payable are repaid before accounts receivable are collected. This view. of the operating cycle also consists of two components: the payables deferral period, begins with the creation of an account repayment. Also called the and concludes with its , this period corresponds to the time interval that the company is able to postpo ne its payment for its credit purchases of raw materials the cash conversion cycle, describes the time that elapses between the for the raw materials and the collection of funds resulting from the credit sale of the finished product In general, a manufacturing firm is required to pay its accounts payable, a spontaneous receives the cash inflow from the collection of its account receivable, a spontaneous of funds, before it of funds. This means that the firm may require an additional, non-spontaneous of financing to cover this period to ensure the firm's liquidity and solvency The equation that best represents the firm's cash conversion cycle as function of the firm's payables deferral period (P), receivables conversion period (R), and inventory conversion period () is: O (IR) P O I RP O P+I R Consider this data for Galaxy Wholesalers Incorporated and use it to complete the table: Selected Financial Data for Galaxy Wholesalers Incorporated Average cash $37,500 $340,000 Average accounts payable $900,000 Average accounts receivable $450,000 Average inventories $3,000,000 Average cash sales $9,000,000 Average credit sales $5,400,000 Average cost of goods sold 365 days Average number of days per year Inventory conversion period Payables deferral period 36.50 days Receivables conversion period Operating cycle Cash conversion cycle 43.94 days