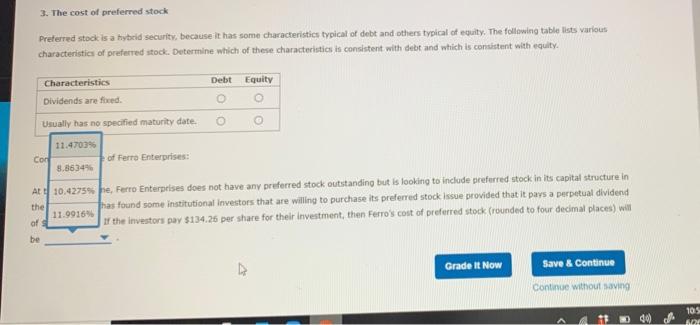

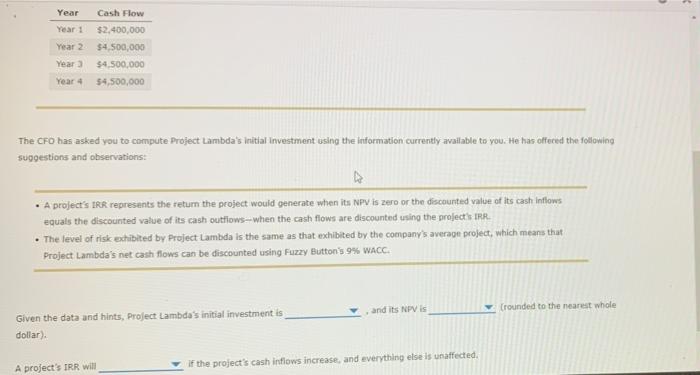

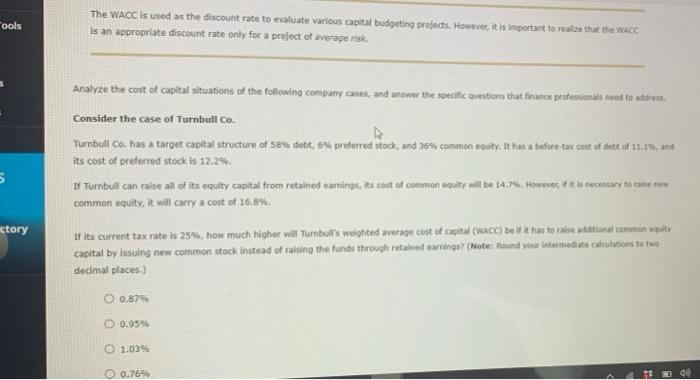

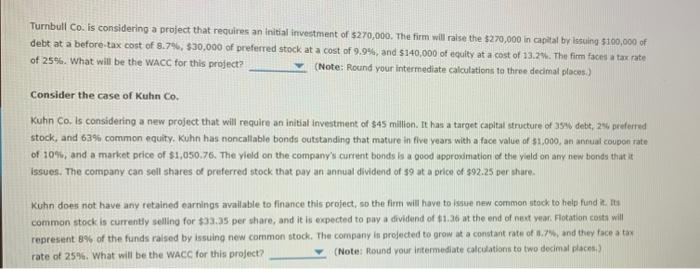

3. The cost of preferred stock Preferred stock is a hybeid security, because it has some characteristics typical of debt and others typical of equity. The following table lists various characteristics of preferred stock. Determine which of these characteristics is consistent with debt and which is consistent with equity. Debt Equity Characteristics Dividends are fixed Usually has no specified maturity date 11.4703 Cor of Ferro Enterprises: 8.8634% A 10.42759 be, Ferro Enterprises does not have any preferred stock outstanding but is looking to include preferred stock in its capital structure in Thas found some institutional investors that are willing to purchase its preferred stock issue provided that it pays a perpetual dividend 11.99169 of By the investors pay $134.26 per share for their investment, then Ferro's cost of preferred stock (rounded to four decimal places) will be the Grade It Now Save & Continue Continue without saving 105 IND Year Year 1 Year 2 Year Year 4 Cash Flow $2,400.000 $4,500,000 $4.500.000 54,500,000 The CFO has asked you to compute Project Lambda's initial Investment using the information currently available to you. He has offered the following suggestions and observations: A project's IRR represents the return the project would generate when its NPV is zero or the discounted value of its cash inflows equals the discounted value of its cash outflows-when the cash flows are discounted using the project's RR The level of risk exhibited by Project Lambda is the same as that exhibited by the company's average project, which means that Project Lambda's net cash flows can be discounted using Fuzzy Button's 9% WACC. and its NPV is (rounded to the nearest whole Given the data and hints, Project Lambda's initial investment is dollar) A project's IRR will if the project's cash intlows increase, and everything else is unaffected. "ools The WACC is used as the discount rate to evaluate various capital budgeting projects. However, it is important to realize that the WACC is an appropriate discount rate only for a project of average risk Analyze the cost of capital situations of the following company cases, and answer the specific questions that finance professionals need to address Consider the case of Turnbull Co. Turnbull Co. has a target capital structure of 58% debt, 6% preferred stock, and 369 common equity. It has a before-tax cont of dete of 11.1%, and its cost of preferred stock is 12.2% If Turnbull can raise all of its equity capital from retained earrings, its cost of common equity will be 14.78, However, it is necessary to caite na common equity, it will carry a cost of 16.8% ictory If its current tax rate is 25%, how much higher will Turnbull's weighted average cost of capital (WACC) Detit has to raise saditional common equity capital by issuing new common stock instead of raising the funds through retained earninga? (Note: Round your intermediate calculations to two decimal places.) 0.87% 0.95% @ 1.0394 0.769 Turnbull Co. is considering a project that requires an initial investment of $270,000. The firm will raise the $270,000 in capital by Issuing $100,000 of debt at a before-tax cost of 9.7%, $30,000 of preferred stock at a cost of 9.9%, and $140,000 of equity at a cost of 13.2. The firm faces a tax rate of 25%. What will be the WACC for this project (Note: Round your intermediate calculations to three decimal places.) Consider the case of Kuhn Co. Kuhn Co. is considering a new project that will require an initial investment of $45 million. It has a target capital structure of 39 debt, 2 preferred stock, and 63% common equity. Kuhn has noncallable bonds outstanding that mature in five years with a face value of $1,000, an annual coupon rate of 10%, and a market price of $1,050.76. The yield on the company's current bonds is a good approximation of the yield on any new bonds that it issues. The company can sell shares of preferred stock that pay an annual dividend of 9 at a price of $92.25 per shure. Kuhn does not have any retained earnings available to finance this project, so the firm will have to issue new common stock to help fund it. Its common stock is currently selling for $33.95 per share, and it is expected to pay a dividend of 61.36 at the end of next year. Flotation costs will represent 8% of the funds raised by issuing new common stock. The company in projected to grow at a constant rate of , and they face a tax rate of 25%. What will be the WACC for this project? (Note: Round your intermediate calculations to two decimal places) 3. The cost of preferred stock Preferred stock is a hybeid security, because it has some characteristics typical of debt and others typical of equity. The following table lists various characteristics of preferred stock. Determine which of these characteristics is consistent with debt and which is consistent with equity. Debt Equity Characteristics Dividends are fixed Usually has no specified maturity date 11.4703 Cor of Ferro Enterprises: 8.8634% A 10.42759 be, Ferro Enterprises does not have any preferred stock outstanding but is looking to include preferred stock in its capital structure in Thas found some institutional investors that are willing to purchase its preferred stock issue provided that it pays a perpetual dividend 11.99169 of By the investors pay $134.26 per share for their investment, then Ferro's cost of preferred stock (rounded to four decimal places) will be the Grade It Now Save & Continue Continue without saving 105 IND Year Year 1 Year 2 Year Year 4 Cash Flow $2,400.000 $4,500,000 $4.500.000 54,500,000 The CFO has asked you to compute Project Lambda's initial Investment using the information currently available to you. He has offered the following suggestions and observations: A project's IRR represents the return the project would generate when its NPV is zero or the discounted value of its cash inflows equals the discounted value of its cash outflows-when the cash flows are discounted using the project's RR The level of risk exhibited by Project Lambda is the same as that exhibited by the company's average project, which means that Project Lambda's net cash flows can be discounted using Fuzzy Button's 9% WACC. and its NPV is (rounded to the nearest whole Given the data and hints, Project Lambda's initial investment is dollar) A project's IRR will if the project's cash intlows increase, and everything else is unaffected. "ools The WACC is used as the discount rate to evaluate various capital budgeting projects. However, it is important to realize that the WACC is an appropriate discount rate only for a project of average risk Analyze the cost of capital situations of the following company cases, and answer the specific questions that finance professionals need to address Consider the case of Turnbull Co. Turnbull Co. has a target capital structure of 58% debt, 6% preferred stock, and 369 common equity. It has a before-tax cont of dete of 11.1%, and its cost of preferred stock is 12.2% If Turnbull can raise all of its equity capital from retained earrings, its cost of common equity will be 14.78, However, it is necessary to caite na common equity, it will carry a cost of 16.8% ictory If its current tax rate is 25%, how much higher will Turnbull's weighted average cost of capital (WACC) Detit has to raise saditional common equity capital by issuing new common stock instead of raising the funds through retained earninga? (Note: Round your intermediate calculations to two decimal places.) 0.87% 0.95% @ 1.0394 0.769 Turnbull Co. is considering a project that requires an initial investment of $270,000. The firm will raise the $270,000 in capital by Issuing $100,000 of debt at a before-tax cost of 9.7%, $30,000 of preferred stock at a cost of 9.9%, and $140,000 of equity at a cost of 13.2. The firm faces a tax rate of 25%. What will be the WACC for this project (Note: Round your intermediate calculations to three decimal places.) Consider the case of Kuhn Co. Kuhn Co. is considering a new project that will require an initial investment of $45 million. It has a target capital structure of 39 debt, 2 preferred stock, and 63% common equity. Kuhn has noncallable bonds outstanding that mature in five years with a face value of $1,000, an annual coupon rate of 10%, and a market price of $1,050.76. The yield on the company's current bonds is a good approximation of the yield on any new bonds that it issues. The company can sell shares of preferred stock that pay an annual dividend of 9 at a price of $92.25 per shure. Kuhn does not have any retained earnings available to finance this project, so the firm will have to issue new common stock to help fund it. Its common stock is currently selling for $33.95 per share, and it is expected to pay a dividend of 61.36 at the end of next year. Flotation costs will represent 8% of the funds raised by issuing new common stock. The company in projected to grow at a constant rate of , and they face a tax rate of 25%. What will be the WACC for this project? (Note: Round your intermediate calculations to two decimal places)