Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3) The effective combined tax rate in an owner managed corporation is 40%. An outlay of $20,000 for certain new assets in under consideration. It

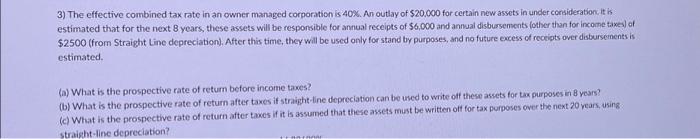

3) The effective combined tax rate in an owner managed corporation is 40%. An outlay of $20,000 for certain new assets in under consideration. It is estimated that for the next 8 years, these assets will be responsible for annual receipts of $6,000 and annual disbursements (other than for income taxes) of $2500 (from Straight Line depreciation). After this time, they will be used only for stand by purposes, and no future excess of receipts over disbursements is estimated. (a) What is the prospective rate of return before income taxes? (b) What is the prospective rate of return after taxes if straight-line depreciation can be used to write off these assets for tax purposes in 8 years? (c) What is the prospective rate of return after taxes if it is assumed that these assets must be written off for tax purposes over the next 20 years, using straight-line depreciation?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started