Answered step by step

Verified Expert Solution

Question

1 Approved Answer

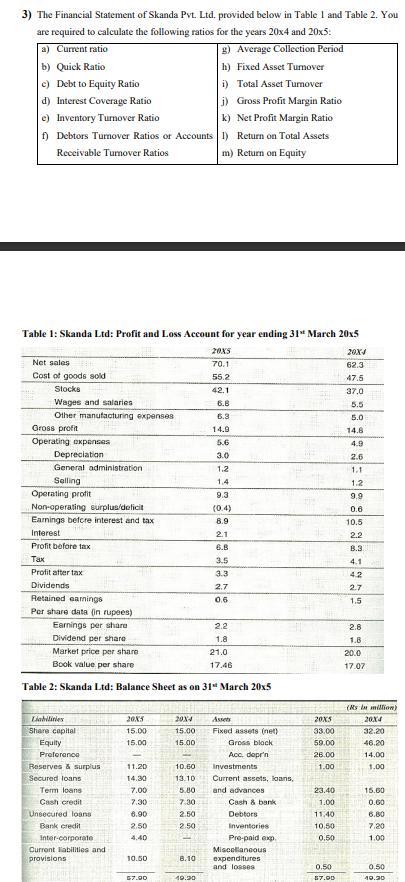

3) The Financial Statement of Skanda Pvt. Ltd. provided below in Table 1 and Table 2. You are required to calculate the following ratios

3) The Financial Statement of Skanda Pvt. Ltd. provided below in Table 1 and Table 2. You are required to calculate the following ratios for the years 20x4 and 20x5: a) Current ratio g) Average Collection Period h) Fixed Asset Turnover i) Total Asset Turnover b) Quick Ratio e) Debt to Equity Ratio d) Interest Coverage Ratio e) Inventory Turnover Ratio f) Debtors Turnover Ratios or Accounts 1) Return on Total Assets Receivable Tumover Ratios m) Return on Equity Table 1: Skanda Ltd: Profit and Loss Account for year ending 31" March 20x5 20X5 70.1 55.2 42.1 6.8 6.3 Net sales Cost of goods sold Stocks Wages and salaries Other manufacturing expenses Gross profit Operating expenses Depreciation General administration Selling Operating profit Non-operating surplus/deficit Earnings before interest and tax Interest Profit before tax Tax Profit after tax Dividends Retained earnings Por share data (in rupees) Liabilities Share capital Equity Preference Reserves & surplus Secured loans Term loans Cash credit Unsecured loans Bank credit Inter-corporate Current liabilities and provisions 20X5 15.00 15.00 Earnings per share Dividend per share. Market price per share Book value per share Table 2: Skanda Ltd: Balance Sheet as on 31 March 20x5 11.20 14.30 7.00 7.30 6.90 2.50 4.40 10.50 $7.90 20X-4 15.00 15.00 10.60 13.10 j) Gross Profit Margin Ratio Net Profit Margin Ratio k) 5.80 7.30 2.50 2.50 8.10 49.20 14.9 5.6 3.0 1.2 1.4 9.3 (0.4) 8.9 2.1 6.B 3.5 3.3 2.7 0.6 2.2 1.8 21.0 17.46 Assets Fixed assets (net) Gross block Acc. depe'n Investments Current assets, loans, and advances Cash & bank Debtors Inventories Pre-paid exp. Miscellaneous expenditures and losses 20X5 33.00 59.00 26.00 1.00 23.40 1.00 11.40 10.50 0,50 0.50 $7.00 20XJ 62.3 47.5 37.0 5.5 5.0 14.8 4.9 2.6 1.1 1.2 9.9 0.6 10.5 2.2 8.3 4.1 4.2 2.7 1.5 2.8 1.8 20.0 17.07 (Rs in million) 20X4 32.20 46.20 14.00 1.00 15.00 0.00 6.80 7.20 1.00 0.50 19.30

Step by Step Solution

★★★★★

3.30 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started