Answered step by step

Verified Expert Solution

Question

1 Approved Answer

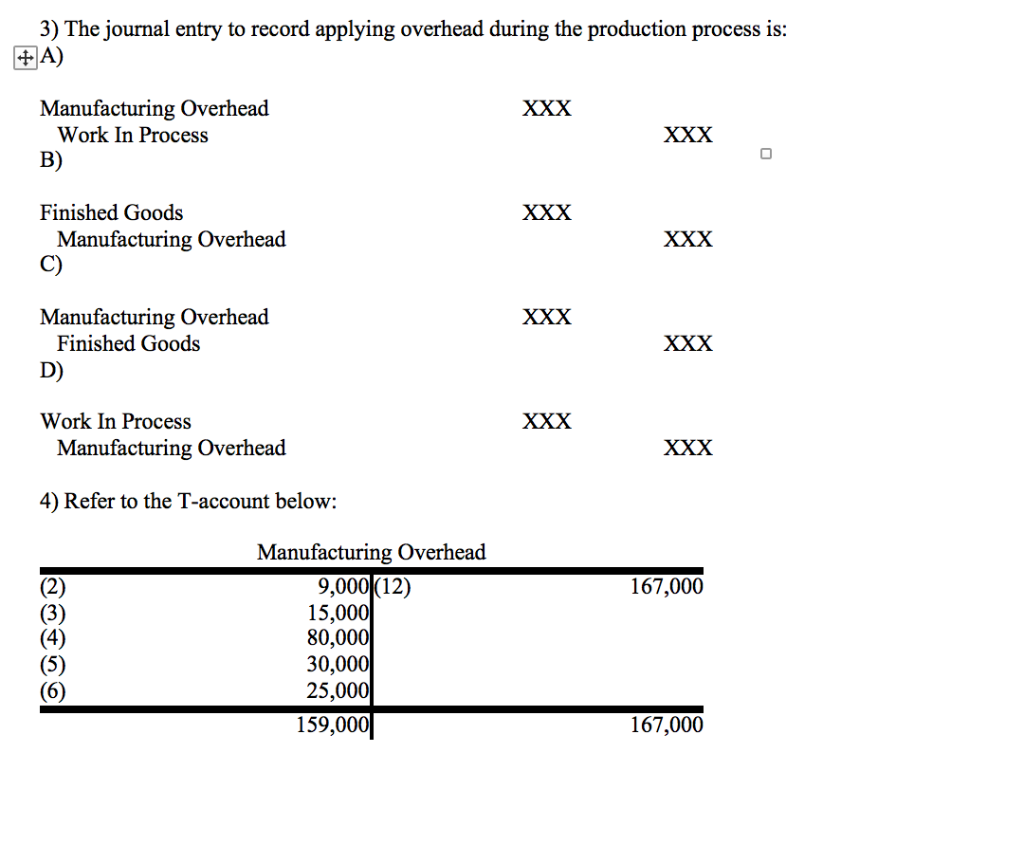

3) The journal entry to record applying overhead during the production process is: +A) Manufacturing Overhead Work In Process B) Finished Goods Manufacturing Overhead

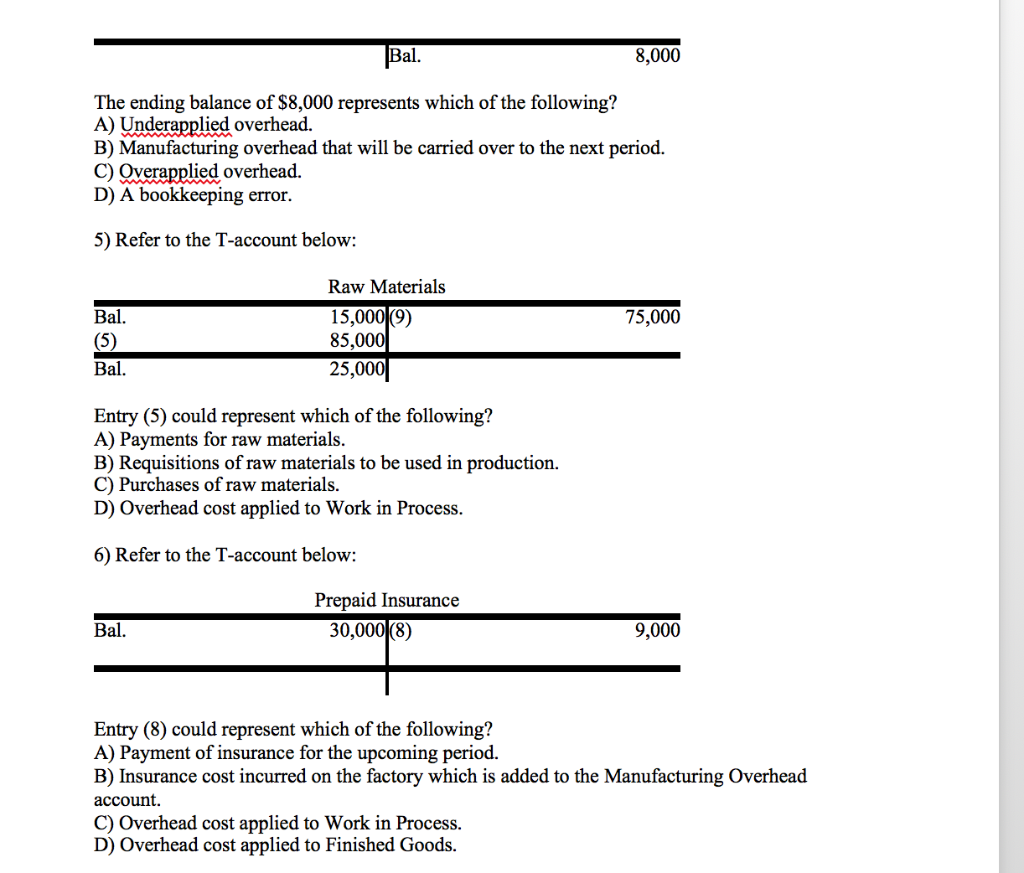

3) The journal entry to record applying overhead during the production process is: +A) Manufacturing Overhead Work In Process B) Finished Goods Manufacturing Overhead Manufacturing Overhead Finished Goods D) Work In Process Manufacturing Overhead 4) Refer to the T-account below: Manufacturing Overhead 9,000 (12) 15,000 80,000 30,000 25,000 159,000 XXX XXX XXX XXX XXX XXX XXX XXX 167,000 167,000 0 Bal. (5) Bal. Bal. The ending balance of $8,000 represents which of the following? A) Underapplied overhead. B) Manufacturing overhead that will be carried over to the next period. C) Overapplied overhead. D) A bookkeeping error. 5) Refer to the T-account below: Raw Materials 15,000 (9) 85,000 25,000 Entry (5) could represent which of the following? A) Payments for raw materials. Bal. B) Requisitions of raw materials be used in production. C) Purchases of raw materials. D) Overhead cost applied to Work in Process. 6) Refer to the T-account below: 8,000 Prepaid Insurance 30,000 (8) 75,000 9,000 Entry (8) could represent which of the following? A) Payment of insurance for the upcoming period. B) Insurance cost incurred on the factory which is added to the Manufacturing Overhead account. C) Overhead cost applied to Work in Process. D) Overhead cost applied to Finished Goods.

Step by Step Solution

★★★★★

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started