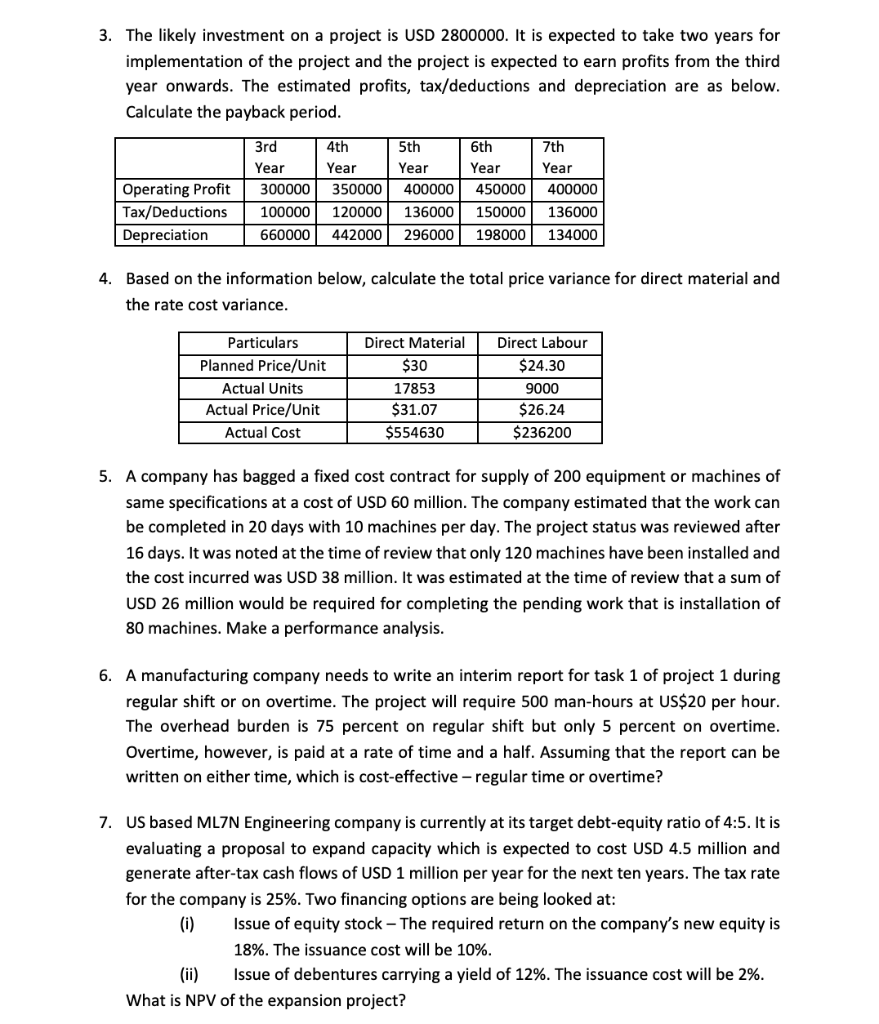

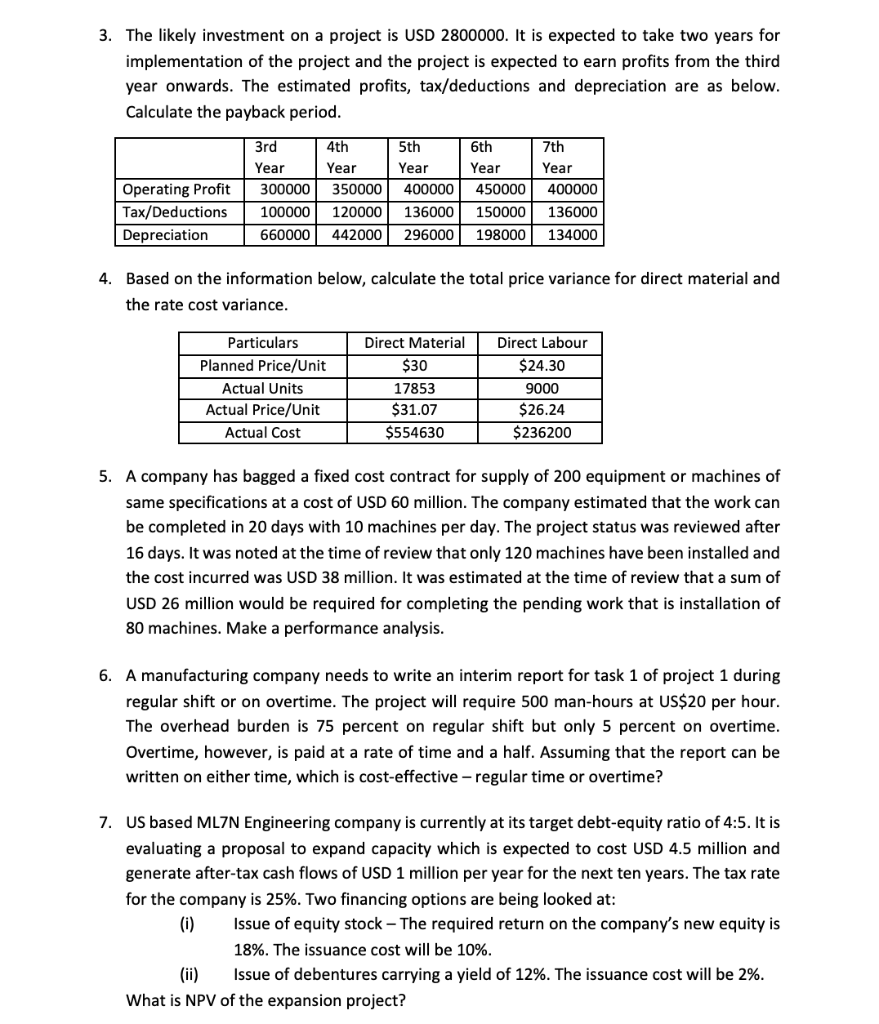

3. The likely investment on a project is USD 2800000 . It is expected to take two years for implementation of the project and the project is expected to earn profits from the third year onwards. The estimated profits, tax/deductions and depreciation are as below. Calculate the payback period. 4. Based on the information below, calculate the total price variance for direct material and the rate cost variance. 5. A company has bagged a fixed cost contract for supply of 200 equipment or machines of same specifications at a cost of USD 60 million. The company estimated that the work can be completed in 20 days with 10 machines per day. The project status was reviewed after 16 days. It was noted at the time of review that only 120 machines have been installed and the cost incurred was USD 38 million. It was estimated at the time of review that a sum of USD 26 million would be required for completing the pending work that is installation of 80 machines. Make a performance analysis. 6. A manufacturing company needs to write an interim report for task 1 of project 1 during regular shift or on overtime. The project will require 500 man-hours at US\$20 per hour. The overhead burden is 75 percent on regular shift but only 5 percent on overtime. Overtime, however, is paid at a rate of time and a half. Assuming that the report can be written on either time, which is cost-effective - regular time or overtime? 7. US based ML7N Engineering company is currently at its target debt-equity ratio of 4:5. It is evaluating a proposal to expand capacity which is expected to cost USD 4.5 million and generate after-tax cash flows of USD 1 million per year for the next ten years. The tax rate for the company is 25%. Two financing options are being looked at: (i) Issue of equity stock - The required return on the company's new equity is 18%. The issuance cost will be 10%. (ii) Issue of debentures carrying a yield of 12%. The issuance cost will be 2%. What is NPV of the expansion project? 3. The likely investment on a project is USD 2800000 . It is expected to take two years for implementation of the project and the project is expected to earn profits from the third year onwards. The estimated profits, tax/deductions and depreciation are as below. Calculate the payback period. 4. Based on the information below, calculate the total price variance for direct material and the rate cost variance. 5. A company has bagged a fixed cost contract for supply of 200 equipment or machines of same specifications at a cost of USD 60 million. The company estimated that the work can be completed in 20 days with 10 machines per day. The project status was reviewed after 16 days. It was noted at the time of review that only 120 machines have been installed and the cost incurred was USD 38 million. It was estimated at the time of review that a sum of USD 26 million would be required for completing the pending work that is installation of 80 machines. Make a performance analysis. 6. A manufacturing company needs to write an interim report for task 1 of project 1 during regular shift or on overtime. The project will require 500 man-hours at US\$20 per hour. The overhead burden is 75 percent on regular shift but only 5 percent on overtime. Overtime, however, is paid at a rate of time and a half. Assuming that the report can be written on either time, which is cost-effective - regular time or overtime? 7. US based ML7N Engineering company is currently at its target debt-equity ratio of 4:5. It is evaluating a proposal to expand capacity which is expected to cost USD 4.5 million and generate after-tax cash flows of USD 1 million per year for the next ten years. The tax rate for the company is 25%. Two financing options are being looked at: (i) Issue of equity stock - The required return on the company's new equity is 18%. The issuance cost will be 10%. (ii) Issue of debentures carrying a yield of 12%. The issuance cost will be 2%. What is NPV of the expansion project