Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3. The manufacturing firm X have the option to go ahead with a project. Assume that the projects first year costs $60, and increases

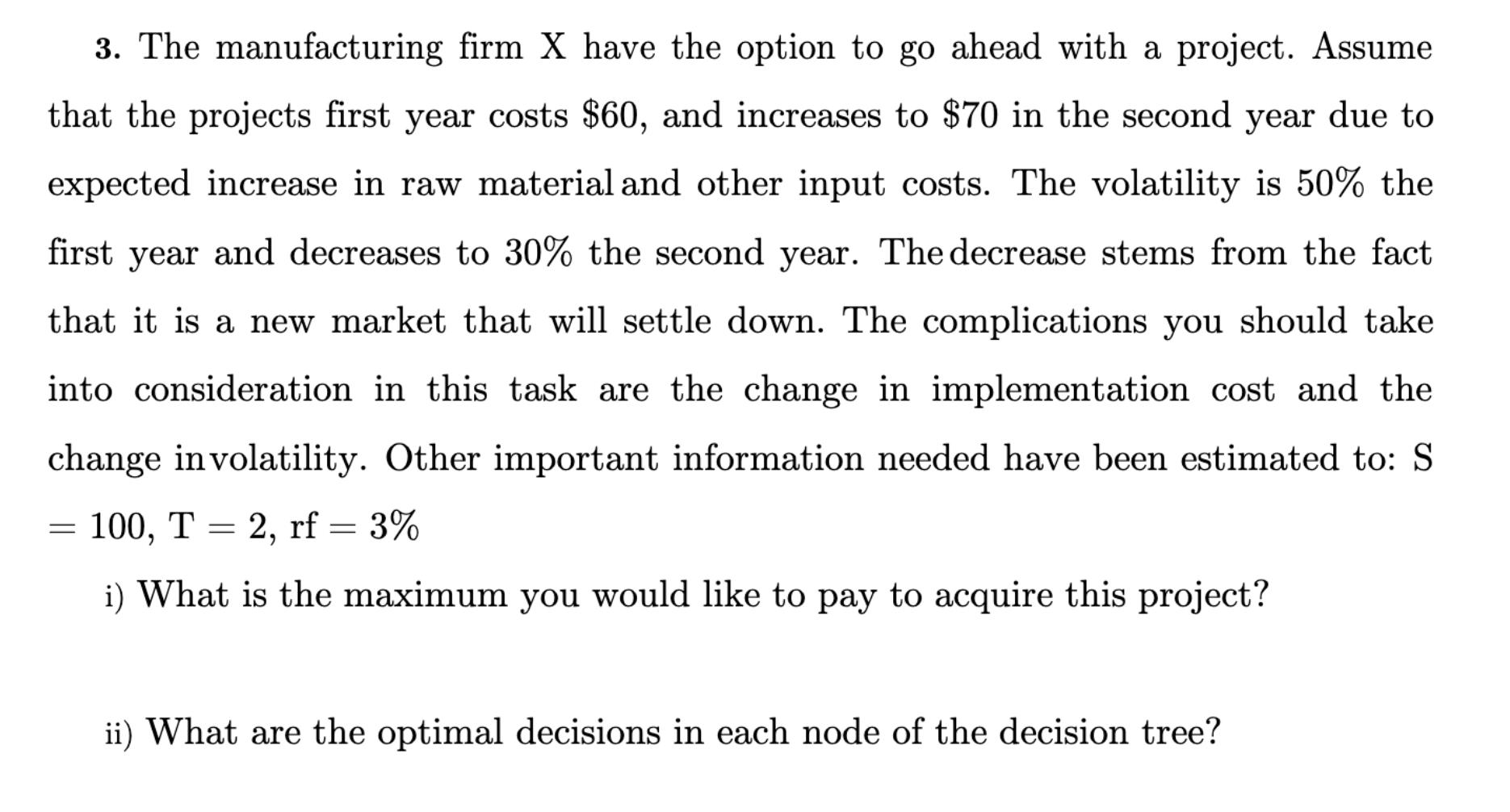

3. The manufacturing firm X have the option to go ahead with a project. Assume that the projects first year costs $60, and increases to $70 in the second year due to expected increase in raw material and other input costs. The volatility is 50% the first year and decreases to 30% the second year. The decrease stems from the fact that it is a new market that will settle down. The complications you should take into consideration in this task are the change in implementation cost and the change in volatility. Other important information needed have been estimated to: S = 100, T = 2, rf = 3% i) What is the maximum you would like to pay to acquire this project? ii) What are the optimal decisions in each node of the decision tree?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the maximum amount you would be willing to pay for the project and determine the optima...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started