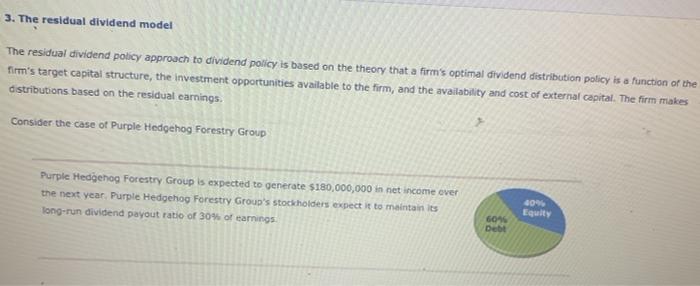

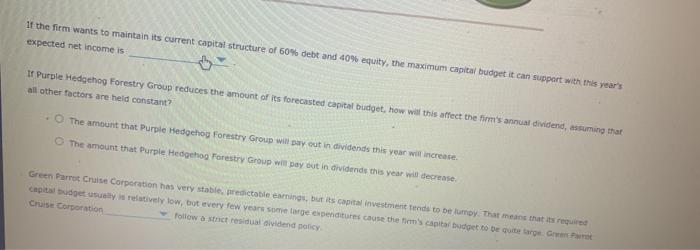

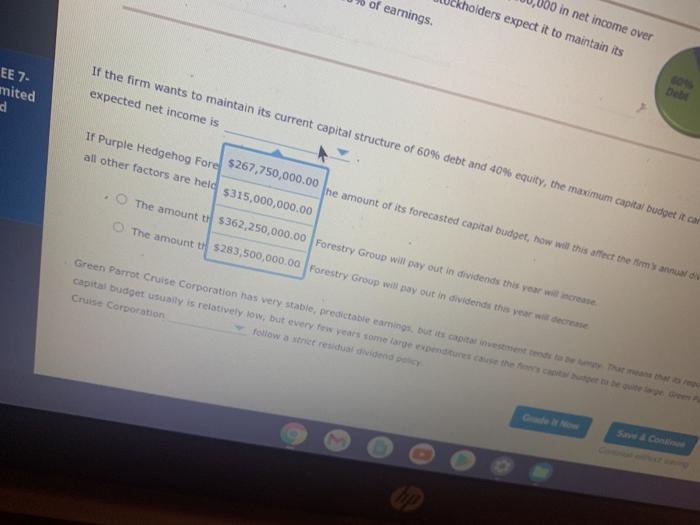

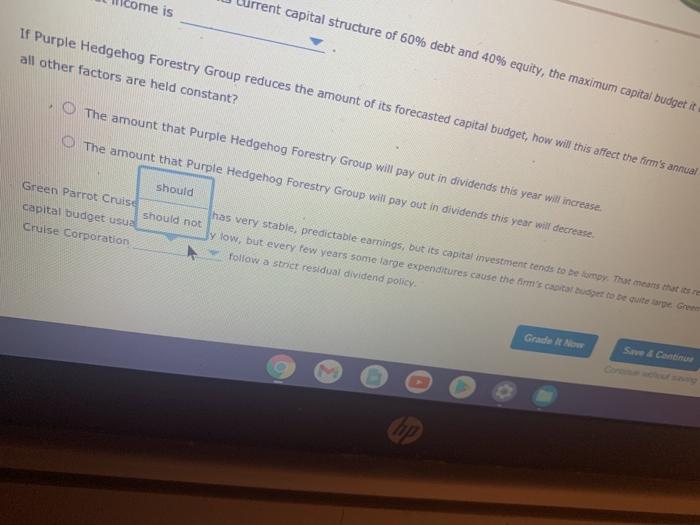

3. The residual dividend model The residual dividend policy approach to dividend policy is based on the theory that a firm's optimal dividend distribution policy is a function of the firm's target capital structure, the investment opportunities available to the firm, and the availability and cost of external capital. The firm makes distributions based on the residual earnings. Consider the case of Purple Hedgehog Forestry Group Purple Hedgehog Forestry Group is expected to generate $180,000,000 in net income over the next year. Purple Hedgehog Forestry Group's stockholders expect it to maintain its long-run dividend payout ratio of 30% of earnings 40 Equity 6096 Debt it the firm wants to maintain its current capital structure of 50% debt and 40% equity, the maximum capital budget it can support with this year's expected net income is 5 Ir Purple Hedgehog Forestry Group reduces the amount of its forecasted capital budget, how well this affect the firm's annual dividend, assuming that all other factors are held constant? The amount that Purple Hedgehog Forestry Group will pay out in dividends this year will increase The amount that Purple Hedgehog Forestry Group will pay out in dividends this year will decrease Green Parrot Cruise Corporation has very stable predictable earnings, but its capital investment tends to be tumoy. That means that required capital de sus relatively low, but every few years some are expenditures cause the firm's capital budget to be quite target Cruise Corporation Follow a strict residual dividend pancy of earnings. holders expect it to maintain its in net income over EE 7- mited If the firm wants to maintain its current capital structure of 60% debt and 40% equity, the maximum capital budget it car expected net income is d IT Purple Hedgehog Fore $267,750,000.00 ne amount or its forecasted capital budget, how will this affect the Romano all other factors are held $315,000,000.00 The amount to $362,250,000.00 Forestry Group will pay out in dividends this year we increase The amount to $283,500,000.00 Forestry Group will say out in dividends this year wil decrease Green Parrot Cruise Corporation has very stable, predictable caminos, out its converted to be capital budget usually is relatively low, but every few years some are expenditures cause there were Cruise Corporation follow a strict residual divided come is ent capital structure of 60% debt and 40% equity, the maximum capital budget it If Purple Hedgehog Forestry Group reduces the amount of its forecasted capital budget, how will this affect the firm's annual all other factors are held constant? The amount that Purple Hedgehog Forestry Group will pay out in dividends this year will increase The amount that Purple Hedgehog Forestry Group will pay out in dividends this year will decrease should Green Parrot Cruise has very stable, predictable camnings, but its capital investment tends to be compy. That means that it should not capital budget usua y low, but every few years some targe expenditures cause the firm's capital budget to be quite areGre Cruise Corporation follow a strict residual dividend policy. Grade it Sive Conti top