Question

3. The table below gives the probability of different returns for three different assets. Using this table, calculate the following: a. The expected return

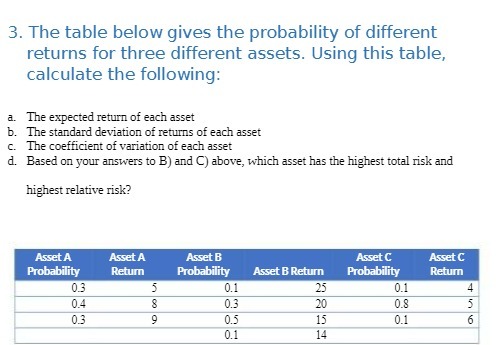

3. The table below gives the probability of different returns for three different assets. Using this table, calculate the following: a. The expected return of each asset b. The standard deviation of returns of each asset c. The coefficient of variation of each asset d. Based on your answers to B) and C) above, which asset has the highest total risk and highest relative risk? Asset A Asset A Asset B Probability Return Probability Asset B Return Asset C Probability Asset C Return 0.3 5 0.1 0.4 8 0.3 0.3 9 0.5 0.1 2822 25 0.1 4 20 0.8 5 15 0.1 6 14

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the expected return standard deviation of returns and coefficient of variation for each asset well use the given probability and return v...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Quantitative Investment Analysis

Authors: Richard A. DeFusco, Dennis W. McLeavey, Jerald E. Pinto, David E. Runkle

3rd edition

111910422X, 978-1119104544, 1119104548, 978-1119104223

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App