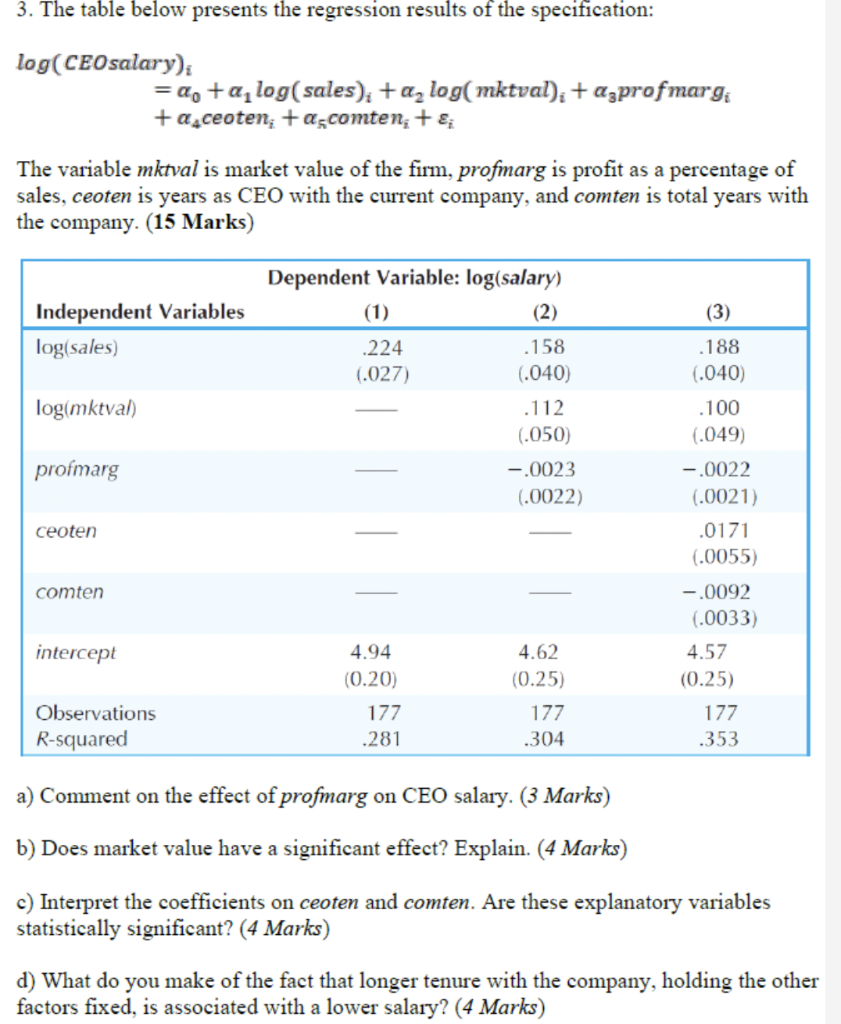

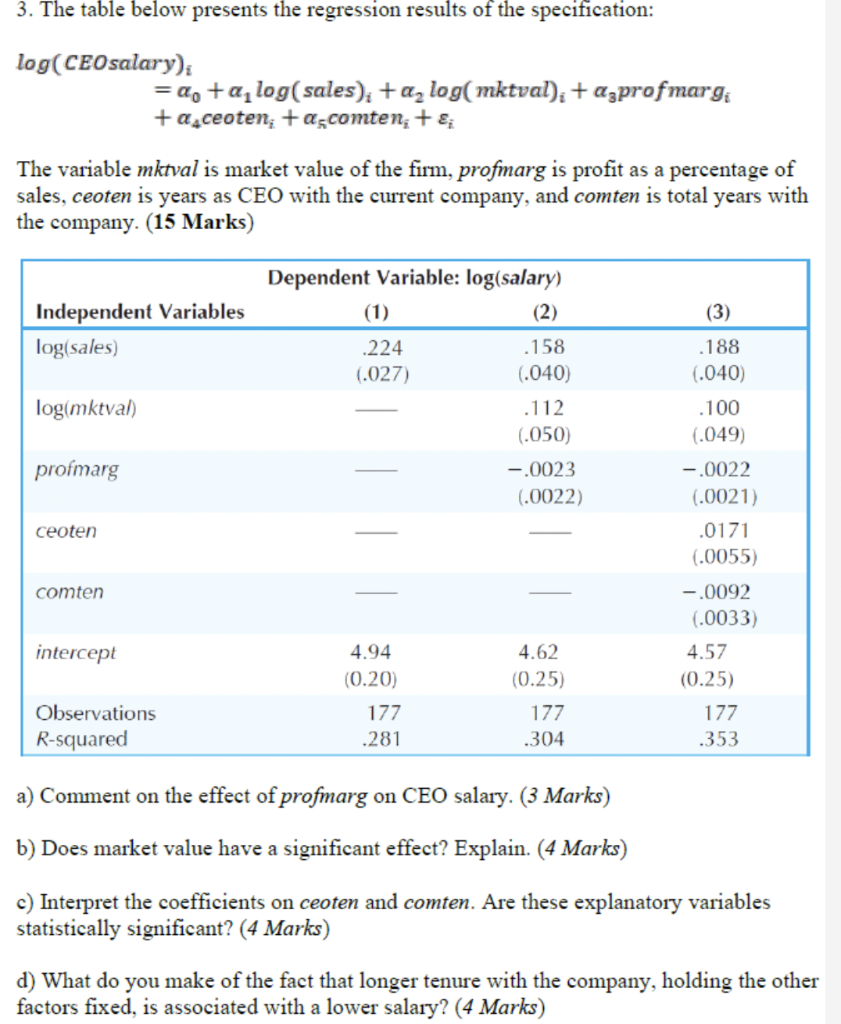

3. The table below presents the regression results of the specification: log(CEOsalary); = a, +alog(sales), +az log( mktval), +azprofmargi +a.ceoten; +ascomten; + &; The variable mktval is market value of the firm, profmarg is profit as a percentage of sales, ceoten is years as CEO with the current company, and comten is total years with the company. (15 Marks) (3) Independent Variables log(sales) Dependent Variable: log(salary) (1) (2) .224 .158 (.027) (.040) .112 (.050) -.0023 0.0022) log(mktval) profmarg ceoten .188 (.040) .100 (.049) -.0022 (.0021) .0171 (.0055) -.0092 (.0033) 4.57 (0.25) 177 .353 comten intercept 4.94 4.62 (0.25) 177 .304 (0.20) 177 .281 Observations R-squared a) Comment on the effect of profmarg on CEO salary. (3 Marks) b) Does market value have a significant effect? Explain. (4 Marks) c) Interpret the coefficients on ceoten and comten. Are these explanatory variables statistically significant? (4 Marks) d) What do you make of the fact that longer tenure with the company, holding the other factors fixed, is associated with a lower salary? (4 Marks) 3. The table below presents the regression results of the specification: log(CEOsalary); = a, +alog(sales), +az log( mktval), +azprofmargi +a.ceoten; +ascomten; + &; The variable mktval is market value of the firm, profmarg is profit as a percentage of sales, ceoten is years as CEO with the current company, and comten is total years with the company. (15 Marks) (3) Independent Variables log(sales) Dependent Variable: log(salary) (1) (2) .224 .158 (.027) (.040) .112 (.050) -.0023 0.0022) log(mktval) profmarg ceoten .188 (.040) .100 (.049) -.0022 (.0021) .0171 (.0055) -.0092 (.0033) 4.57 (0.25) 177 .353 comten intercept 4.94 4.62 (0.25) 177 .304 (0.20) 177 .281 Observations R-squared a) Comment on the effect of profmarg on CEO salary. (3 Marks) b) Does market value have a significant effect? Explain. (4 Marks) c) Interpret the coefficients on ceoten and comten. Are these explanatory variables statistically significant? (4 Marks) d) What do you make of the fact that longer tenure with the company, holding the other factors fixed, is associated with a lower salary? (4 Marks)