Answered step by step

Verified Expert Solution

Question

1 Approved Answer

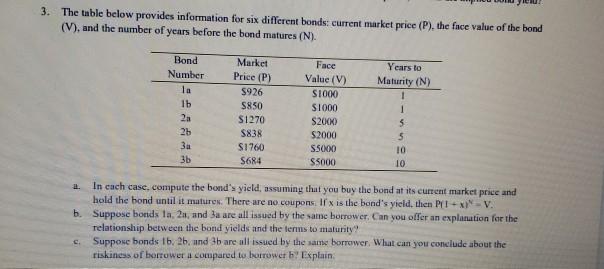

3. The table below provides information for six different bonds current market price (P), the face value of the bond (V), and the number of

3. The table below provides information for six different bonds current market price (P), the face value of the bond (V), and the number of years before the bond matures (N). Face Value (V) Years to Maturity (N) Bond Number la 1b 2a 25 3a 3b Market Price (P) $926 5850 S1270 5838 51760 5684 S1000 S1000 S2000 S2000 S5000 S5000 1 5 5 10 10 In each case, compute the bond's yield, assuming that you buy the bond at its current market price and hold the bond until it matures. There are no coupons. Ifx is the band's yield, then PI-XIV. b. Suppose bonds la 21, and Ja are all issued by the same borrower. Can you offer an explanation for the relationship between the bond yields and the terms to maturity Suppose bonds 1b, 2bund b are all issued by the same borrower. What can you conclude about the riskiness of borrower a compared to borrower bExplain

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started