Question

3) TMZ Transportation purchased a truck 5 years ago at a cost of $98,000. The truck has been depreciated on an annual basis using

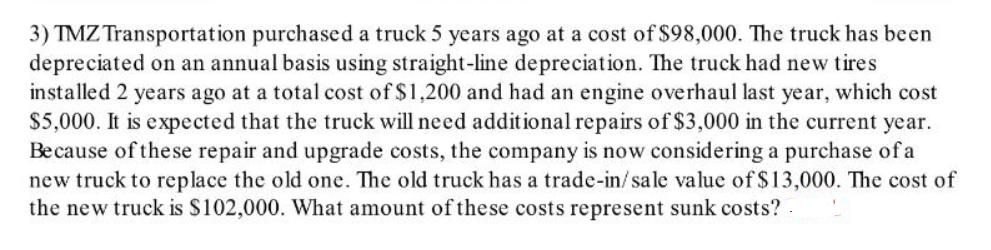

3) TMZ Transportation purchased a truck 5 years ago at a cost of $98,000. The truck has been depreciated on an annual basis using straight-line depreciation. The truck had new tires installed 2 years ago at a total cost of $1,200 and had an engine overhaul last year, which cost $5,000. It is expected that the truck will need additional repairs of $3,000 in the current year. Because of these repair and upgrade costs, the company is now considering a purchase of a new truck to replace the old one. The old truck has a trade-in/sale value of $13,000. The cost of the new truck is $102,000. What amount of these costs represent sunk costs?.

Step by Step Solution

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Answer As per th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Discovering Advanced Algebra An Investigative Approach

Authors: Jerald Murdock, Ellen Kamischke, Eric Kamischke

1st edition

1559539844, 978-1604400069, 1604400064, 978-1559539845

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App