Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3. US Auto Company would like to offer rebates to its customers in order to increase sales. If it lowers prices sales will increase.

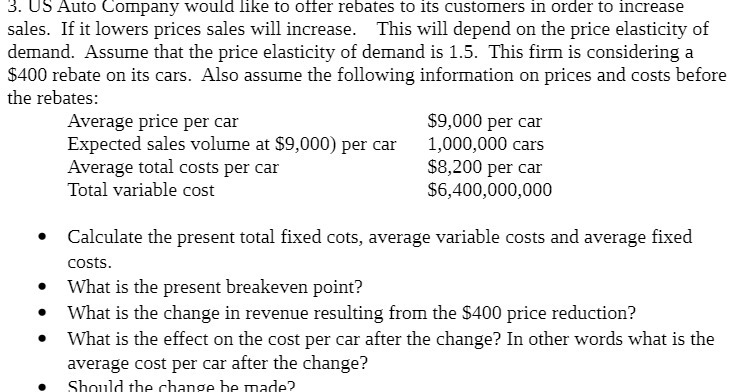

3. US Auto Company would like to offer rebates to its customers in order to increase sales. If it lowers prices sales will increase. This will depend on the price elasticity of demand. Assume that the price elasticity of demand is 1.5. This firm is considering a $400 rebate on its cars. Also assume the following information on prices and costs before the rebates: Average price per car Expected sales volume at $9,000) per car Average total costs per car Total variable cost $9,000 per car 1,000,000 cars $8,200 per car $6,400,000,000 Calculate the present total fixed cots, average variable costs and average fixed costs. What is the present breakeven point? What is the change in revenue resulting from the $400 price reduction? What is the effect on the cost per car after the change? In other words what is the average cost per car after the change? Should the change be made?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Present Total Fixed Costs Total Variable Cost 6400000000 Average Total Cost per Car 8200 Total Variable Cost Average Total Cost per Car Expected Sal...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started