Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3 Use the following to answer questions 23 - 30 PJ Corp. reported the following income statement results: Sales Sales returns & allowances Gross profit

3

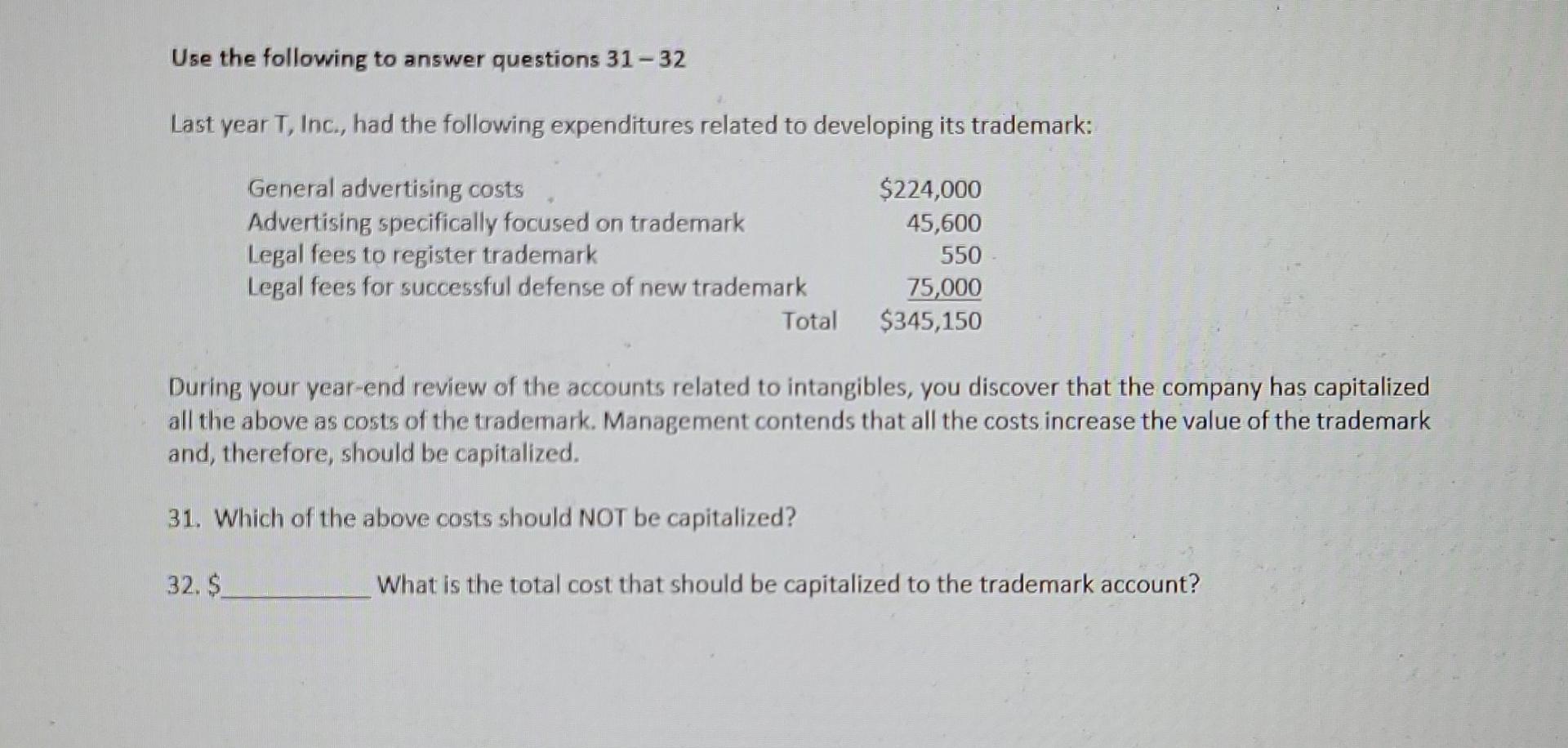

Use the following to answer questions 23 - 30 PJ Corp. reported the following income statement results: Sales Sales returns & allowances Gross profit Operating expense Gain on sale of equipment Net income $900,000 20,000 382,800 183,000 15,000 113,520 23. $ Calculate Net sales 24. $ Calculate Cost of Goods Sold 25.$ Calculate operating income 26. $ Calculate Income before Income tax (IBT) 27. $ Calculate income tax expense 28. %. Calculate the gross profit margin (one decimal place) 29, %. Calculate the profit margin (one decimal place) 30. S determine IBT. Assume the company had a loss (instead of the gain) on the sale of equipment of $3,000 Use the following to answer questions 31 - 32 Last year T, Inc., had the following expenditures related to developing its trademark: General advertising costs Advertising specifically focused on trademark Legal fees to register trademark Legal fees for successful defense of new trademark Total $224,000 45,600 550 75,000 $345,150 During your year-end review of the accounts related to intangibles, you discover that the company has capitalized all the above as costs of the trademark. Management contends that all the costs increase the value of the trademark and, therefore, should be capitalized. 31. Which of the above costs should NOT be capitalized? 32. $ What is the total cost that should be capitalized to the trademark accountStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started