Answered step by step

Verified Expert Solution

Question

1 Approved Answer

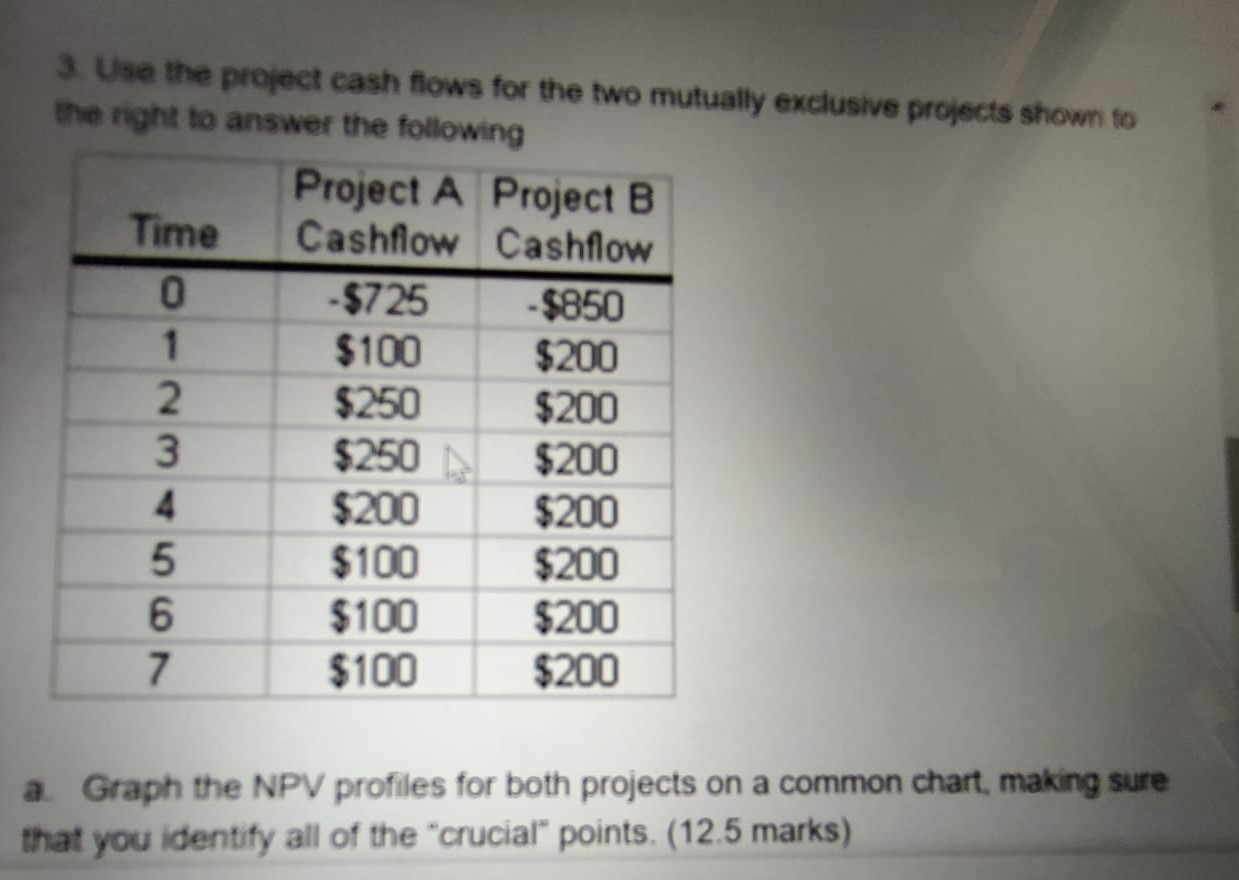

3. Use the project cash flows for the two mutually exclusive projects shown to the right to answer the following Project A Project B

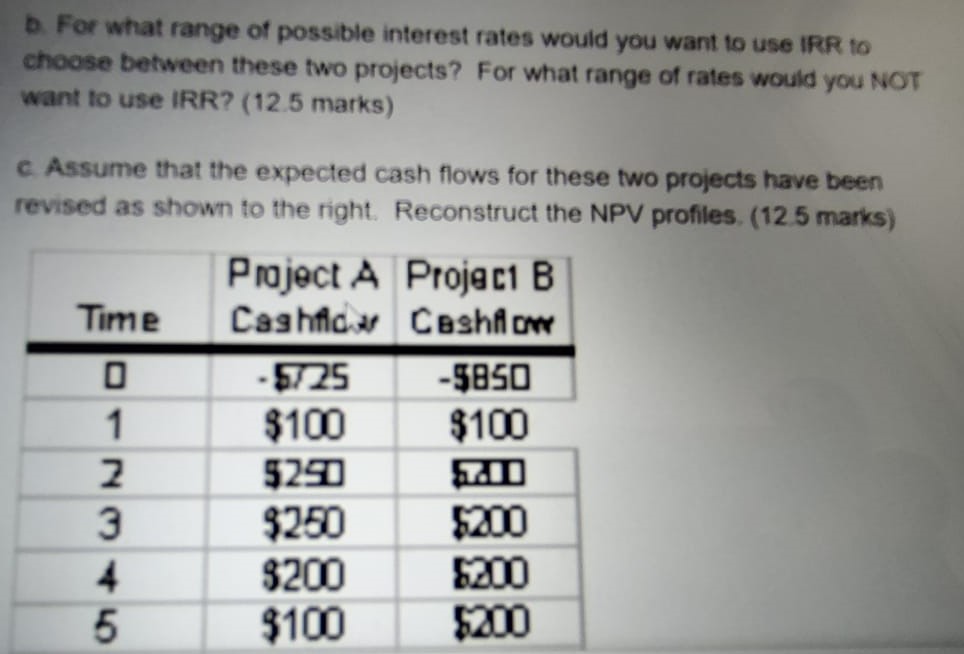

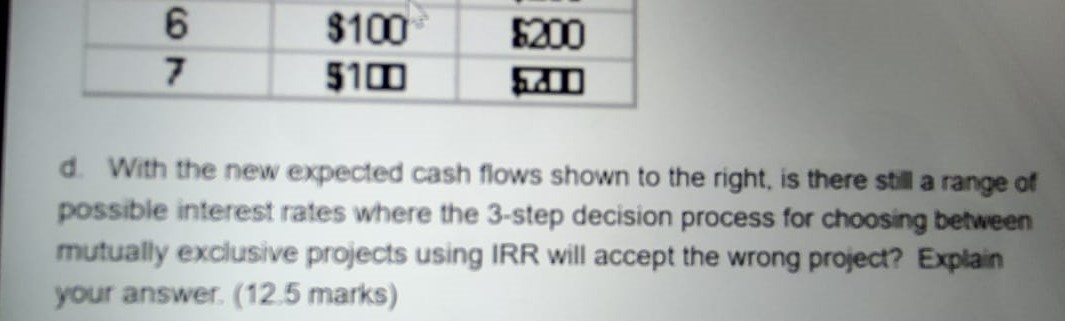

3. Use the project cash flows for the two mutually exclusive projects shown to the right to answer the following Project A Project B Time Cashflow Cashflow 0123456 -$725 -$850 $100 $200 $250 $200 $250 $200 $200 $200 $100 $200 $100 $200 7 $100 $200 a. Graph the NPV profiles for both projects on a common chart, making sure that you identify all of the "crucial" points. (12.5 marks) b. For what range of possible interest rates would you want to use IRR to choose between these two projects? For what range of rates would you NOT want to use IRR? (12.5 marks) c. Assume that the expected cash flows for these two projects have been revised as shown to the right. Reconstruct the NPV profiles. (12.5 marks) Project A Project B Time Cashflow Cashflow 2 710 0 -5725 -5850 $100 $100 5250 P 3 $250 $200 4 $200 $200 5 $100 $200 6 $100 $200 7 5100 57.00 d. With the new expected cash flows shown to the right, is there still a range of possible interest rates where the 3-step decision process for choosing between mutually exclusive projects using IRR will accept the wrong project? Explain your answer. (12.5 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started