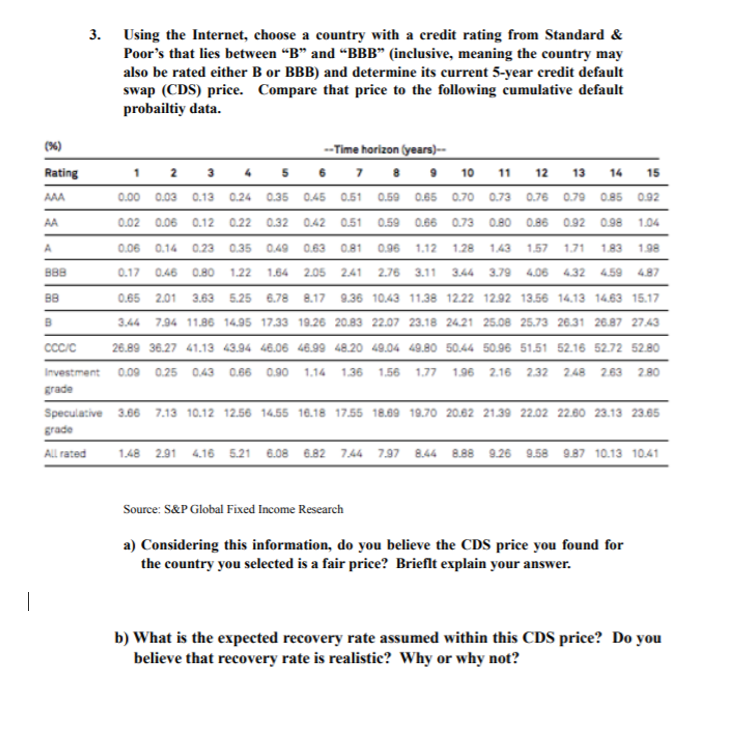

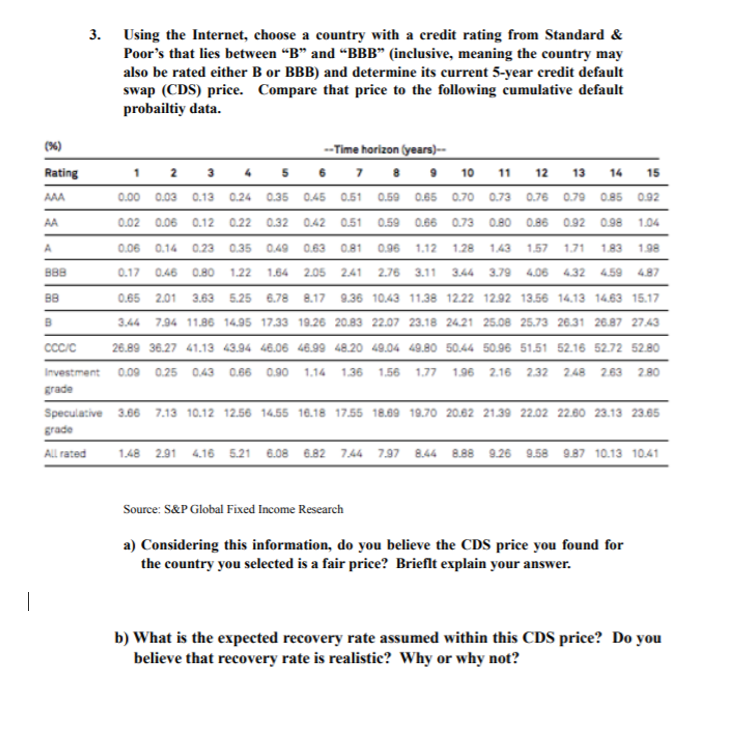

3. Using the Internet, choose a country with a credit rating from Standard & Poor's that lies between "B" and "BBB (inclusive, meaning the country may also be rated either B or BBB) and determine its current 5-year credit default swap (CDS) price. Compare that price to the following cumulative default probailtiy data. (%) Rating --Time horizon (years)-- 4 5 6 7 8 9 10 11 12 13 14 0.24 0.35 0.45 0.51 0.59 0.65 0.70 0.73 0.76 0.79 0.85 15 AAA 0.00 0.03 0.13 0.92 AA 0.02 0.06 0.12 0.22 0.32 0.42 0.51 0.59 0.66 0.73 0.80 0.86 0.92 0.98 1.04 A 0.06 0.14 0.23 0.350.49 0.63 0.81 0.96 1.12 1.28 1.43 1.57 1.71 183 1.98 B88 0.17 0.46 0.80 1.22 1.64 2.05 2.41 2.76 3.11 3.79 406 432 4.59 4.87 BB 0.65 2.01 3.63 5.25 6.78 8.17 9.36 10.43 11.38 12.22 12.92 13.56 14,13 14,63 15.17 3.44 7.94 11.96 14.95 17.33 19.26 20.83 22.07 23.18 2421 25.08 25.73 26.31 26.87 2743 CCCC 26.89 36.27 41.13 43.94 46.06 46.99 48.20 49.04 49.80 5044 50.96 51.51 52.16 52.72 52.80 Investment 0.09 0.25 0.43 0.66 0.90 1.14 1.36 1.56 1.77 1.96 2.16 2.32 248 263 280 grade Speculative 3.66 7.13 10.12 12.56 14.55 16.18 17.55 18.69 19.70 20.62 21.39 22.02 22.60 23.13 23.65 grade All rated 1.48 2.91 4.16 5.21 6.08 6.82 7.44 7.97 8.44 8.88 9.26 9.58 9.87 10.13 10.41 Source: S&P Global Fixed Income Research a) Considering this information, do you believe the CDS price you found for the country you selected is a fair price? Brieflt explain your answer. | b) What is the expected recovery rate assumed within this CDS price? Do you believe that recovery rate is realistic? Why or why not? 3. Using the Internet, choose a country with a credit rating from Standard & Poor's that lies between "B" and "BBB (inclusive, meaning the country may also be rated either B or BBB) and determine its current 5-year credit default swap (CDS) price. Compare that price to the following cumulative default probailtiy data. (%) Rating --Time horizon (years)-- 4 5 6 7 8 9 10 11 12 13 14 0.24 0.35 0.45 0.51 0.59 0.65 0.70 0.73 0.76 0.79 0.85 15 AAA 0.00 0.03 0.13 0.92 AA 0.02 0.06 0.12 0.22 0.32 0.42 0.51 0.59 0.66 0.73 0.80 0.86 0.92 0.98 1.04 A 0.06 0.14 0.23 0.350.49 0.63 0.81 0.96 1.12 1.28 1.43 1.57 1.71 183 1.98 B88 0.17 0.46 0.80 1.22 1.64 2.05 2.41 2.76 3.11 3.79 406 432 4.59 4.87 BB 0.65 2.01 3.63 5.25 6.78 8.17 9.36 10.43 11.38 12.22 12.92 13.56 14,13 14,63 15.17 3.44 7.94 11.96 14.95 17.33 19.26 20.83 22.07 23.18 2421 25.08 25.73 26.31 26.87 2743 CCCC 26.89 36.27 41.13 43.94 46.06 46.99 48.20 49.04 49.80 5044 50.96 51.51 52.16 52.72 52.80 Investment 0.09 0.25 0.43 0.66 0.90 1.14 1.36 1.56 1.77 1.96 2.16 2.32 248 263 280 grade Speculative 3.66 7.13 10.12 12.56 14.55 16.18 17.55 18.69 19.70 20.62 21.39 22.02 22.60 23.13 23.65 grade All rated 1.48 2.91 4.16 5.21 6.08 6.82 7.44 7.97 8.44 8.88 9.26 9.58 9.87 10.13 10.41 Source: S&P Global Fixed Income Research a) Considering this information, do you believe the CDS price you found for the country you selected is a fair price? Brieflt explain your answer. | b) What is the expected recovery rate assumed within this CDS price? Do you believe that recovery rate is realistic? Why or why not