Answered step by step

Verified Expert Solution

Question

1 Approved Answer

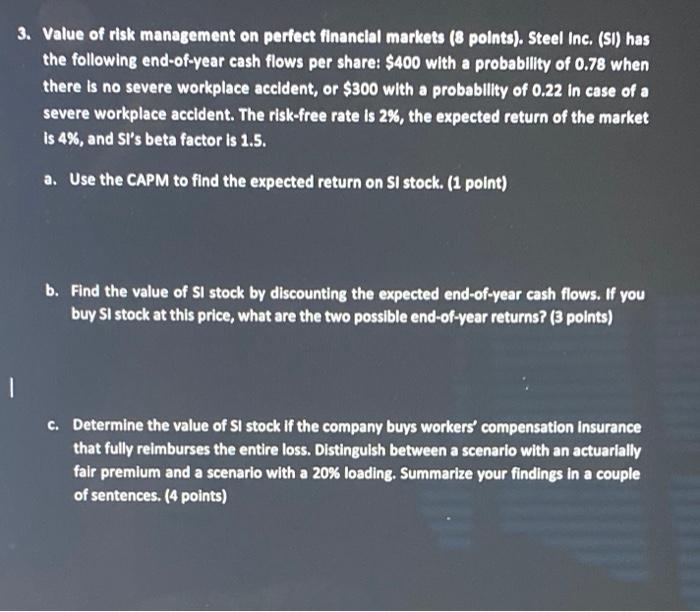

3. Value of risk management on perfect financial markets (8 points). Steel Inc. (SI) has the following end-of-year cash flows per share: $400 with

3. Value of risk management on perfect financial markets (8 points). Steel Inc. (SI) has the following end-of-year cash flows per share: $400 with a probability of 0.78 when there is no severe workplace accident, or $300 with a probability of 0.22 in case of a severe workplace accident. The risk-free rate is 2%, the expected return of the market is 4%, and SI's beta factor is 1.5. a. Use the CAPM to find the expected return on SI stock. (1 point) b. Find the value of SI stock by discounting the expected end-of-year cash flows. If you buy SI stock at this price, what are the two possible end-of-year returns? (3 points) c. Determine the value of SI stock if the company buys workers' compensation Insurance that fully reimburses the entire loss. Distinguish between a scenario with an actuarially fair premium and a scenario with a 20% loading. Summarize your findings in a couple of sentences. (4 points)

Step by Step Solution

★★★★★

3.41 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

a Expected return on Si stock as per CAPM Rf betaRm Rf 3 08 5 3 46 b V...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started