Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3. Volatility models (a) Current market volatility is higher than the historical average of market volatil- ity from a long sample. Given this information

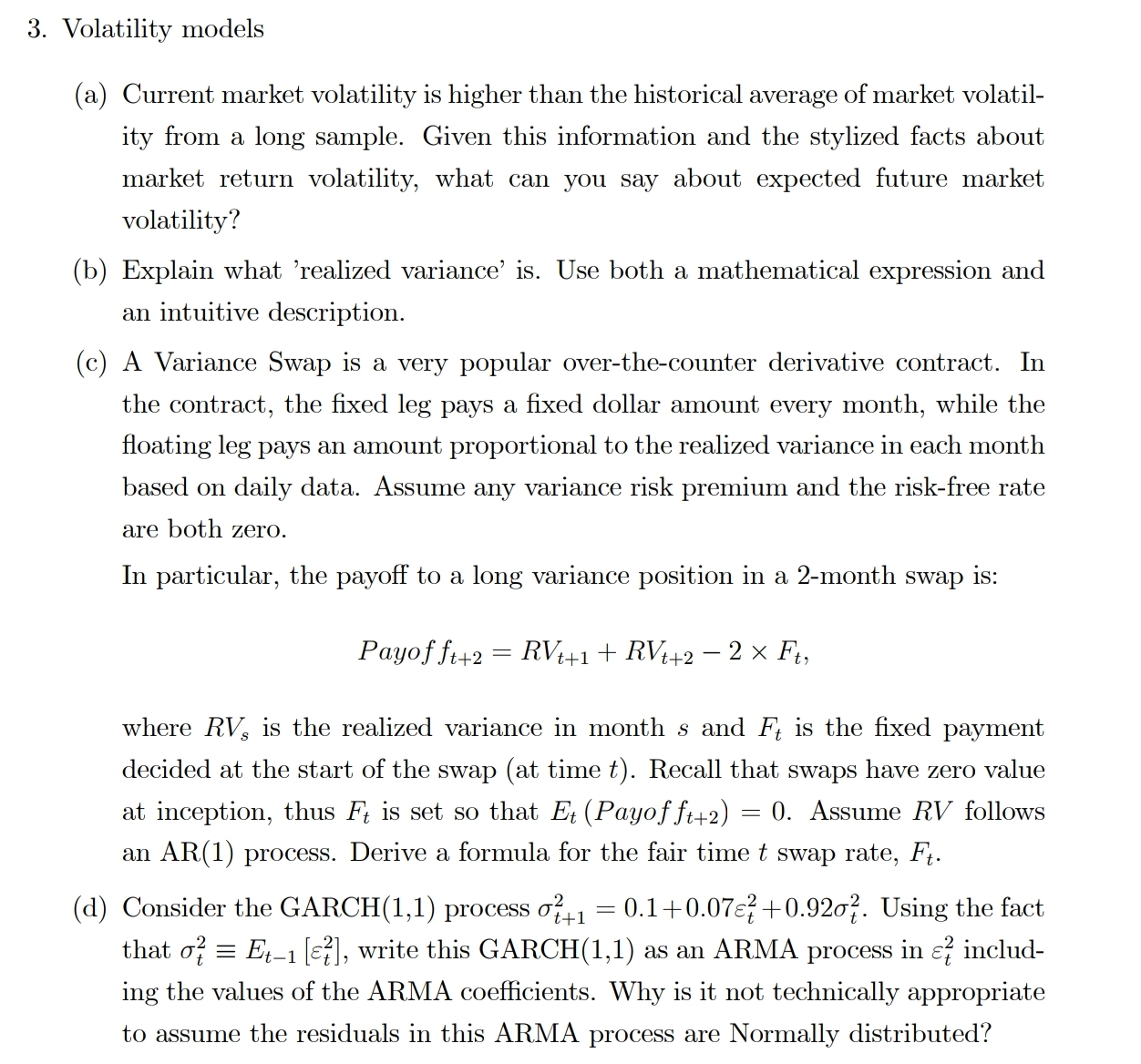

3. Volatility models (a) Current market volatility is higher than the historical average of market volatil- ity from a long sample. Given this information and the stylized facts about market return volatility, what can you say about expected future market volatility? (b) Explain what 'realized variance' is. Use both a mathematical expression and an intuitive description. (c) A Variance Swap is a very popular over-the-counter derivative contract. In the contract, the fixed leg pays a fixed dollar amount every month, while the floating leg pays an amount proportional to the realized variance in each month based on daily data. Assume any variance risk premium and the risk-free rate are both zero. In particular, the payoff to a long variance position in a 2-month swap is: Payofft+2 RVt+1+RVt+2 - 2 Ft, where RV, is the realized variance in months and F is the fixed payment decided at the start of the swap (at time t). Recall that swaps have zero value at inception, thus Ft is set so that Et (Payofft+2) 0. Assume RV follows an AR(1) process. Derive a formula for the fair time t swap rate, Ft. = t+1 (d) Consider the GARCH(1,1) process o7+ = 0.1+0.07 +0.92o. Using the fact that o = Et-1 [7], write this GARCH(1,1) as an ARMA process in & includ- ing the values of the ARMA coefficients. Why is it not technically appropriate to assume the residuals in this ARMA process are Normally distributed?

Step by Step Solution

★★★★★

3.58 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

a If current market volatility is higher than the historical average of market volatility it suggests that there is an expectation of higher future ma...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started