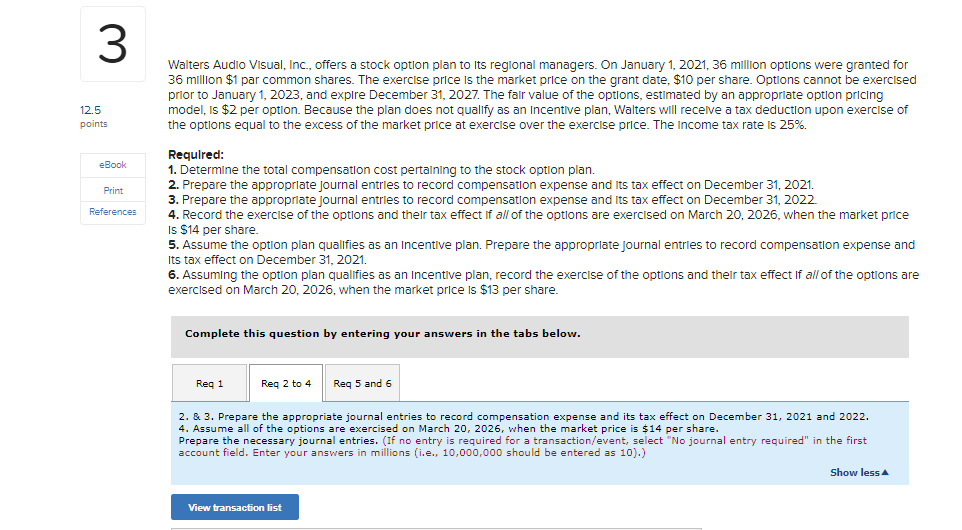

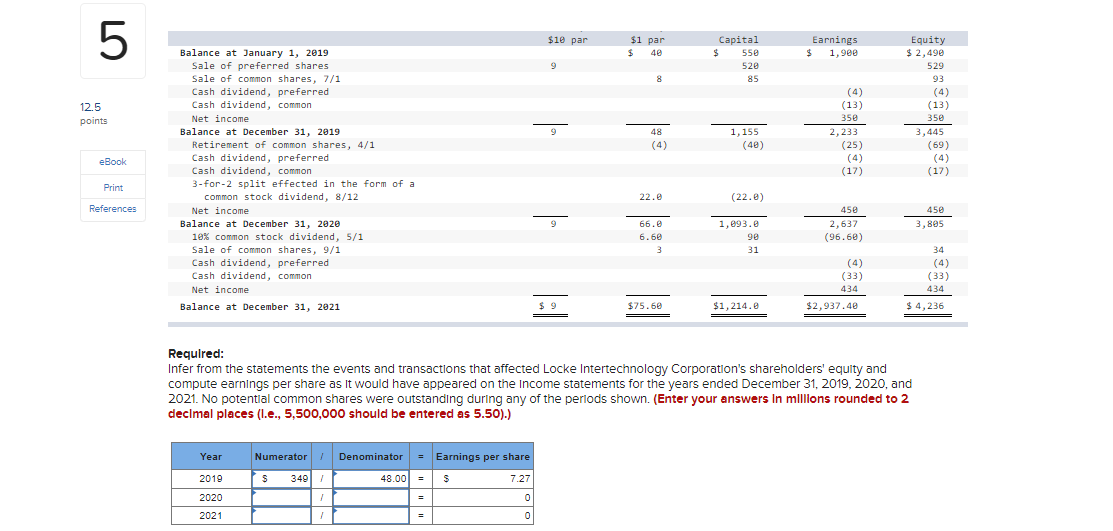

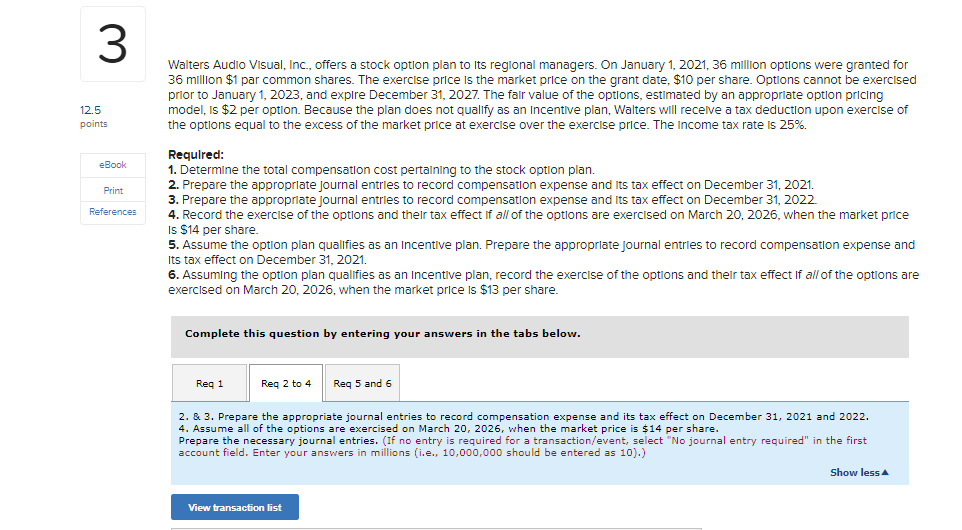

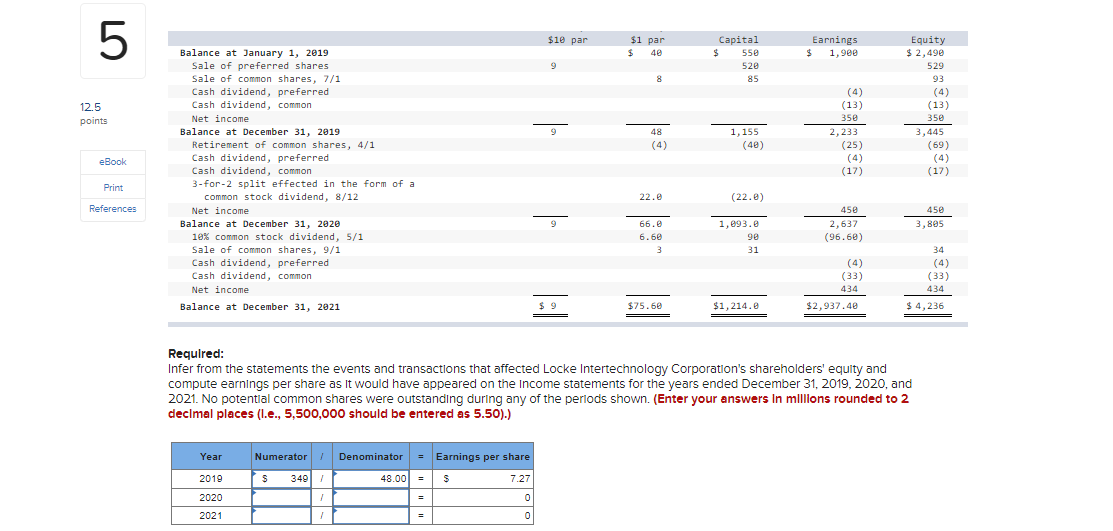

3 Walters Audio Visual, Inc., offers a stock option plan to its regional managers. On January 1, 2021, 36 million options were granted for 36 million $1 par common shares. The exercise price is the market price on the grant date, $10 per share. Options cannot be exercised prior to January 1, 2023, and explre December 31, 2027. The fair value of the options, estimated by an appropriate option pricing model, is $2 per option. Because the plan does not qualify as an Incentive plan, Walters will receive a tax deduction upon exercise of the options equal to the excess of the market price at exercise over the exercise price. The income tax rate is 25%. 12.5 points eBook Print References Required: 1. Determine the total compensation cost pertaining to the stock option plan. 2. Prepare the appropriate journal entries to record compensation expense and its tax effect on December 31, 2021. 3. Prepare the appropriate journal entries to record compensation expense and its tax effect on December 31, 2022 4. Record the exercise of the options and their tax effect of all of the options are exercised on March 20, 2026, when the market price Is $14 per share. 5. Assume the option plan qualifies as an Incentive plan. Prepare the appropriate journal entries to record compensation expense and Its tax effect on December 31, 2021. 6. Assuming the option plan qualifies as an Incentive plan, record the exercise of the options and their tax effect if all of the options are exercised on March 20, 2026, when the market price is $13 per share. Complete this question by entering your answers in the tabs below. Reg 1 Reg 2 to 4 Reg 5 and 6 2. & 3. Prepare the appropriate journal entries to record compensation expense and its tax effect on December 31, 2021 and 2022. 4. Assume all of the options are exercised on March 20, 2026, when the market price is $14 per share. Prepare the necessary journal entries. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions (i.e., 10,000,000 should be entered as 10).) Show less View transaction list 5 $10 par $1 par $ 40 Earnings $ 1,900 Capital $ 550 520 85 Equity $ 2,490 529 93 9 8 12.5 points 9 48 (4) 1,155 (40) (4) (13) 350 2,233 (25) (4) (17) (13) 350 3,445 (69) (4) (17) eBook Print Balance at January 1, 2019 Sale of preferred shares Sale of common shares, 7/1 Cash dividend preferred Cash dividend, common Net income Balance at December 31, 2019 Retirement of common shares, 4/1 Cash dividend, preferred Cash dividend, common 3-for-2 split effected in the form of a common stock dividend, 8/12 Net income Balance at December 31, 2020 10% common stock dividend, 5/1 Sale of common shares, 9/1 Cash dividend, preferred Cash dividend, common Net income Balance at December 31, 2021 22.0 (22.2) References 450 450 3,805 9 2,637 66. 6.5e 3 1,093.0 90 31 (96.60) (4) (33) 434 $2,937.40 34 (4) (33) 434 $ 4,236 $ 9 9 $75.60 $1,214.0 Required: Infer from the statements the events and transactions that affected Locke Intertechnology Corporation's shareholders' equity and compute earnings per share as it would have appeared on the Income statements for the years ended December 31, 2019, 2020, and 2021. No potential common shares were outstanding during any of the periods shown. (Enter your answers in millions rounded to 2 decimal places (.e., 5,500,000 should be entered as 5.50).) Year Numerator Denominator = Earnings per share 2019 S S 349 / 48.00] = S 7.27 2020 1 = 0 2021 1 0