Question

3 years ago Delta Manufacturing purchased a punching machine and a folding machine at the new price shown in the table below. The company plans

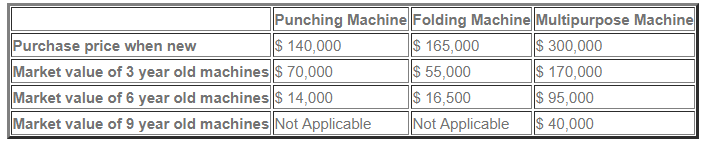

3 years ago Delta Manufacturing purchased a punching machine and a folding machine at the "new price" shown in the table below. The company plans to keep the two machines for another 3 years, when they expect that they can sell the machines for scrap at their market values at that time. The operating cost per year for the punching machine is $ 15,000 and for the folding machine is $ 13,000.

A sales representative from an equipment supplier is trying to convince the management of Delta Manufacturing to replace both of these with a new multipurpose machine. The new machine has an economic life of 9 years when it will be sold for scrap. It has an operating cost of $ 15,000 per year.

Another option available to Delta manufacturing is to subcontract the punching and folding work to another company. This will cost $ 85,000 per year.

Use a discount rate of 11%. (All answers should be to the nearest dollar. Your sign convention should be such that all of your answers below are positive.)

What is the cost per year associated with keeping the old punching machine?

What is the cost per year associated with keeping the old folding machine?

What is the cost per year associated with purchasing the new machine?

What should Delta Manufacturing do?

| A. | Keep both of the old machines. | |

| B. | Replace the old machines with a new multipurpose machine. | |

| C. | Sell both old machines and subcontract out the work. |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started