Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3 Yoong, Kua and Chia were partners sharing profits and losses in the ratio 2:2: 1 respectively. Yoong was entitled to a salary of

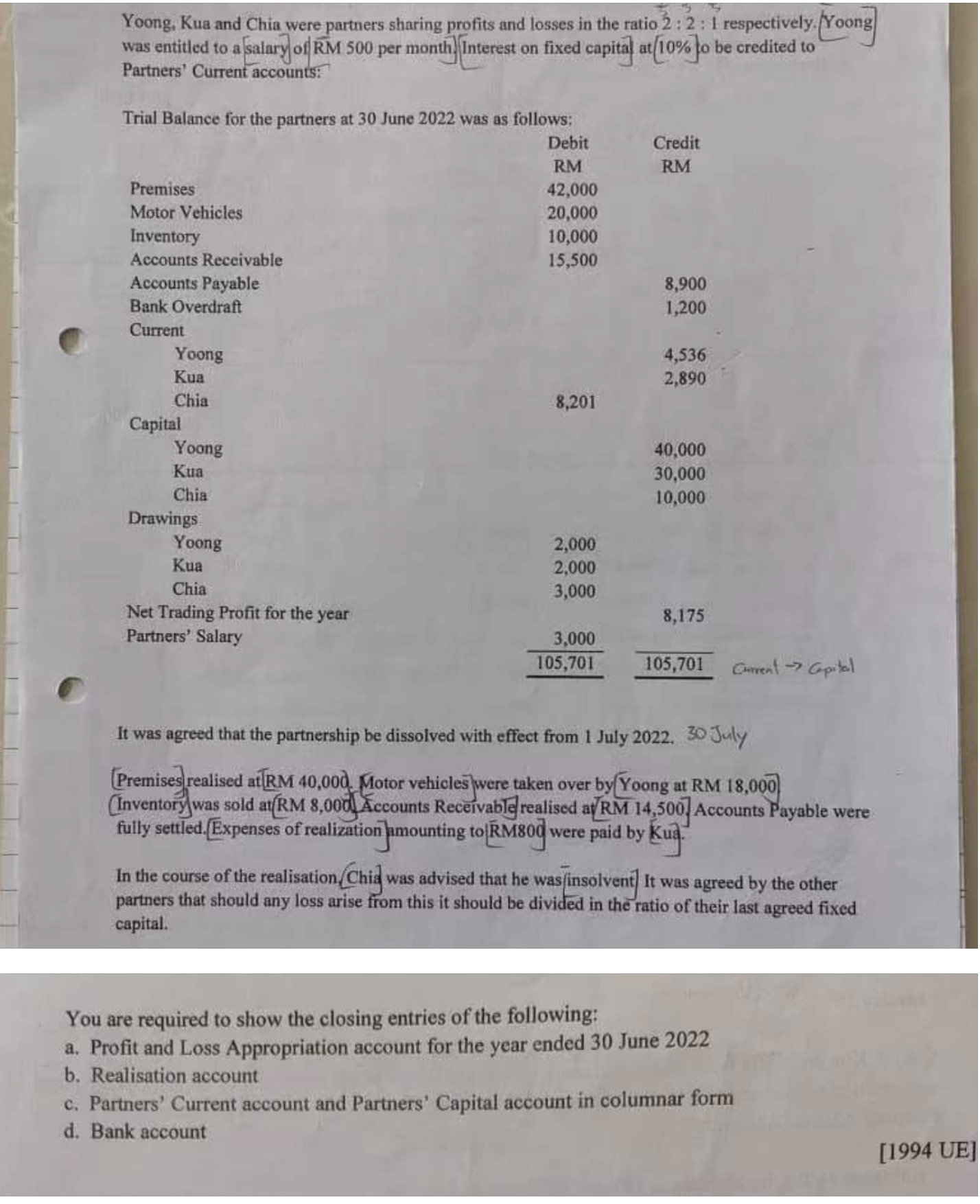

3 Yoong, Kua and Chia were partners sharing profits and losses in the ratio 2:2: 1 respectively. Yoong was entitled to a salary of RM 500 per month Interest on fixed capital at 10% to be credited to Partners' Current accounts: Trial Balance for the partners at 30 June 2022 was as follows: Debit RM Premises Motor Vehicles Inventory Accounts Receivable Accounts Payable Bank Overdraft Current Yoong Kua Chia Capital Yoong Kua Chia Drawings Yoong Kua Chia Net Trading Profit for the year Partners' Salary 42,000 20,000 10,000 15,500 8,201 2,000 2,000 3,000 3,000 105,701 Credit RM 8,900 1,200 4,536 2,890 40,000 30,000 10,000 8,175 105,701 It was agreed that the partnership be dissolved with effect from 1 July 2022. 30 July (Premises realised at RM 40,000. Motor vehicles were taken over by Yoong at RM 18,000 Inventory was sold at RM 8,000 Accounts Receivable realised av/RM 14,500] Accounts Payable were fully settled. Expenses of realization amounting to RM800 were paid by Kud Current Capital In the course of the realisation Chia was advised that he was insolvent] It was agreed by the other partners that should any loss arise from this it should be divided in the ratio of their last agreed fixed capital. You are required to show the closing entries of the following: a. Profit and Loss Appropriation account for the year ended 30 June 2022 b. Realisation account c. Partners' Current account and Partners' Capital account in columnar form d. Bank account [1994 UE]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The question youve presented is related to accounting specifically the closing entries for a partnership for the year ended 30 June 2022 To address this question we need to make closing entries for th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started