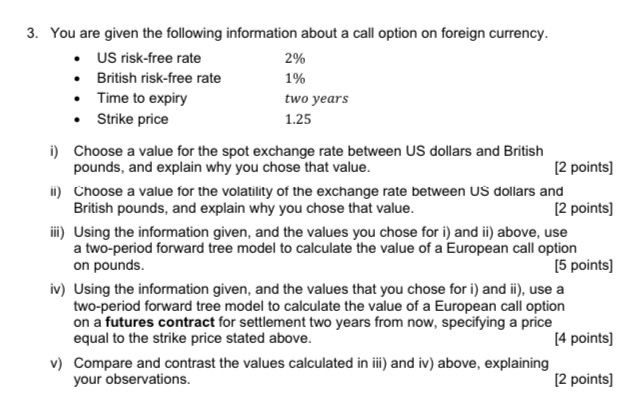

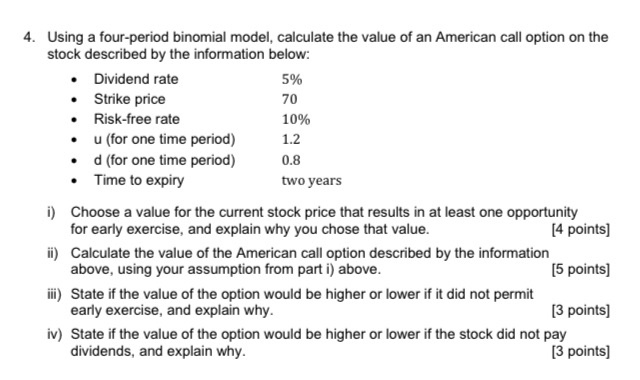

3. You are given the following information about a call option on foreign currency. US risk-free rate 2% British risk-free rate 1% Time to expiry two years Strike price 1.25 i) Choose a value for the spot exchange rate between US dollars and British pounds, and explain why you chose that value. [2 points) 1) Choose a value for the volatility of the exchange rate between US dollars and British pounds, and explain why you chose that value. [2 points) iii) Using the information given, and the values you chose for i) and ii) above, use a two-period forward tree model to calculate the value of a European call option on pounds. [5 points) iv) Using the information given, and the values that you chose for i) and ii), use a two-period forward tree model to calculate the value of a European call option on a futures contract for settlement two years from now, specifying a price equal to the strike price stated above. [4 points) v) Compare and contrast the values calculated in ii) and iv) above, explaining your observations. [2 points) 4. Using a four-period binomial model, calculate the value of an American call option on the stock described by the information below: Dividend rate 5% Strike price 70 Risk-free rate 10% u (for one time period) 1.2 d (for one time period) 0.8 Time to expiry two years i) Choose a value for the current stock price that results in at least one opportunity for early exercise, and explain why you chose that value. [4 points) ii) Calculate the value of the American call option described by the information above, using your assumption from parti) above. [5 points) iii) State if the value of the option would be higher or lower if it did not permit early exercise, and explain why. [3 points) iv) State if the value of the option would be higher or lower if the stock did not pay dividends, and explain why. [3 points) 3. You are given the following information about a call option on foreign currency. US risk-free rate 2% British risk-free rate 1% Time to expiry two years Strike price 1.25 i) Choose a value for the spot exchange rate between US dollars and British pounds, and explain why you chose that value. [2 points) 1) Choose a value for the volatility of the exchange rate between US dollars and British pounds, and explain why you chose that value. [2 points) iii) Using the information given, and the values you chose for i) and ii) above, use a two-period forward tree model to calculate the value of a European call option on pounds. [5 points) iv) Using the information given, and the values that you chose for i) and ii), use a two-period forward tree model to calculate the value of a European call option on a futures contract for settlement two years from now, specifying a price equal to the strike price stated above. [4 points) v) Compare and contrast the values calculated in ii) and iv) above, explaining your observations. [2 points) 4. Using a four-period binomial model, calculate the value of an American call option on the stock described by the information below: Dividend rate 5% Strike price 70 Risk-free rate 10% u (for one time period) 1.2 d (for one time period) 0.8 Time to expiry two years i) Choose a value for the current stock price that results in at least one opportunity for early exercise, and explain why you chose that value. [4 points) ii) Calculate the value of the American call option described by the information above, using your assumption from parti) above. [5 points) iii) State if the value of the option would be higher or lower if it did not permit early exercise, and explain why. [3 points) iv) State if the value of the option would be higher or lower if the stock did not pay dividends, and explain why. [3 points)