Question

3. You are presented with the following information regarding Portfolios X, Y, and Z: a. b. Portfolio X Portfolio Y Portfolio Z E(r) 12%

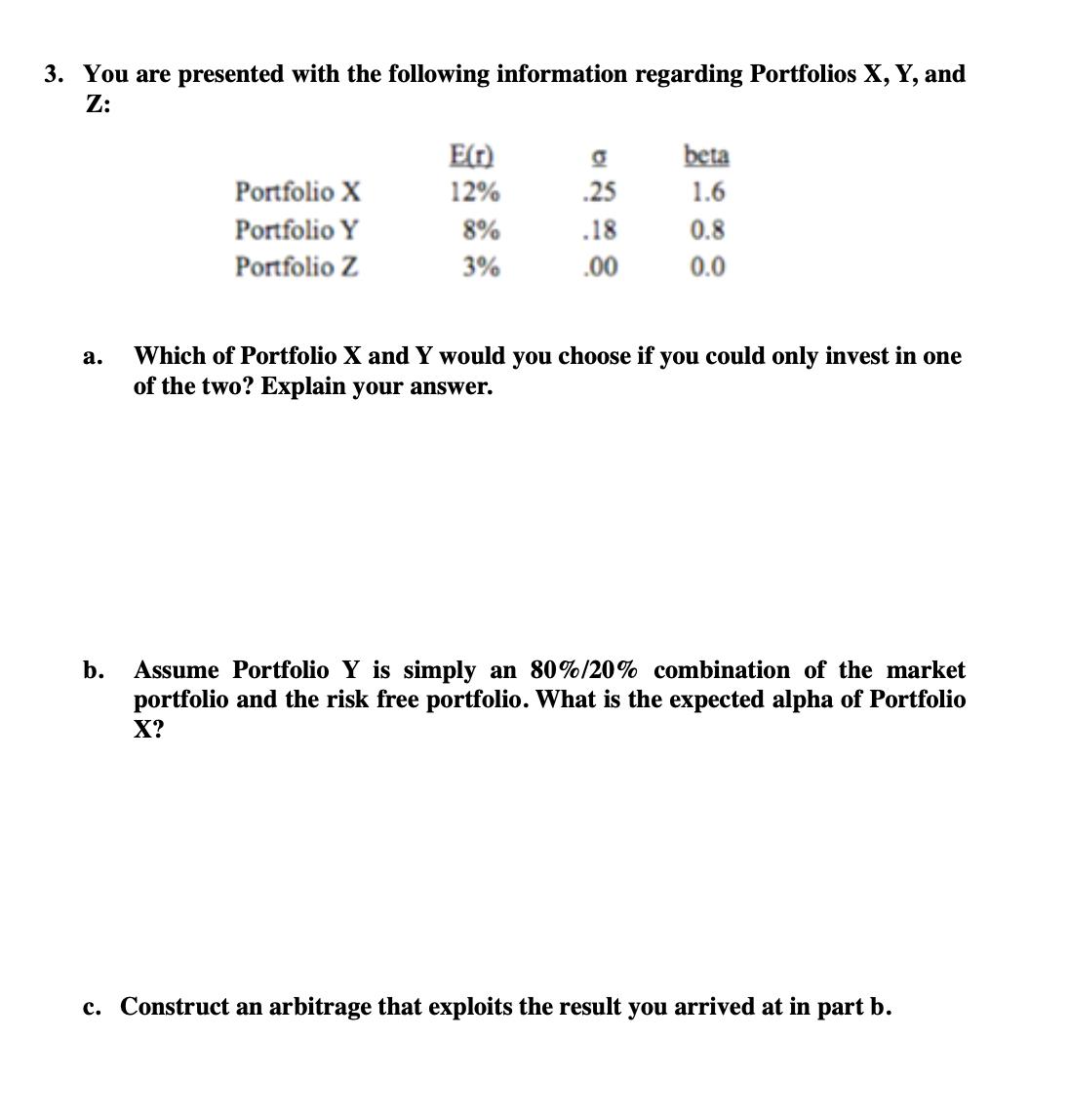

3. You are presented with the following information regarding Portfolios X, Y, and Z: a. b. Portfolio X Portfolio Y Portfolio Z E(r) 12% 8% 3% g .25 .18 .00 beta 1.6 0.8 0.0 Which of Portfolio X and Y would you choose if you could only invest in one of the two? Explain your answer. Assume Portfolio Y is simply an 80%/20% combination of the market portfolio and the risk free portfolio. What is the expected alpha of Portfolio X? c. Construct an arbitrage that exploits the result you arrived at in part b.

Step by Step Solution

3.51 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

a To determine whether to choose Portfolio X or Y we can compare their expected returns and betas Portfolio X has an expected return of 12 and a beta ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

College Accounting A Practical Approach

Authors: Jeffrey Slater, Brian Zwicker

11th Canadian Edition

132564440, 978-0132564441

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App