Answered step by step

Verified Expert Solution

Question

1 Approved Answer

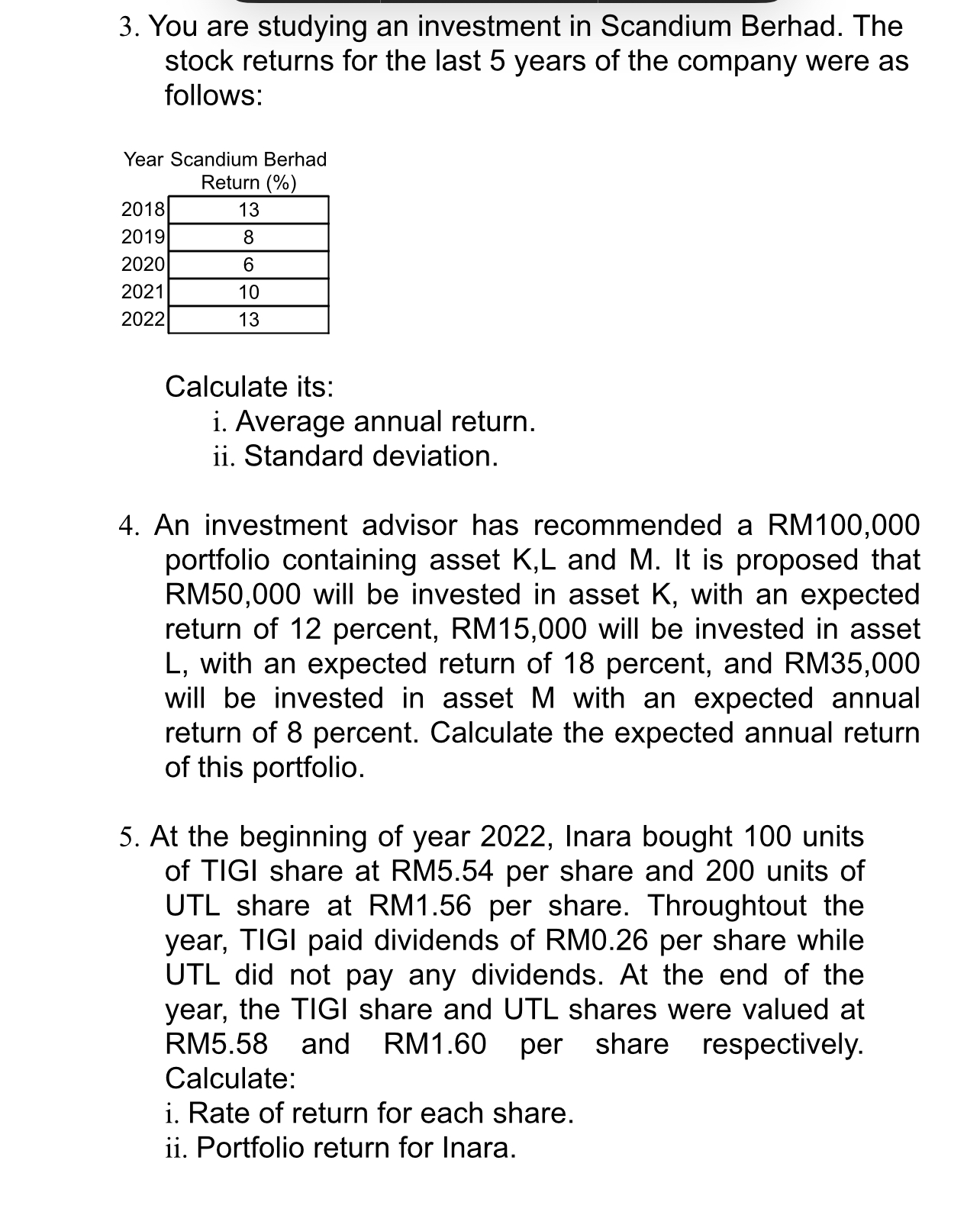

3. You are studying an investment in Scandium Berhad. The stock returns for the last 5 years of the company were as follows: Year Scandium

3. You are studying an investment in Scandium Berhad. The stock returns for the last 5 years of the company were as follows: Year Scandium Berhad Roturn 1\%) Calculate its: i. Average annual return. ii. Standard deviation. 4. An investment advisor has recommended a RM100,000 portfolio containing asset K,L and M. It is proposed that RM50,000 will be invested in asset K, with an expected return of 12 percent, RM15,000 will be invested in asset L, with an expected return of 18 percent, and RM35,000 will be invested in asset M with an expected annual return of 8 percent. Calculate the expected annual return of this portfolio. 5. At the beginning of year 2022, Inara bought 100 units of TIGI share at RM5.54 per share and 200 units of UTL share at RM1.56 per share. Throughtout the year, TIGI paid dividends of RM0.26 per share while UTL did not pay any dividends. At the end of the year, the TIGI share and UTL shares were valued at RM5.58 and RM1.60 per share respectively. Calculate: i. Rate of return for each share. ii. Portfolio return for Inara

3. You are studying an investment in Scandium Berhad. The stock returns for the last 5 years of the company were as follows: Year Scandium Berhad Roturn 1\%) Calculate its: i. Average annual return. ii. Standard deviation. 4. An investment advisor has recommended a RM100,000 portfolio containing asset K,L and M. It is proposed that RM50,000 will be invested in asset K, with an expected return of 12 percent, RM15,000 will be invested in asset L, with an expected return of 18 percent, and RM35,000 will be invested in asset M with an expected annual return of 8 percent. Calculate the expected annual return of this portfolio. 5. At the beginning of year 2022, Inara bought 100 units of TIGI share at RM5.54 per share and 200 units of UTL share at RM1.56 per share. Throughtout the year, TIGI paid dividends of RM0.26 per share while UTL did not pay any dividends. At the end of the year, the TIGI share and UTL shares were valued at RM5.58 and RM1.60 per share respectively. Calculate: i. Rate of return for each share. ii. Portfolio return for Inara Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started