Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3. You believe arbitrage price theory is a model for equity market returns. Your friend tells you she has found an investment manager who

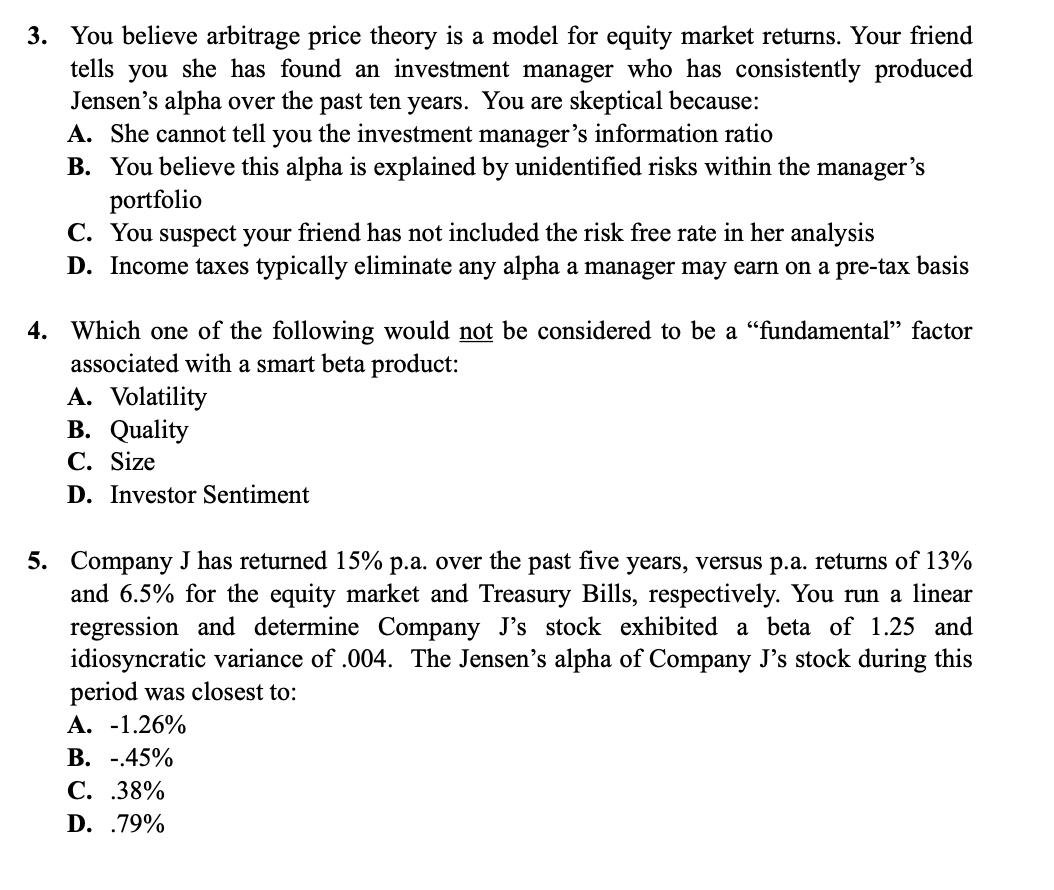

3. You believe arbitrage price theory is a model for equity market returns. Your friend tells you she has found an investment manager who has consistently produced Jensen's alpha over the past ten years. You are skeptical because: A. She cannot tell you the investment manager's information ratio B. You believe this alpha is explained by unidentified risks within the manager's portfolio C. You suspect your friend has not included the risk free rate in her analysis D. Income taxes typically eliminate any alpha a manager may earn on a pre-tax basis 4. Which one of the following would not be considered to be a "fundamental" factor associated with a smart beta product: A. Volatility B. Quality C. Size D. Investor Sentiment 5. Company J has returned 15% p.a. over the past five years, versus p.a. returns of 13% and 6.5% for the equity market and Treasury Bills, respectively. You run a linear regression and determine Company J's stock exhibited a beta of 1.25 and idiosyncratic variance of .004. The Jensen's alpha of Company J's stock during this period was closest to: A. -1.26% B. -.45% C. .38% D. .79%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The image contains examstyle questions related to finance and investment concepts Lets go through them one by one Question 3 You are skeptical about t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started