Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3. You have been called in to value a dental practice by an old friend and have been provided with the following information: The

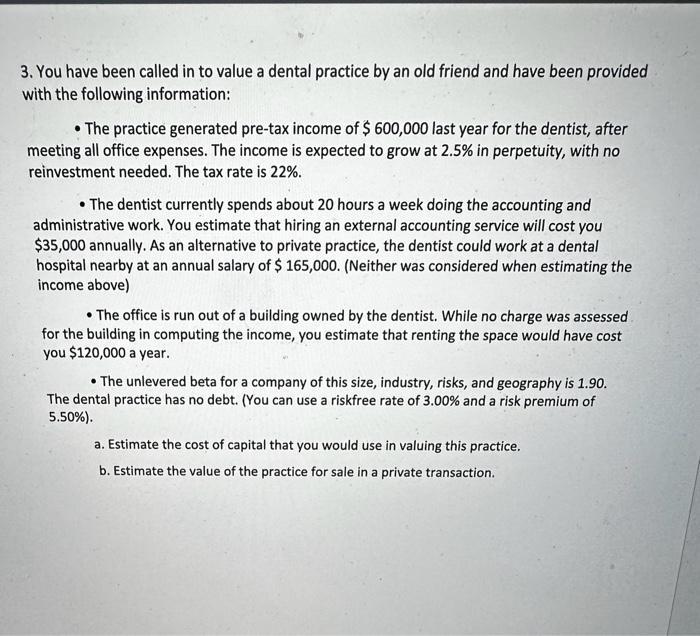

3. You have been called in to value a dental practice by an old friend and have been provided with the following information: The practice generated pre-tax income of $ 600,000 last year for the dentist, after meeting all office expenses. The income is expected to grow at 2.5% in perpetuity, with no reinvestment needed. The tax rate is 22%. The dentist currently spends about 20 hours a week doing the accounting and administrative work. You estimate that hiring an external accounting service will cost you $35,000 annually. As an alternative to private practice, the dentist could work at a dental hospital nearby at an annual salary of $ 165,000. (Neither was considered when estimating the income above) The office is run out of a building owned by the dentist. While no charge was assessed for the building in computing the income, you estimate that renting the space would have cost you $120,000 a year. The unlevered beta for a company of this size, industry, risks, and geography is 1.90. The dental practice has no debt. (You can use a riskfree rate of 3.00% and a risk premium of 5.50%). a. Estimate the cost of capital that you would use in valuing this practice. b. Estimate the value of the practice for sale in a private transaction.

Step by Step Solution

★★★★★

3.39 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

a To estimate the cost of capital we need to first calculate the cost of equity and the weighted ave...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started