Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3. You have just turned 60 and have decided to retire. You have sufficient retirement savings to get by without taking Canada Pension Plan

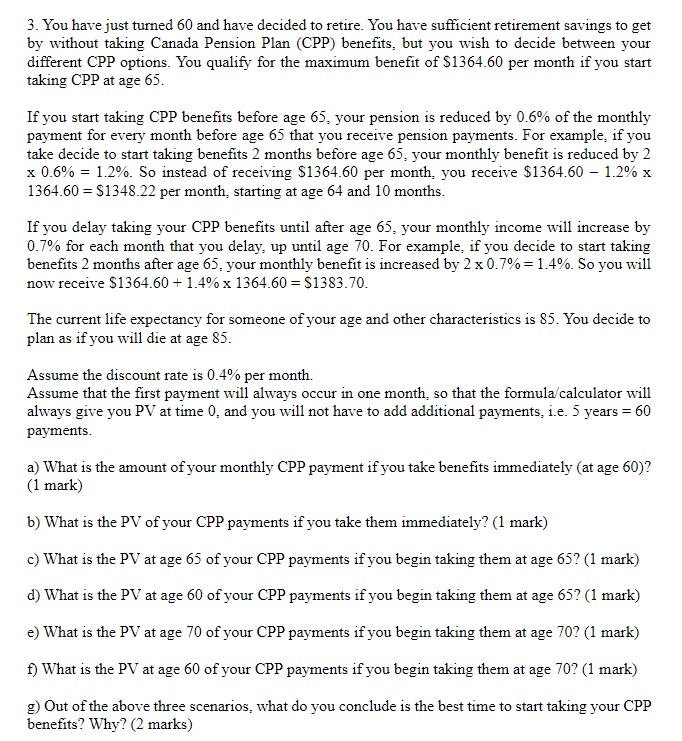

3. You have just turned 60 and have decided to retire. You have sufficient retirement savings to get by without taking Canada Pension Plan (CPP) benefits, but you wish to decide between your different CPP options. You qualify for the maximum benefit of $1364.60 per month if you start taking CPP at age 65. If you start taking CPP benefits before age 65, your pension is reduced by 0.6% of the monthly payment for every month before age 65 that you receive pension payments. For example, if you take decide to start taking benefits 2 months before age 65, your monthly benefit is reduced by 2 x 0.6% = 1.2%. So instead of receiving $1364.60 per month, you receive $1364.60 - 1.2% x 1364.60 = $1348.22 per month, starting at age 64 and 10 months. If you delay taking your CPP benefits until after age 65, your monthly income will increase by 0.7% for each month that you delay, up until age 70. For example, if you decide to start taking benefits 2 months after age 65, your monthly benefit is increased by 2 x 0.7% = 1.4%. So you will now receive $1364.60 +1.4% x 1364.60 = $1383.70. The current life expectancy for someone of your age and other characteristics is 85. You decide to plan as if you will die at age 85. Assume the discount rate is 0.4% per month. Assume that the first payment will always occur in one month, so that the formula/calculator will always give you PV at time 0, and you will not have to add additional payments, i.e. 5 years = 60 payments. a) What is the amount of your monthly CPP payment if you take benefits immediately (at age 60)? (1 mark) b) What is the PV of your CPP payments if you take them immediately? (1 mark) c) What is the PV at age 65 of your CPP payments if you begin taking them at age 65? (1 mark) d) What is the PV at age 60 of your CPP payments if you begin taking them at age 65? (1 mark) e) What is the PV at age 70 of your CPP payments if you begin taking them at age 70? (1 mark) f) What is the PV at age 60 of your CPP payments if you begin taking them at age 70? (1 mark) g) Out of the above three scenarios, what do you conclude is the best time to start taking your CPP benefits? Why? (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started