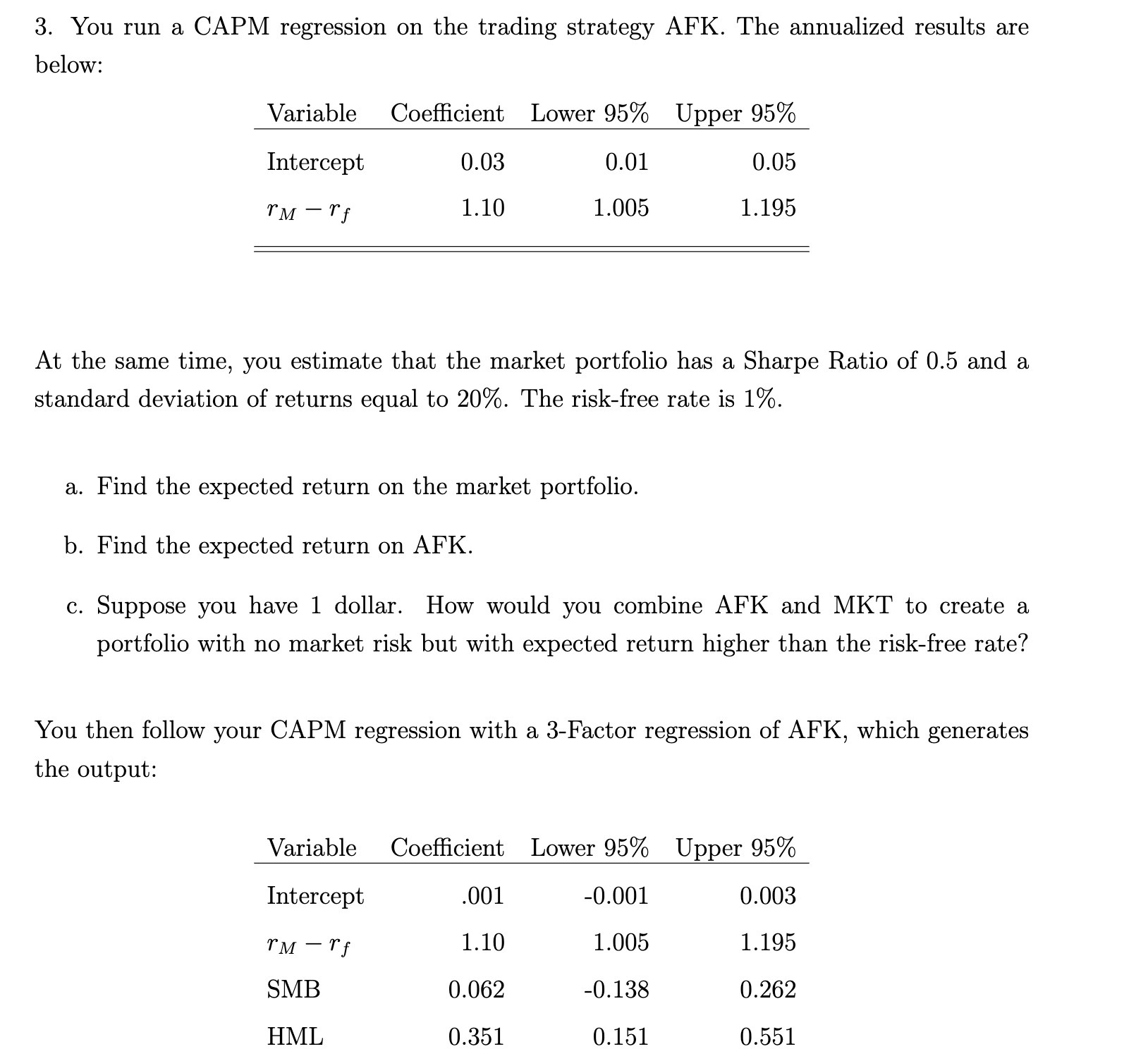

3. You run a CAPM regression on the trading strategy AFK. The annualized results are below: Variable Coefficient Lower 95% Upper 95% Intercept 0.03

3. You run a CAPM regression on the trading strategy AFK. The annualized results are below: Variable Coefficient Lower 95% Upper 95% Intercept 0.03 0.01 0.05 TM-rf 1.10 1.005 1.195 At the same time, you estimate that the market portfolio has a Sharpe Ratio of 0.5 and a standard deviation of returns equal to 20%. The risk-free rate is 1%. a. Find the expected return on the market portfolio. b. Find the expected return on AFK. c. Suppose you have 1 dollar. How would you combine AFK and MKT to create a portfolio with no market risk but with expected return higher than the risk-free rate? You then follow your CAPM regression with a 3-Factor regression of AFK, which generates the output: Variable Coefficient Lower 95% Upper 95% Intercept .001 -0.001 0.003 rf 1.10 1.005 1.195 SMB 0.062 -0.138 0.262 HML 0.351 0.151 0.551

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Given Market portfolio Sharpe Ratio 05 Market standard deviation 20 Risk free rate 1 To fin...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started