Question

3.) You would like to compute ROE of Phillipe for 2015 using Dupont Identity. According to Dupont Identity, ROE = ( ratio1 ) * (

3.) You would like to compute ROE of Phillipe for 2015 using Dupont Identity.

According to Dupont Identity,

ROE = ( ratio1 ) * ( ratio2 ) * ( ratio3 )

a.What are the ratios 1-3?

b. Compute the three ratios above and confirm the ROE using Dupont Identity is the same as the ROE value from 2-5)

4.) Phillipe company has 10,000,000 (10 millions) shares of common stock outstanding and stock price per share $30.

(All numbers in balance sheet and income statement are in millions.

a. What is the P/E ratio of this company?

b. What is the market-to-book ratio of this company?

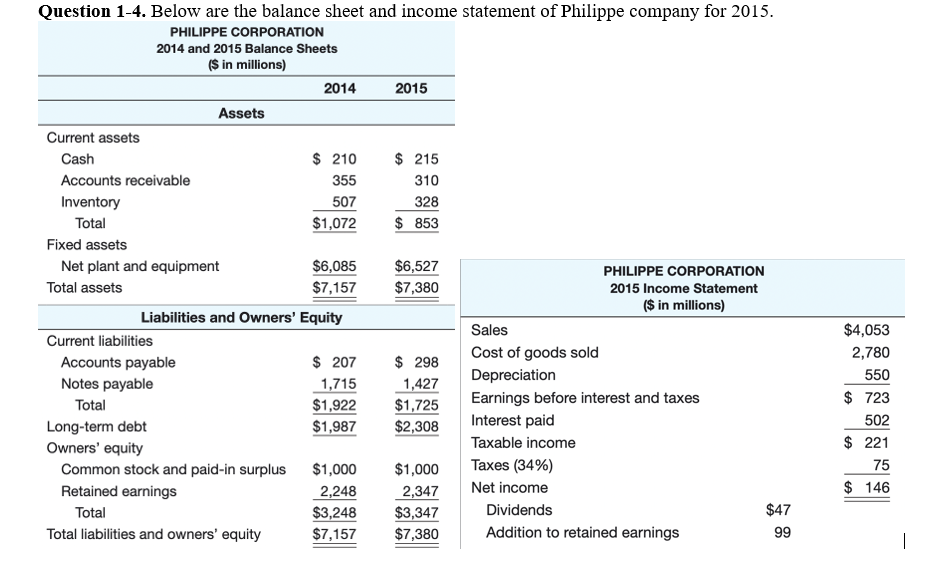

Question 1-4. Below are the balance sheet and income statement of Philippe company for 2015. PHILIPPE CORPORATION 2014 and 2015 Balance Sheets (s in millions) 2014 2015 Assets Current assets Cash $ 210 $ 215 Accounts receivable 355 310 Inventory 507 328 Total $1,072 $ 853 Fixed assets Net plant and equipment $6,085 $6,527 PHILIPPE CORPORATION Total assets $7,157 $7,380 2015 Income Statement ($ in millions) Liabilities and Owners' Equity Sales Current liabilities Accounts payable $ 207 Cost of goods sold $ 298 Depreciation Notes payable 1,715 1,427 Total $1,922 $1,725 Earnings before interest and taxes Long-term debt $1,987 $2,308 Interest paid Owners' equity Taxable income Common stock and paid-in surplus $1,000 $1,000 Taxes (34%) Retained earnings 2,248 2,347 Net income Total $3,248 $3,347 Dividends Total liabilities and owners' equity $7,157 $7,380 Addition to retained earnings $4,053 2,780 550 $ 723 502 $ 221 75 $ 146

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started