Question

3. Your firm plans to purchase a manufacturing machine, which costs $500,000 from a local manufacturer. This machine has straight-line depreciation period of 8 years.

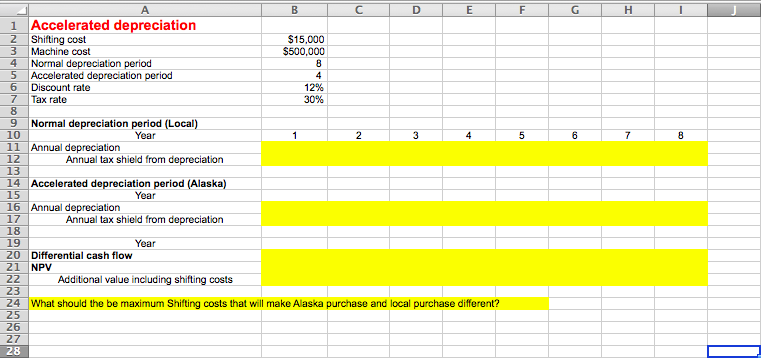

3. Your firm plans to purchase a manufacturing machine, which costs $500,000 from a local manufacturer. This machine has straight-line depreciation period of 8 years. However, you were told that if you buy the same machine from a manufacturer from Alaska, the U.S. tax authorities will allow you an accelerated straight-line depreciation period of 4 years. You also know that in the latter case you will have to pay additional shipping costs of $15,000 (payable today).

Assuming your firms tax rate is 30%, and the discount rate is 12%, from which manufacturer should you buy the machine?

What is the maximal shipping cost at which youll be indifferent between the manufacturers (assuming that shipping cost cannot be considered for depreciation purpose)? Answer withoutusing Excels function Goal Seek or Solver

Hint: you need to consider the tax benefit of depreciation for these two different choices. Tax benefit related to depreciation is called a tax shield of depreciation. Put it more straightforward, if your firm has a tax rate of 30%, for every $100 depreciation, this will save you $30 taxes.

please add formulas

1 Accelerated depreciation 2 Shifting cost 3 Machine cost 4 Normal depreciation period $15,000 $500,000 6 Discount rate 7 Tax rate 8 9 Normal depreciation period (Local) 10 11 Annual depreciation 12 13 14 Accelerated depreciation period (Alaska) 15 16 Annual depreciation 17 18 19 20 Differential cash flow 21 NPV 1296 30% Annual tax shield from depreciation Annual tax shield from depreciation Additional value including shifting costs 23 24 What should the be maximum Shifting costs that will make Alaska purchase and local purchase different? 25 26 27 28Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started