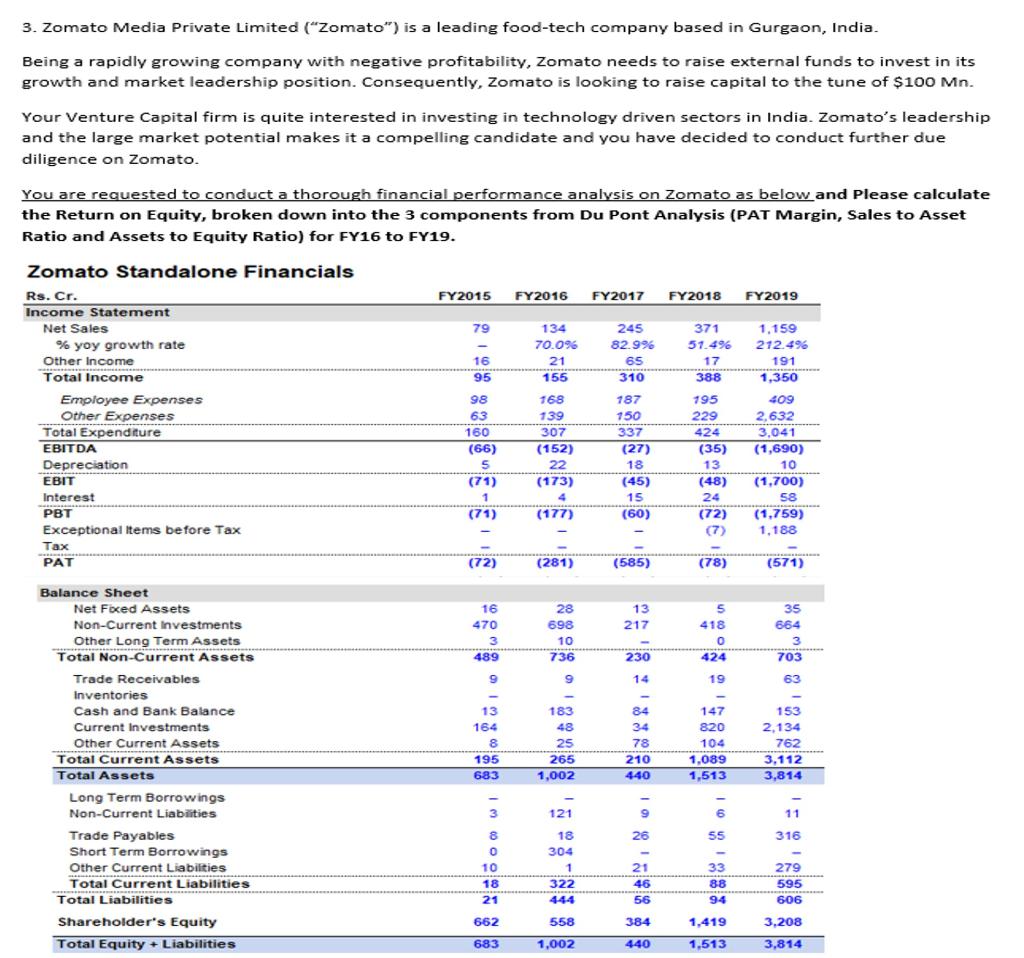

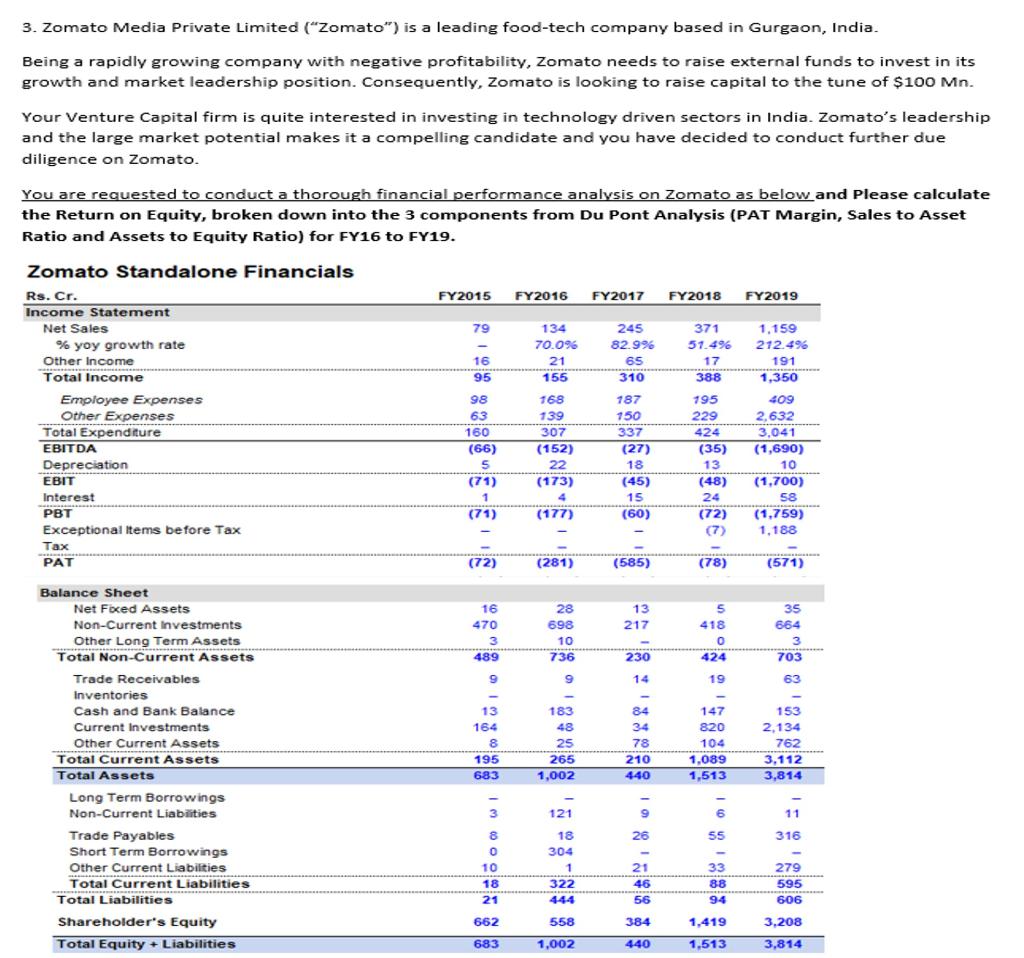

3. Zomato Media Private Limited ("Zomato") is a leading food-tech company based in Gurgaon, India Being a rapidly growing company with negative profitability, Zomato needs to raise external funds to invest in its growth and market leadership position. Consequently, Zomato is looking to raise capital to the tune of $100 Mn. Your Venture Capital firm is quite interested in investing in technology driven sectors in India. Zomato's leadership and the large market potential makes it a compelling candidate and you have decided to conduct further due diligence on Zomato. You are requested to conduct a thorough financial performance analysis on Zomato as below and Please calculate the Return on Equity, broken down into the 3 components from Du Pont Analysis (PAT Margin, Sales to Asset Ratio and Assets to Equity Ratio) for FY16 to FY19. FY2015 FY2016 FY2017 FY2018 FY2019 79 1.159 212.4% 16 245 82.9% 65 310 191 95 1,350 Zomato Standalone Financials Rs. Cr. Income Statement Net Sales % yoy growth rate Other Income Total Income Employee Expenses Other Expenses Total Expenditure EBITDA Depreciation EBIT Interest PBT Exceptional Items before Tax Tax PAT 98 63 160 (66) 5 (71) 1 (71) 134 70.0% 21 155 168 139 307 (152) 22 (173) 4 (177) 187 750 337 (27) 18 (45) 15 (60) 371 51.4% 17 388 195 229 424 (35) 13 (48) 24 (72) 409 2,632 3.041 (1,690) 10 (1,700) 58 (1,759) 1,188 (72) (281) (585) (78) (571) 13 16 470 3 489 28 698 10 736 217 5 418 0 424 35 664 3 703 63 230 9 9 14 19 Balance Sheet Net Foxed Assets Non-Current Investments Other Long Term Assets Total Non-Current Assets Trade Receivables Inventories Cash and Bank Balance Current Investments Other Current Assets Total Current Assets Total Assets Long Term Borrowings Non-Current Liabilities Trade Payables Short Term Borrowings Other Current Liabilities Total Current Liabilities Total Liabilities Shareholder's Equity Total Equity + Liabilities 13 164 8 195 683 183 48 25 265 1,002 84 34 78 210 440 147 820 104 1,089 1,513 153 2,134 762 3,112 3,814 6 121 18 9 26 11 316 55 3 8 0 10 18 21 304 1 322 21 46 56 33 88 94 279 595 606 662 558 384 1,419 3,208 3,814 683 1,002 440 1,513