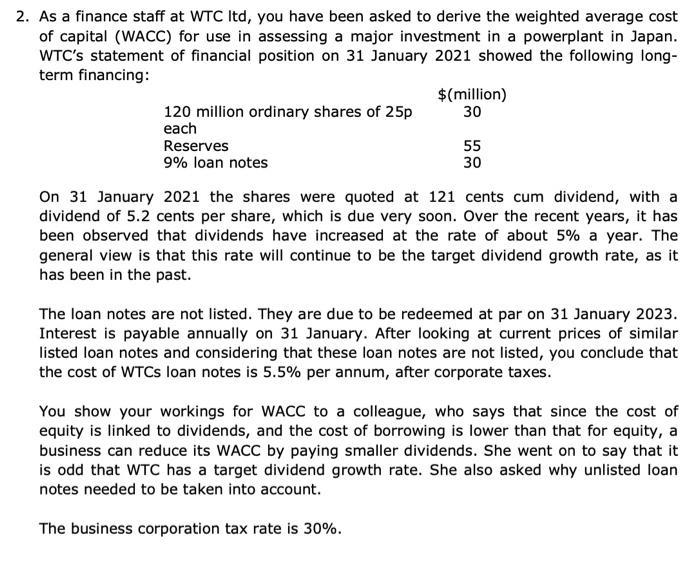

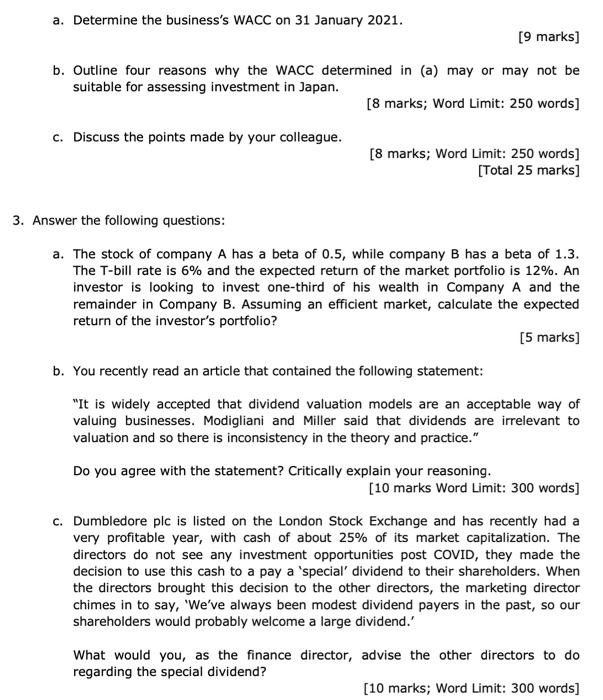

30 2. As a finance staff at WTC ltd, you have been asked to derive the weighted average cost of capital (WACC) for use in assessing a major investment in a powerplant in Japan. WTC's statement of financial position on 31 January 2021 showed the following long- term financing: $(million) 120 million ordinary shares of 25p each Reserves 55 9% loan notes 30 On 31 January 2021 the shares were quoted at 121 cents cum dividend, with a dividend of 5.2 cents per share, which is due very soon. Over the recent years, it has been observed that dividends have increased at the rate of about 5% a year. The general view is that this rate will continue to be the target dividend growth rate, as it has been in the past. The loan notes are not listed. They are due to be redeemed at par on 31 January 2023. Interest is payable annually on 31 January. After looking at current prices of similar listed loan notes and considering that these loan notes are not listed, you conclude that the cost of WTCs loan notes is 5.5% per annum, after corporate taxes. You show your workings for WACC to a colleague, who says that since the cost of equity is linked to dividends, and the cost of borrowing is lower than that for equity, a business can reduce its WACC by paying smaller dividends. She went on to say that it is odd that WTC has a target dividend growth rate. She also asked why unlisted loan notes needed to be taken into account. The business corporation tax rate is 30%. a. Determine the business's WACC on 31 January 2021. [9 marks] b. Outline four reasons why the WACC determined in (a) may or may not be suitable for assessing investment in Japan. [8 marks; Word Limit: 250 words ] c. Discuss the points made by your colleague. [8 marks; Word Limit: 250 words] [Total 25 marks) 3. Answer the following questions: a. The stock of company A has a beta of 0.5, while company B has a beta of 1.3. The T-bill rate is 6% and the expected return of the market portfolio is 12%. An investor is looking to invest one-third of his wealth in Company A and the remainder in Company B. Assuming an efficient market, calculate the expected return of the investor's portfolio? [5 marks] b. You recently read an article that contained the following statement: "It is widely accepted that dividend valuation models are an acceptable way of valuing businesses. Modigliani and Miller said that dividends are irrelevant to valuation and so there is inconsistency in the theory and practice." Do you agree with the statement? Critically explain your reasoning. [10 marks Word Limit: 300 words] c. Dumbledore plc is listed on the London Stock Exchange and has recently had a very profitable year, with cash of about 25% of its market capitalization. The directors do not see any investment opportunities post COVID, they made the decision to use this cash to a pay a 'special dividend to their shareholders. When the directors brought this decision to the other directors, the marketing director chimes in to say, 'We've always been modest dividend payers in the past, so our shareholders would probably welcome a large dividend.' What would you, as the finance director, advise the other directors to do regarding the special dividend? [10 marks; Word Limit: 300 words]