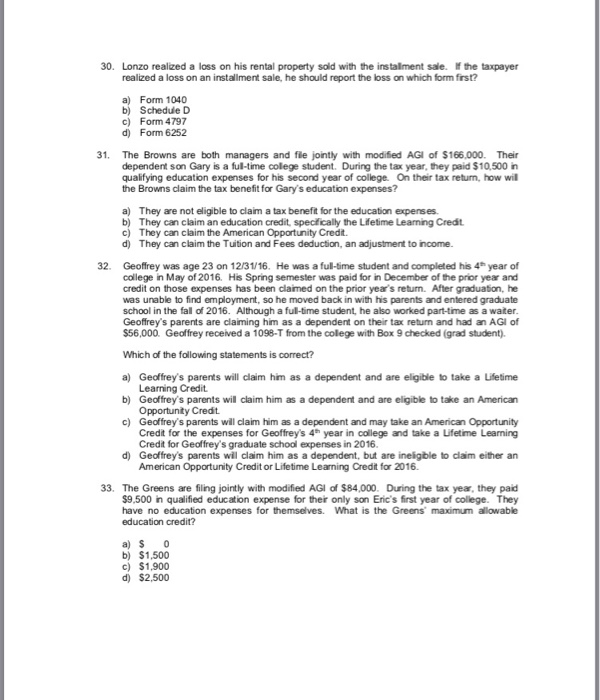

30. Lonzo realized a loss on his rental property sold with the instalment sale. the taxpayer realized a loss on an installment sale, he should report the loss on which form first? a) Form 1040 b) Schedue D c) Form 4797 d) Form 6252 31. The Browns are both managers and fle jointly with modified AGI of $166,000 Their dependent son Gary is a ful-time colege student. During the tax year, they paid $10,500 in qualifying education expenses for his second year of college. On their tax return, how will the Browns claim the tax benefit for Gary's education expenses? They a) b) are not eligible to claim a tax benefit for the education expenses They can claim an education credit, specfically the Lfetime Leaning Credt. c) They can claim the American Opportunity Credit. d) They can claim the Tuition and Fees deduction, an adjustment to income. 32. Geoffrey was age 23 on 12/31/16. He was a ful-time student and completed his 4h year of college in May of 2016. His Spring semester was paid for in December of the prior year and credit on those expenses has been claimed on the prior year's return. After graduation, he was unable to find employment, so he moved back in with his parents and entered graduate school in the fal of 2016. Although a full-time student, he also worked part-time as a water Geoffrey's parents are claiming him as a dependent on their tax return and had an AGI of 56,000 Geoffrey received a 1098-T from the colege with Box 9 checked (grad student) Which of the following statements is correct? a) Geoffrey's parents will claim him as a dependent and are eligible to take a Lifetime Learning Credit b) Geoffrey's parents will claim him as a dependent and are eligible to take an American Opportunity Credit c) Geoffrey's parents will claim him as a dependent and may take an American Opportunity Credit for the expenses for Geoffrey's 4h year in college and take a Lifetime Learning Credit for Geoffrey's graduate school expenses in 2016. d) Geoffrey's parents wil claim him as a dependent, but are ineigble to claim either an American Opportunity Credit or Lifetime Learning Credit for 2016 33. The Greens are iling jointly with modified AGI of $84,000. $9,500 in qualified education expense for their only son Eric's first year of college. They have no education expenses for themselves. What is the Greens maximum allowable education credit? During the tax year, they paid a) S0 b) $1,500 c) $1,900 d) $2,500