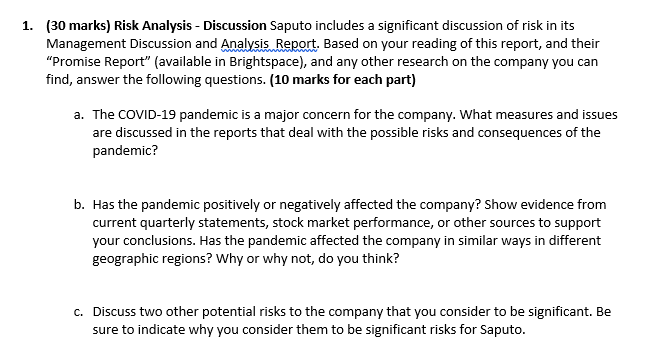

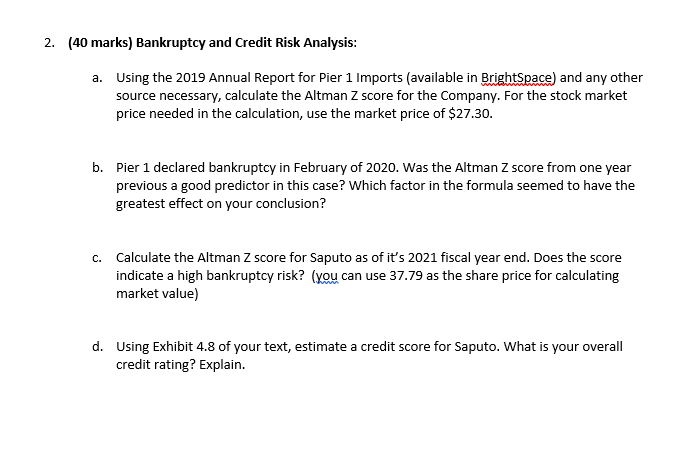

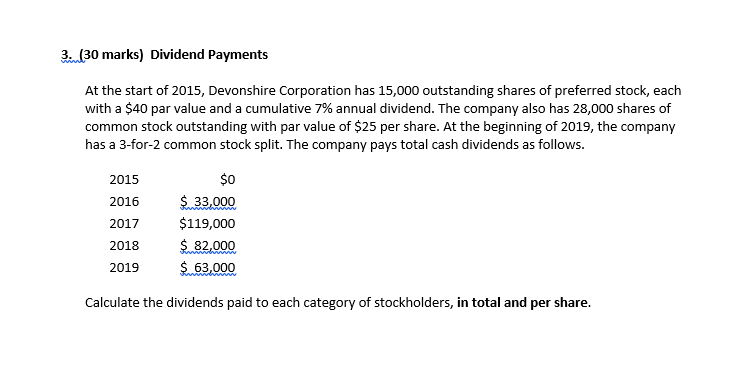

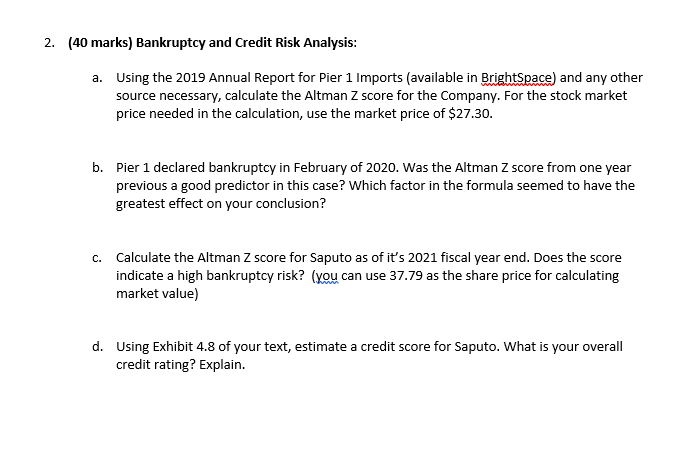

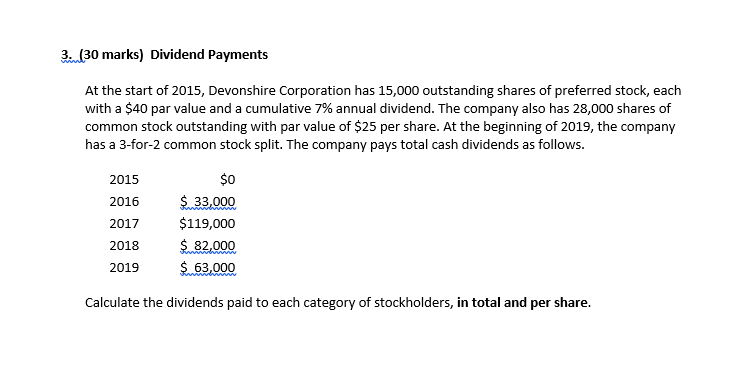

(30 marks) Risk Analysis - Discussion Saputo includes a significant discussion of risk in its Management Discussion and Analysis Report. Based on your reading of this report, and their "Promise Report" (available in Brightspace), and any other research on the company you can find, answer the following questions. (10 marks for each part) a. The COVID-19 pandemic is a major concern for the company. What measures and issues are discussed in the reports that deal with the possible risks and consequences of the pandemic? b. Has the pandemic positively or negatively affected the company? Show evidence from current quarterly statements, stock market performance, or other sources to support your conclusions. Has the pandemic affected the company in similar ways in different geographic regions? Why or why not, do you think? c. Discuss two other potential risks to the company that you consider to be significant. Be sure to indicate why you consider them to be significant risks for Saputo. (40 marks) Bankruptcy and Credit Risk Analysis: a. Using the 2019 Annual Report for Pier 1 Imports (available in BrightSpace) and any other source necessary, calculate the Altman Z score for the Company. For the stock market price needed in the calculation, use the market price of \$27.30. b. Pier 1 declared bankruptcy in February of 2020 . Was the Altman Z score from one year previous a good predictor in this case? Which factor in the formula seemed to have the greatest effect on your conclusion? c. Calculate the Altman Z score for Saputo as of it's 2021 fiscal year end. Does the score indicate a high bankruptcy risk? (you can use 37.79 as the share price for calculating market value) d. Using Exhibit 4.8 of your text, estimate a credit score for Saputo. What is your overall credit rating? Explain. (30 marks) Dividend Payments At the start of 2015 , Devonshire Corporation has 15,000 outstanding shares of preferred stock, each with a $40 par value and a cumulative 7% annual dividend. The company also has 28,000 shares of common stock outstanding with par value of \$25 per share. At the beginning of 2019, the company has a 3 -for-2 common stock split. The company pays total cash dividends as follows. Calculate the dividends paid to each category of stockholders, in total and per share. (30 marks) Risk Analysis - Discussion Saputo includes a significant discussion of risk in its Management Discussion and Analysis Report. Based on your reading of this report, and their "Promise Report" (available in Brightspace), and any other research on the company you can find, answer the following questions. (10 marks for each part) a. The COVID-19 pandemic is a major concern for the company. What measures and issues are discussed in the reports that deal with the possible risks and consequences of the pandemic? b. Has the pandemic positively or negatively affected the company? Show evidence from current quarterly statements, stock market performance, or other sources to support your conclusions. Has the pandemic affected the company in similar ways in different geographic regions? Why or why not, do you think? c. Discuss two other potential risks to the company that you consider to be significant. Be sure to indicate why you consider them to be significant risks for Saputo. (40 marks) Bankruptcy and Credit Risk Analysis: a. Using the 2019 Annual Report for Pier 1 Imports (available in BrightSpace) and any other source necessary, calculate the Altman Z score for the Company. For the stock market price needed in the calculation, use the market price of \$27.30. b. Pier 1 declared bankruptcy in February of 2020 . Was the Altman Z score from one year previous a good predictor in this case? Which factor in the formula seemed to have the greatest effect on your conclusion? c. Calculate the Altman Z score for Saputo as of it's 2021 fiscal year end. Does the score indicate a high bankruptcy risk? (you can use 37.79 as the share price for calculating market value) d. Using Exhibit 4.8 of your text, estimate a credit score for Saputo. What is your overall credit rating? Explain. (30 marks) Dividend Payments At the start of 2015 , Devonshire Corporation has 15,000 outstanding shares of preferred stock, each with a $40 par value and a cumulative 7% annual dividend. The company also has 28,000 shares of common stock outstanding with par value of \$25 per share. At the beginning of 2019, the company has a 3 -for-2 common stock split. The company pays total cash dividends as follows. Calculate the dividends paid to each category of stockholders, in total and per share