Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Two gas stations, A-OK Oil and X-on Service Station, compete to sell gas in a very small town. Every day, they choose whether to

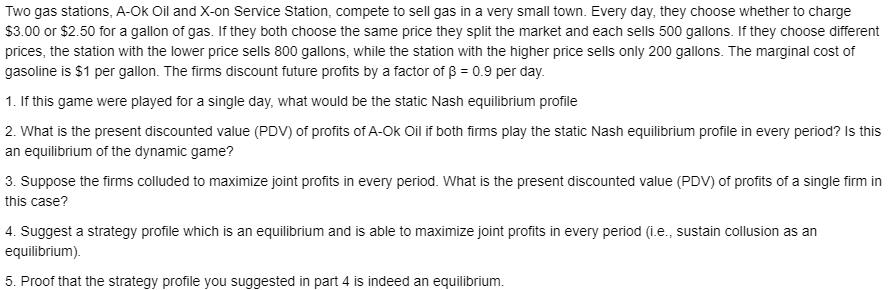

Two gas stations, A-OK Oil and X-on Service Station, compete to sell gas in a very small town. Every day, they choose whether to charge $3.00 or $2.50 for a gallon of gas. If they both choose the same price they split the market and each sells 500 gallons. If they choose different prices, the station with the lower price sells 800 gallons, while the station with the higher price sells only 200 gallons. The marginal cost of gasoline is $1 per gallon. The firms discount future profits by a factor of = 0.9 per day. 1. If this game were played for a single day, what would be the static Nash equilibrium profile 2. What is the present discounted value (PDV) of profits of A-Ok Oil if both firms play the static Nash equilibrium profile in every period? Is this an equilibrium of the dynamic game? 3. Suppose the firms colluded to maximize joint profits in every period. What is the present discounted value (PDV) of profits of a single firm in this case? 4. Suggest a strategy profile which is an equilibrium and is able to maximize joint profits in every period (i.e., sustain collusion as an equilibrium). 5. Proof that the strategy profile you suggested in part 4 is indeed an equilibrium.

Step by Step Solution

★★★★★

3.40 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

1 If this game were played for a single day what would be the static Nash equilibrium profile In the static Nash equilibrium both firms would charge 300 per gallon This is because if one firm charges ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started