Answered step by step

Verified Expert Solution

Question

1 Approved Answer

[30 points] Deshaun wants to create a diverse portfolio for his retirement account. He has set aside $6,000 this year. He has selected five investment

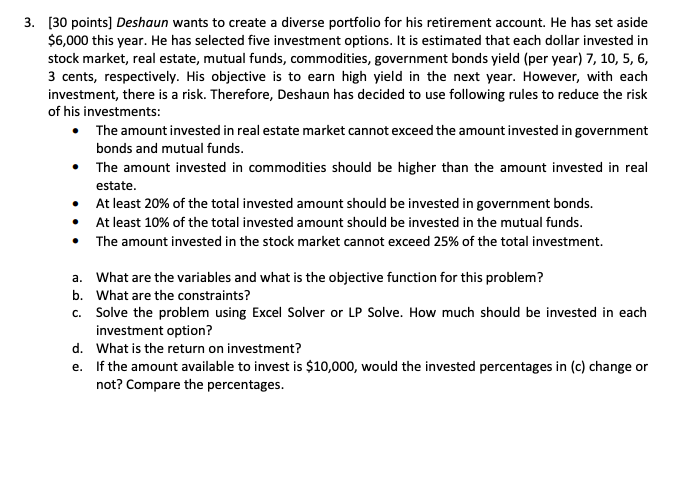

[30 points] Deshaun wants to create a diverse portfolio for his retirement account. He has set aside $6,000 this year. He has selected five investment options. It is estimated that each dollar invested in stock market, real estate, mutual funds, commodities, government bonds yield (per year) 7, 10, 5, 6, 3 cents, respectively. His objective is to earn high yield in the next year. However, with each investment, there is a risk. Therefore, Deshaun has decided to use following rules to reduce the risk of his investments: - The amount invested in real estate market cannot exceed the amount invested in government bonds and mutual funds. - The amount invested in commodities should be higher than the amount invested in real estate. - At least 20% of the total invested amount should be invested in government bonds. - At least 10% of the total invested amount should be invested in the mutual funds. - The amount invested in the stock market cannot exceed 25% of the total investment. a. What are the variables and what is the objective function for this problem? b. What are the constraints? c. Solve the problem using Excel Solver or LP Solve. How much should be invested in each investment option? d. What is the return on investment? e. If the amount available to invest is $10,000, would the invested percentages in (c) change or not? Compare the percentages

[30 points] Deshaun wants to create a diverse portfolio for his retirement account. He has set aside $6,000 this year. He has selected five investment options. It is estimated that each dollar invested in stock market, real estate, mutual funds, commodities, government bonds yield (per year) 7, 10, 5, 6, 3 cents, respectively. His objective is to earn high yield in the next year. However, with each investment, there is a risk. Therefore, Deshaun has decided to use following rules to reduce the risk of his investments: - The amount invested in real estate market cannot exceed the amount invested in government bonds and mutual funds. - The amount invested in commodities should be higher than the amount invested in real estate. - At least 20% of the total invested amount should be invested in government bonds. - At least 10% of the total invested amount should be invested in the mutual funds. - The amount invested in the stock market cannot exceed 25% of the total investment. a. What are the variables and what is the objective function for this problem? b. What are the constraints? c. Solve the problem using Excel Solver or LP Solve. How much should be invested in each investment option? d. What is the return on investment? e. If the amount available to invest is $10,000, would the invested percentages in (c) change or not? Compare the percentages Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started