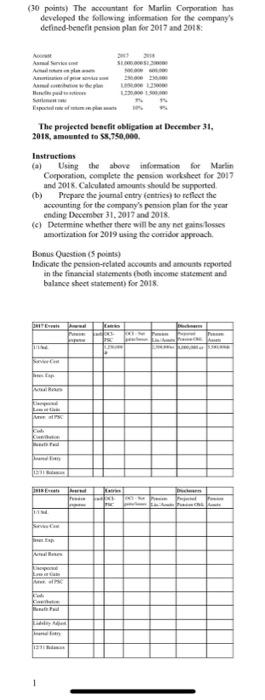

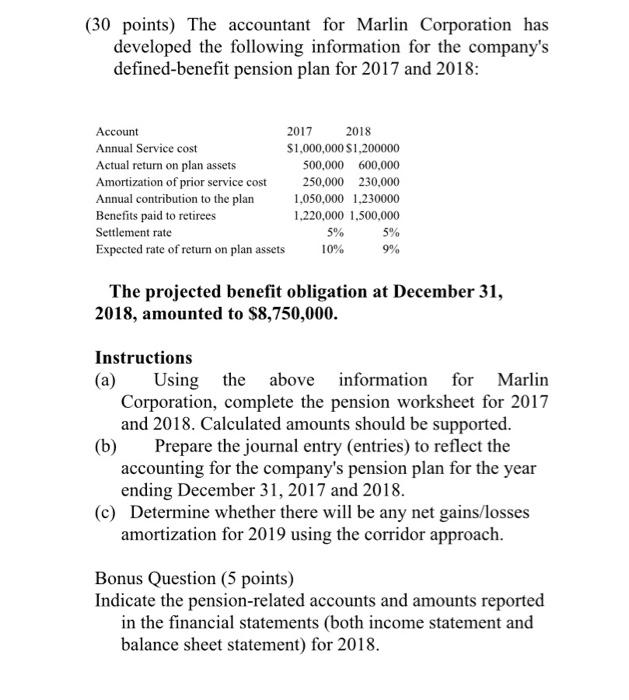

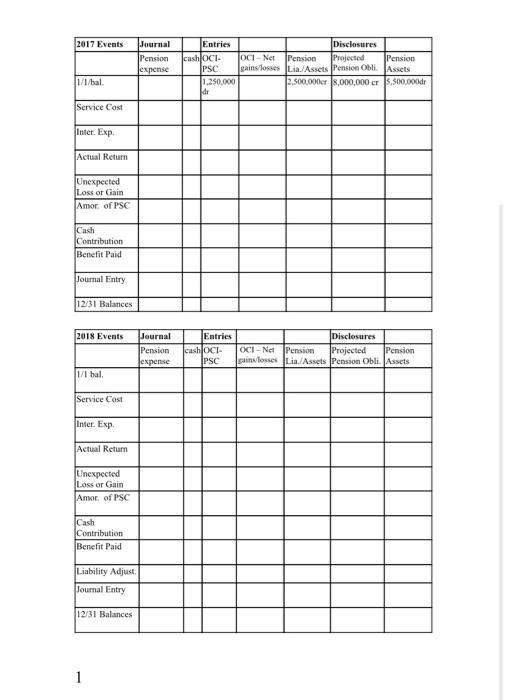

(30 points) The accountant for Marlin Corporation has developed the following information for the company's defined benefit pension plan for 2017 and 2018 S. Awal And we The projected benefit obligation at December 31, 2018, amounted to $8.750,000 Instructions (a) Using the above information for Marlin Corporation, complete the pension worksheet for 2017 and 2018. Calculated amounts should be supported Prepare the journal entry entries to reflect the accounting for the company's pension plan for the year ending December 31, 2017 and 2018 (e) Determine whether there will be any net gains fosses amortization for 2019 using the corridor approach Bonus Question (5 points) Indicate the persion-related accounts and amounts reported in the financial statements both income statement and balance sheet statement) for 2018 ONITE ka (30 points) The accountant for Marlin Corporation has developed the following information for the company's defined-benefit pension plan for 2017 and 2018: Account 2017 2018 Annual Service cost $1,000,000 $1,200000 Actual return on plan assets 500,000 600,000 Amortization of prior service cost 250,000 230,000 Annual contribution to the plan 1,050,000 1,230000 Benefits paid to retirees 1,220,000 1,500,000 Settlement rate 5% 5% Expected rate of return on plan assets 10% 9% The projected benefit obligation at December 31, 2018, amounted to $8,750,000. Instructions (a) Using the above information for Marlin Corporation, complete the pension worksheet for 2017 and 2018. Calculated amounts should be supported. (b) Prepare the journal entry (entries) to reflect the accounting for the company's pension plan for the year ending December 31, 2017 and 2018. (c) Determine whether there will be any net gains/losses amortization for 2019 using the corridor approach. Bonus Question (5 points) Indicate the pension-related accounts and amounts reported in the financial statements (both income statement and balance sheet statement) for 2018. 2017 Events Journal Pension Jexpense Entries Disclosures cash OCI OCI-Net Pension Projected Pension PSC gains/losses Lia. Assets Pension Obli. Assets 1.250.000 2.500.000er ,000,000 cr 5,500,000 dr dr 1/1/bal. Service Cost Inter. Exp Actual Return Unexpected Loss or Gain Amor of PSC Cash Contribution Benefit Paid Journal Entry 12/31 Balances 2018 Events Journal Pension expense Entries cash OCH PSC Disclosures OCI-Net Pension Projected Pension Sain losses Lia./Assets Pension Obli. Assets 1/1 bal Service Cost Inter. Exp Actual Return Unexpected Loss or Gain Amor of PSC Cash Contribution Benefit Paid Liability Adjust Journal Entry 12/31 Balances 1 (30 points) The accountant for Marlin Corporation has developed the following information for the company's defined benefit pension plan for 2017 and 2018 S. Awal And we The projected benefit obligation at December 31, 2018, amounted to $8.750,000 Instructions (a) Using the above information for Marlin Corporation, complete the pension worksheet for 2017 and 2018. Calculated amounts should be supported Prepare the journal entry entries to reflect the accounting for the company's pension plan for the year ending December 31, 2017 and 2018 (e) Determine whether there will be any net gains fosses amortization for 2019 using the corridor approach Bonus Question (5 points) Indicate the persion-related accounts and amounts reported in the financial statements both income statement and balance sheet statement) for 2018 ONITE ka (30 points) The accountant for Marlin Corporation has developed the following information for the company's defined-benefit pension plan for 2017 and 2018: Account 2017 2018 Annual Service cost $1,000,000 $1,200000 Actual return on plan assets 500,000 600,000 Amortization of prior service cost 250,000 230,000 Annual contribution to the plan 1,050,000 1,230000 Benefits paid to retirees 1,220,000 1,500,000 Settlement rate 5% 5% Expected rate of return on plan assets 10% 9% The projected benefit obligation at December 31, 2018, amounted to $8,750,000. Instructions (a) Using the above information for Marlin Corporation, complete the pension worksheet for 2017 and 2018. Calculated amounts should be supported. (b) Prepare the journal entry (entries) to reflect the accounting for the company's pension plan for the year ending December 31, 2017 and 2018. (c) Determine whether there will be any net gains/losses amortization for 2019 using the corridor approach. Bonus Question (5 points) Indicate the pension-related accounts and amounts reported in the financial statements (both income statement and balance sheet statement) for 2018. 2017 Events Journal Pension Jexpense Entries Disclosures cash OCI OCI-Net Pension Projected Pension PSC gains/losses Lia. Assets Pension Obli. Assets 1.250.000 2.500.000er ,000,000 cr 5,500,000 dr dr 1/1/bal. Service Cost Inter. Exp Actual Return Unexpected Loss or Gain Amor of PSC Cash Contribution Benefit Paid Journal Entry 12/31 Balances 2018 Events Journal Pension expense Entries cash OCH PSC Disclosures OCI-Net Pension Projected Pension Sain losses Lia./Assets Pension Obli. Assets 1/1 bal Service Cost Inter. Exp Actual Return Unexpected Loss or Gain Amor of PSC Cash Contribution Benefit Paid Liability Adjust Journal Entry 12/31 Balances 1